The federal government based upon several new programs creates opportunities for Electric Vehicle related companies and corporate site location projects.

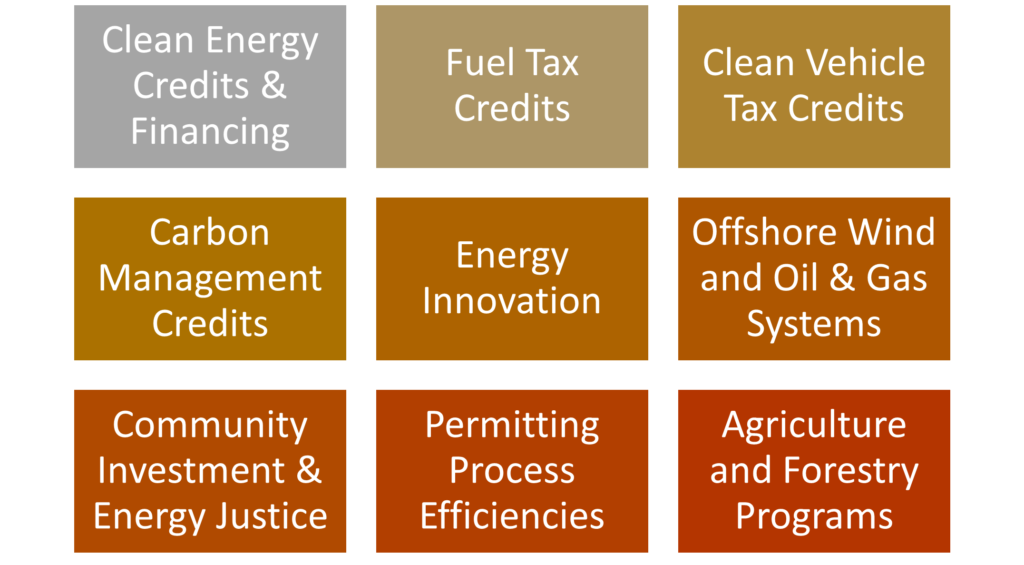

The Inflation Reduction Act of 2022 (IRA) provides over $320 B in incentives designed to increase clean energy production in the United States, support energy innovation, and encourage investing in disadvantaged communities and projects that redevelop fossil fuel infrastructure and employ displaced workers. The IRA includes new and expanded tax credits and grant programs spanning a variety of categories.

The IRA allows taxpayers to transfer most of the credits. The IRA provides the Department of Energy Loan Programs Office with $40 B in loan authority supported by $3.6 B in credit subsidy for loan guarantees under section 1703 of the Energy Policy Act for innovative clean energy

technologies, including renewable energy systems, carbon capture, nuclear energy, and

critical minerals processing, manufacturing, and recycling. Companies seeking to develop renewable energy projects associated with their corporate site location project could capitalize on the Clean Electricity Investment Tax Credit. This program provides a technology-neutral tax credit for investment in facilities that generate clean electricity, and it replaces the investment tax credit for facilities generating electricity from renewable sources for facilities placed in service after 12/31/24, and the phase-out starts the later of (a) 2032 or (b) when U.S. greenhouse gas emissions from electricity are 25% of 2022 emissions. The tax credit is increased by 5 times for facilities meeting prevailing wage and registered apprenticeship requirements, increased by up to 10 percentage points for facilities meeting certain domestic content requirements for steel, iron, and manufactured products, and if located in an energy community.

The IRA also includes several funding and tax programs to boost domestic manufacturing of clean energy technologies, including:

- Up to $250 billion in new loan authority for Energy Infrastructure Reinvestment Financing, and a $5 B in a credit subsidy to support up to $250 B in new loan authority to guarantee loans to projects that retool, repower, repurpose, or replace energy infrastructure that has ceased operations or that enable operating energy infrastructure to avoid, reduce, use, or sequester greenhouse gases such as building clean energy facilities on former coal mining sites, reconductoring transmission lines, or updating operating energy facilities with pollution control technologies.

- Extension and Expansion of the Advanced Energy Project Credit for $10 B for projects that (1) re-equip, expand, or establish an industrial or manufacturing facility for the production or recycling of a range of renewable energy and energy efficiency equipment, carbon capture equipment, and advanced vehicles; (2) re-equip an industrial or manufacturing facility with equipment designed to reduce greenhouse gas emissions by at least 20 percent; or (3) re-equip, expand, or establish an industrial facility for the processing, refining, or recycling of critical materials.

- A new Advanced Manufacturing Production Credit for domestic manufacturing of components along the supply chain for solar modules, wind turbines, battery cells and modules, and critical minerals processing.

- Energy Community Tax Credit Bonus applies a bonus of up to 10% for projects and facilities located in energy communities for a “brownfield site” or a coal community.

To qualify for the domestic content bonus credit (10%), taxpayers must demonstrate sufficient use of domestic iron, steel, and manufactured components. Several tax credits provide enhanced clean energy tax benefits of 5 times the base rate if prevailing wage and apprenticeship requirements are met. To meet apprenticeship requirements, qualified apprentices must be used for a designated percentage of total labor hours for construction, alteration, or repair work on the qualified facility or energy project (10% for projects started before 1/1/23, 12.5% for projects started during 2023 and 15% for projects started after 12/31/23).

Contact Wade Williams at [email protected] if you have any questions regarding the EV industry or other corporate site location matters.