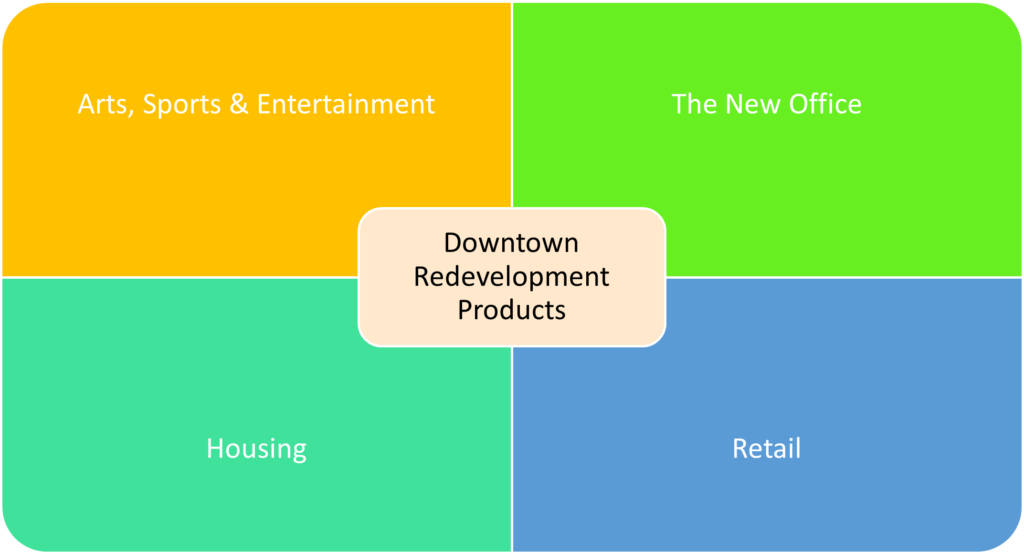

Following the definition of an urban Downtowns economic development challenge, companies and communities need to implement an action plan based upon focusing on the opportunities for the Downtown and the region based upon the building block of all successful economies- focus on creating a diverse market from growing industries.

Downtowns can continue to thrive by remaining regional and statewide centers for arts and entertainment venues that can create major mixed-use developments. Downtowns historically are home to historic theaters, major league and amateur sports venues, and large-scale greenspaces and parks that all serve as national attractions for residents, office workers and visitors. Indianapolis continues to plan for Downtown redevelopment based on the sports venue model that has created an economic model that includes national NCAA events and major league sports championships. Now Indianapolis is looking to capture future growth around professional soccer. Downtown Indianapolis will see a transformation of its southwest quadrant with Indy Eleven & Keystone Group having unveiled renderings of Eleven Park, a major neighborhood development that will be anchored by a 20,000-seat multipurpose stadium.[i] The stadium will be home to Indy Eleven, an American professional soccer team playing in the United Soccer League. Diamond Chain, the former company on the property, has recently ceased production at the facility and will vacate the property by the end of April.[ii] Rezoning to accommodate the project was filed earlier this month, and groundbreaking on Eleven Park for site work is scheduled to begin in May.[iii] The Eleven Park development will also include over 600 apartments; 205,000 square feet of office space; nearly 200,000 square feet for retail space and restaurants; a hotel; public plazas with green space; and public parking garages.[iv]

Downtown Cleveland has been reborn around the development of housing. Downtown Cleveland has over 25,000 residents, more than double Cleveland’s younger and bigger brother Columbus. Nearly twenty years ago, Cleveland responded to the post-9/11 recession and Great Recession with a series of strategies designed to reimagine and transform Downtown Cleveland from a 9-to-5 central business district into a diverse, vibrant, mixed-use neighborhood. This collection of strategies reimagined Downtown as a walkable, transit-oriented neighborhood. Over a ten-year period, this led to 32% population growth, 15.3% private sector job growth, and the conversion of over 5 million square feet of underutilized space in historic buildings to housing, hospitality, and other uses. Much of Cleveland’s success has been in the development community’s use of historic preservation tax credits from the state and federal government. In fact, Cleveland has over 108 completed State of Ohio Historic Preservation tax credit program projects while Columbus has less than 50. Cleveland is planning for its next phase of residential development Downtown through better utilization of the public spaces downtown through smaller, more frequent events, a more concerted effort at developing and sustaining a downtown retail sector, and additional lighting, way-finding, and placemaking improvements and helping to facilitate the conversion of vacant office spaces into flex spaces or residential units.

Des Moines, Iowa has a thriving Downtown. Downtown Des Moines has 81,000 workers, and 10,500 residents and has recently seen $2 B in Downtown investment plus a 41% increase in hotel rooms, 55% in food and beverage sales, and a 25% increase in retail sales according to a recent report from the City of Des Moines and Des Moines Partnership.[v] The Historic East Village offers one example of a successful Downtown Des Moines neighborhood. The Historic East Village is the retail hallmark of Downtown. The district is still growing and expanding with residential to the north in the Bridge District aimed at supporting Historic East Village retail. The planned Market District to the south will also bring residential and green space to the area. Developments surrounding the Historic East Village should help retail grow and thrive, building off the current momentum and eclectic identity. Continued growth in the Historic East Village should focus on supporting the already strong retail mix with restaurants that complement the existing eclectic mix, and specialty retail that provides small and mid-sized retailers that complement not duplicate the existing retail base.

