Most really good parties result in an equally strong hangover. 2024 will likely be a hangover and not a party year. The federal government, in response first to COVID-19 and then based upon a political turnover to the Democrats in Washington, ran the money printing press 24 hours a day. The Congress with the support of President Joe Biden primed the economic pump to an unprecedented level putting government money into the national economy. Much of that government funding and policy was geared toward address major economic policy goals of bringing back microprocessor chip production back to the United States and transitioning the global auto industry to Electric Vehicles. Also, the Biden Administration supported worker wage increases through unionization more than any administration in recent times.

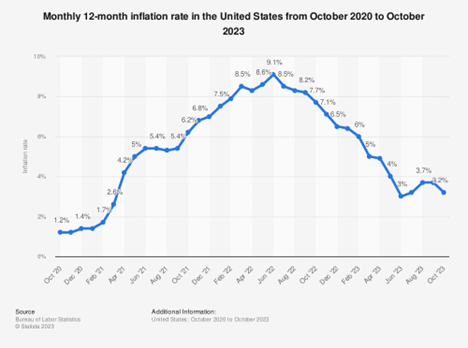

The result of Washington’s spending and wage policy was inflation. Inflation was at a post-pandemic high of 9.1, and inflation remains a concern at 3.2%.

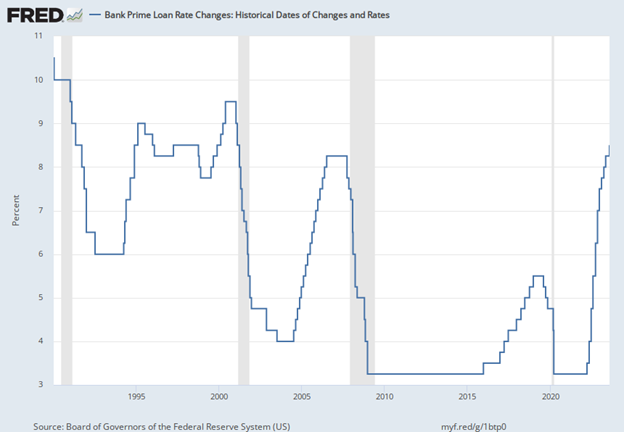

Driven by concerns over the U.S. inflation rate, the Federal Reserve did the right thing and increased interest rates to slow the economy down. Inflation is now showing signs of continuing to go down, and the Federal Reserve has indicated it may not raise rates again in 2024 due to the inflation rate.

The U.S. bank prime loan rate which is the lending rate for most commercial loans was 8.25% in 2007, and the bank prime loan rate was as low as 3.25% between 2020 and 2022. Unfortunately, the current bank prime loan rate is 8.25%.

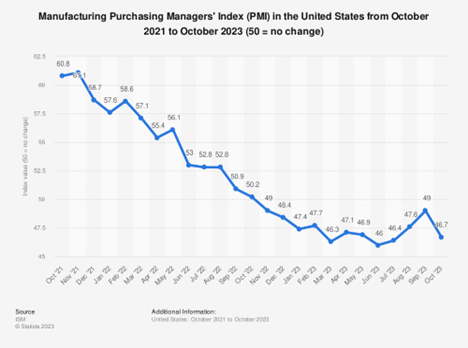

A slowing by the Federal Reserve of new interest rate hikes will not reverse the damage done to the U.S. economy in 2024. Economic measures illustrate a tough road ahead in 2024. The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors based upon a survey of supply chain managers across 19 industries, and it consists of a diffusion index that summarizes whether market conditions are expanding, staying the same, or contracting as viewed by purchasing managers. The purpose of the PMI is to provide information about current and future business conditions to company decision-makers, analysts, and investors. As illustrated by the chart below, In October 2023, the value of the PMI in the United States stood at 46.7. An index value above 50 percent indicates a positive development in the manufacturing sector, whereas a value below 50 percent indicates a negative situation. As manufacturing is a major driver of corporate site location projects, the current PMI is not good news for near-term economic growth.

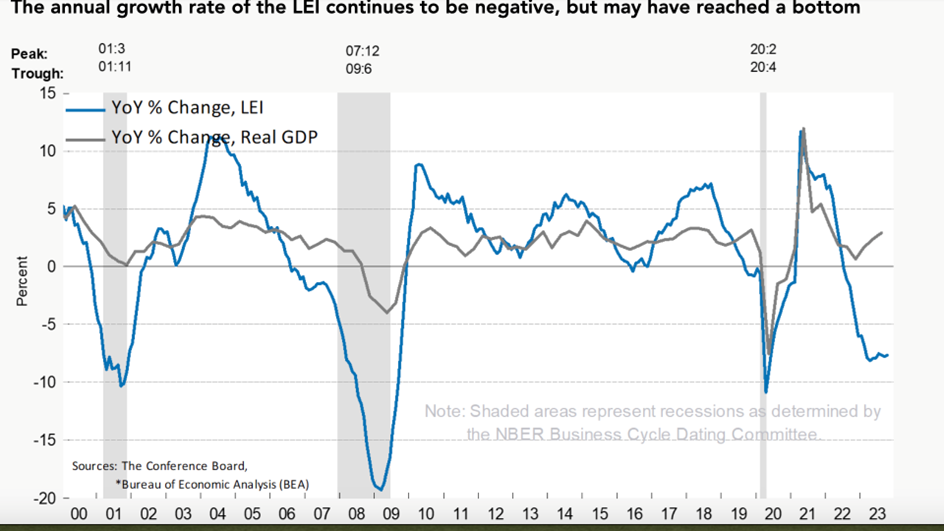

Finally, economists expect economic challenges in 2024. “The US LEI trajectory remained negative, and its six- and twelve-month growth rates also held in negative territory in October,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Among the leading indicators, deteriorating consumers’ expectations for business conditions, lower ISM® Index of New Orders, falling equities, and tighter credit conditions drove the index’s most recent decline. After a pause in September, the LEI resumed signaling a recession in the near term. The Conference Board expects elevated inflation, high-interest rates, and contracting consumer spending—due to depleting pandemic saving and mandatory student loan repayments—to tip the US economy into a very short recession. We forecast that real GDP will expand by just 0.8 percent in 2024.”

Rising interest rates responding to government-driven economic and social policy flooding the U.S. economy with unprecedented levels of money will slow the corporate site location project deal flow in 2024. The United States remains the world’s largest economy and the long-term impact of this economic cooling are unlikely to stop future growth once inflation gets closer to the 2% goal of the Federal Reserve.