Workforce development still matters when it comes to attracting Electric Vehicle (EV) battery production and suppliers. A two percent drop in the U.S. civilian labor participation rate driven by the expedited retirement rates of the Baby Boom generation spurred by COVID-19 keeps the availability of skilled workers a central issue for companies with existing and plans for new facilities.

The EV industry is no different from other advanced manufacturing companies that need a skilled workforce to operate their facilities. The EV industry relies on diverse occupational profiles to meet production and operational demands as shown in the graphic below.

Key Occupations for EV Facility Industry

The generalized labor breakdown in the EV industry includes General Production Labor (70%), Engineering (15%), Management (10%), and Administrative (5%). This diverse workforce collectively contributes to the success and innovation within the electric vehicle industry.

The EV industry consists of 27 critical NAICS codes and their supply chain ties from iron and steel mills to aluminum production that connect the entire electric vehicle ecosystem. Industries like precision-turned-product manufacturing and custom roll forming play crucial roles in shaping metal components for electric vehicle frames and chassis. These companies are integral to the production of robust EV structures. Various codes contribute to the diverse array of components vital for electric vehicles, such as heavy-duty truck manufacturing for electric heavy-duty applications and vehicular lighting equipment manufacturing for energy-efficient lighting systems. In terms of safety and performance, codes related to motor vehicle brake systems, transmission and powertrain parts, and steering and suspension components are essential. They contribute critical components ensuring the safety, optimal performance, and propulsion of electric vehicles. The electric vehicle ecosystem extends beyond physical components to include the electrical infrastructure, with companies specializing in power distribution transformers, motors, generators, storage batteries, and fiber optic cables. They form the backbone of the energy storage, communication, and power distribution networks within electric vehicles. Lastly, the category of all other miscellaneous electrical equipment and component manufacturing encompasses a diverse range of companies contributing various electrical components crucial for vehicle functionality, safety systems, and charging infrastructure. These companies collaborate with EV manufacturers, battery system integrators, and charging infrastructure developers, ensuring compliance with regulations and supporting ongoing maintenance and innovation in the industry.

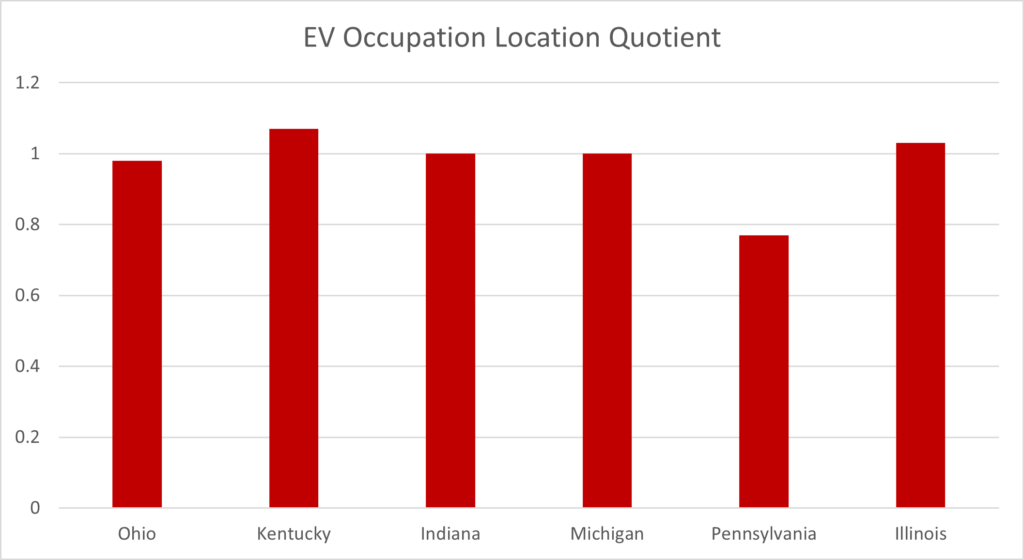

The Midwest has a strong base of workers in the EV manufacturing industry sector as measure by the location quotient in targeted states among the occupations that work in these companies. A location quotient is a measure of industry concentration based upon the employees and their wages in a defined geographic area. A location quotient greater than 1 means that this region has an above average number industry concentration, and should prove an attractive target for companies in that industry considering an economic expansion.

Across Ohio, Kentucky, Indiana, Michigan, Pennsylvania, and Illinois, the manufacturing sector exhibits both shared and distinct characteristics, as evident in the provided chart data above. Ohio stands out for its diverse industrial base, particularly in motor vehicle metal stamping, a critical component of the electric vehicle (EV) ecosystem’s supply chain. This sector plays a key role in shaping the metal components required for electric vehicle manufacturing. In Kentucky, strength in aluminum sheet manufacturing aligns with the EV sector’s demand for lightweight materials, crucial for enhancing fuel efficiency and overall performance. Indiana’s manufacturing landscape prominently features motor vehicle body manufacturing, reflecting the state’s significant role in producing EV bodies and frames. Michigan demonstrates a broad dominance in manufacturing, particularly in other motor vehicle parts manufacturing, highlighting its crucial contributions to the EV ecosystem’s supply chain. This sector likely encompasses the production of various components vital for electric vehicles’ functionality. Pennsylvania’s manufacturing strength in iron and steel mills positions the state as a key player in providing foundational materials for the EV industry, essential for building robust structures and components. Illinois, marked by its prowess in iron and steel manufacturing, further underscores its importance in the EV ecosystem’s supply chain. These materials are foundational for various components in electric vehicles, including their frames and structural elements.

Wage comparisons underscore disparities among these states, emphasizing the economic variations in their manufacturing sectors. Michigan and Pennsylvania lead in total annual wages, particularly in sectors like Other Motor Vehicle Parts Manufacturing, Iron and Steel Mills, and Ferroalloy Manufacturing, respectively. Ohio and Kentucky demonstrate competitive positions in specific sectors, while Indiana showcases strength in motor vehicle body manufacturing. Illinois exhibits a diverse economic profile with significant contributions in multiple sectors.

These disparities underscore the unique economic profiles of each state, showcasing differences in industrial focus and workforce dynamics as depicted in the detailed chart data. This diversity highlights the crucial role of the site selection profession, emphasizing the necessity for corporate assistance in choosing optimal locations for business operations. The site selection industry specializes in comprehensive research, evaluating factors such as site characteristics, labor profiles, tax implications, incentives, and compliance considerations. In a landscape marked by regional variations, leveraging the expertise of site selection professionals becomes pivotal for businesses seeking strategic and tailored decisions in their expansion or relocation endeavors.

The Midwest is a good target for EV companies and should prove to be successful in the retention and attraction of this growing industry.Contact Wade Williams at [email protected] if you have any questions regarding the EV industry or other corporate site location matters.