The Montrose Group 2024 corporate site location trends illustrate the growing impact of a slowing U.S. economy. Based upon the Montrose Group’s negotiation of over 300 corporate site location projects, annually the firm releases a top 10 corporate site location trends.

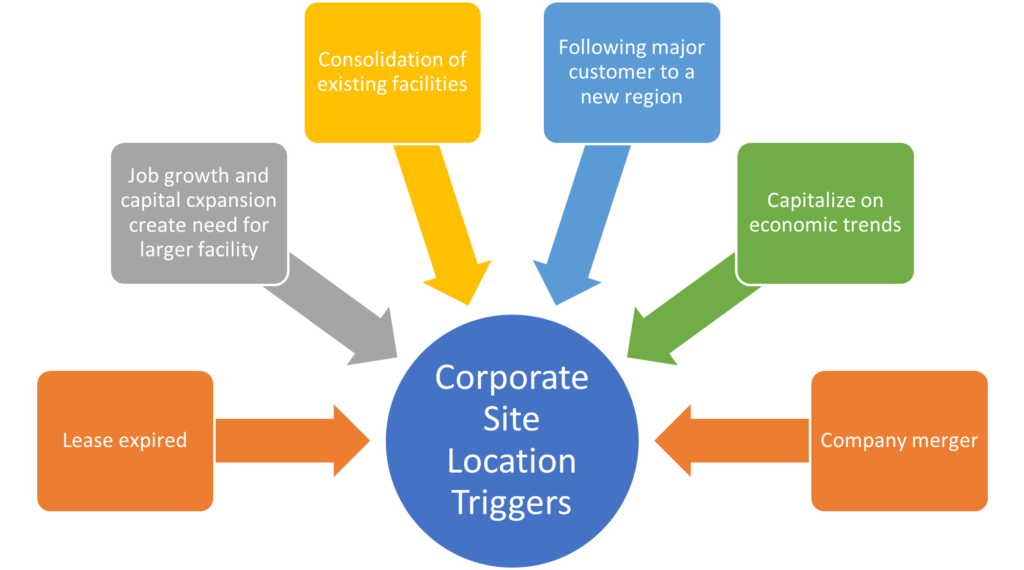

The corporate site location process decides where a company is located, and this process is about a lot more than tax incentives. Triggers such as the end of a real estate lease, growth needs beyond their current facility, decay of their existing facility, consolidation of existing facilities, a growth opportunity tied to a customer, a merger of companies, or a company seeking to capitalize on an economic trend tell a company they should undertake a corporate site location project.

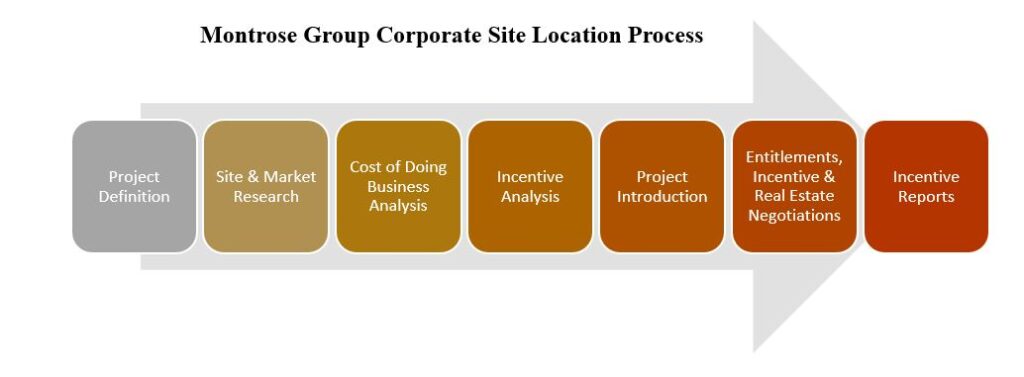

The corporate site location process begins with defining the project to learn about the industry, the number of jobs, payroll, and capital investment planned by a company, needs for the project site, and geographic markets that fit the company’s business plan leading to the creation of potential state and regional target list for the company’s location. Next, market research begins to understand the economic analysis of growth, industry cluster, labor shed, transportation, infrastructure, and supply chain of an industry, company, and region and potential real state options for each of these markets. Sites in these states and regions are reviewed as well as the real estate, labor, and tax policy all impacting the cost of doing business in a region followed by an analysis to review relevant infrastructure finance programs and economic development incentives. Upon completion of this research, the company will then narrow its search to a handful of sites in multiple states and cities that all would fit the company’s business purpose. A confidential Request for Proposal or project letter is then sent from a corporate site location consultant or legal counsel that outlines the nature of the corporate site location project and the specific needs of the company related to the site in question with specific infrastructure, workforce, incentive, and site needs. Site acquisition, land use entitlements, economic development incentives, and government compensation agreements are then negotiated. Defining the economic prospects, workforce capabilities and cost of doing business in multiple regions is the first step for companies considering an economic expansion.

What is a trend? A trend is not a bad mullet haircut popular in the 1990s. A trend applies to the general direction maintained by a winding or irregular course– think the globalization of the U.S. economy. The Montrose Group’s top 10 2024 corporate site location trends are impacted by a slowing economy plus the 2024 economy.

2024 will see a cooling, stagnant economy across the United States as rising interest rates slows down development and economic investment. The evacuation of U.S. offices as a lingering impact of COVID-19 continues the trend of Work from Home that is driving up office occupancy rates and creating a Doom Loop effect that is driving down office rents, building values, future tax gains, and ultimately the loss of public services that will future impact the success of the neighborhood surrounding the vacant office. Challenges with the delivery of energy to economic development projects will also harm the U.S. economy as energy demand grows with energy-intensive data centers and other projects and the supply of energy drops as politicians kill energy-rich coal plants and fight over the location of renewable energy projects. The Presidential election, which may be a rematch of octogenarians illustrates very different views of the national economy and puts at risk everything from chip microprocessors to EV projects in the corporate site location pipeline. The rising interest rates have stopped speculative private industrial park development but the demand for industrial products remains creating an opportunity for the development of the public sector industrial park. The Great Lakes states will remain strong competitors with the South and Southwest as these regions compete for billions of corporate site location projects driven by manufacturing projects. Major corporate site location projects in 2024 will continue for food and beverage processing, Foreign Direct Investments, and the giga factories for chip microprocessors and EV supply chain all continue to move back to the U.S. for production following the disruption caused by COVID-19, rising European energy costs and an Anywhere But China political perspective impacts economic and trade policy. Finally, the early rise of Artificial Intelligence (AI) will impact job growth in banking, insurance and financial services, computer software, and professional service firms as technology replaces college-educated workers. 2024 won’t be the best of years for corporate site location and may well prove a time for companies and communities to prepare for growth in 2025.