Columbus, Ohio transformed a struggling 1980s-era enclosed shopping mall into a community park and mixed-use development that operates as the center of the community. Columbus Commons presently stands on the spot that once housed the City Center, a historic shopping destination in Columbus. Underneath the park’s green lawns, the mall’s original garage still operates as a parking facility for guests and Downtown businesses. The park’s construction began in 2010, and Columbus Commons made its debut in May 2011. In its first year, the park played host to 130 events and more than 300,000 people. Columbus Commons continues to evolve. In 2009, when the Columbus Downtown Development Corporation (CDDC) & Capitol South Community Urban Redevelopment Corporation (Capitol South) first announced the plan to demolish the City Center Mall and create a clean, green slate, Columbus Commons was presented as a mixed-use development, filled with privately developed residential, retail and commercial space, all anchored by greenspace. Since its opening in 2011, the Commons has been a place where people can gather and this sense of community has only been enhanced by the residential and retail additions. The result is a walkable Downtown community with outlets for retail, living, work, entertainment, and play.

Data centers could be an adaptive reuse for empty Downtown office buildings. According to P&S Intelligence, the data center market size stood at USD 263.34 billion in 2022, and it is expected to advance at a compound annual growth rate of 10.9% during 2022–2030, to reach USD 602.76 billion by 2030. The IMD1 MetroEdge Data Center will be a five-story high-rise data center located in the West Side of Chicago in a medical district targeted for transformation. The 16-megawatt facility will support the technology needs of local organizations including healthcare, financial, educational, and government institutions and is a key component of the region’s plans to revitalize the area. Metro Edge Development Partners’ flagship data center is IMD1 in the Illinois Medical District, one of the largest urban medical campuses in the United States. The IMD brings together an ecosystem of enterprises that have inspired medical breakthroughs for over 70 years. Spanning 560 acres, the IMD is an established hub of healthcare, medical research facilities, and biotech incubators, with easy access to O’Hare International Airport, public transportation, major expressways, commuter rails, and all less than two miles from Chicago’s Central Business District.

Technology centers or tech incubators are another potential adaptive reuse of Downtown office space. Holland, Michigan is developing the Next Center. The Next Center will serve as a hub for innovation and business growth to strengthen West Michigan’s entrepreneurial ecosystem. This three-story, 20,000-square-foot, state-of-the-art office building will be owned and operated by Lakeshore Advantage. The Center will house a business incubator, community education space, and the offices of Lakeshore Advantage. St. Louis, who at one point faced over 200 vacant Downtown buildings has launched the T-REX project. T-REX is a non-profit innovation and entrepreneur development center dedicated to strengthening the economic vitality of St. Louis, one startup at a time. Like a magnet, T-REX attracts innovation to our core downtown region. A coworking space, technology incubator, and entrepreneur resource center; we offer an ecosystem where ideas are conceived, brought to fruition, and given room to grow. We’ve worked to create an environment that serves as a network of creativity and support, where abstraction finds clarity in the midst of a collection of bright and dedicated minds. Hovering above a vivacious, animated city, we’re now home to a growing community of well over 400 founders, developers, designers, mentors, educators, and more.

For almost a decade, grants awarded through the Wisconsin Economic Development Corporation’s (WEDC) Community Development Investment (CDI) Grant Program have armed Wisconsin communities with resources critical to building stronger communities and vital local economies. One of the primary community development tools available from WEDC, these grants have benefited 194 projects in 127 Wisconsin communities. Their impact has proven instrumental to the health of downtown and commercial districts from one end of the state to the other. CDI Grants provide up to $250,000, or 25% of eligible project costs, for construction, renovation, and other physical improvements for projects that incorporate a commercial element. Projects are selected and submitted by the municipality, with the grant funds passed to the project through a development agreement. Several successful CDI grant awards illustrate the benefit of this WEDC program for Downtown development. The City of Sturgeon Bay received $250,000 in CDI funds to aid the renovation and rehabilitation of the former Younkers department store downtown. After the chain closed its locations in 2019, the property was acquired by a local retail business and renovated for expanded first-floor retail space for the shop, and retail space for other entrepreneurs. The basement and second-floor spaces were renovated to accommodate additional office and retail tenants. The project will also include public restrooms accessible from an exterior door, a long-identified need. Costs for the project’s first phase—first-floor occupancy—exceeded $1.4 million.

Spurring Downtown development projects is not the only way cities are looking to support Downtown redevelopment. Detroit is going after the owners of vacant buildings and surface parking lots. Detroit’s Land Value Tax Plan is a way for Detroit voters to decide whether to cut homeowners’ taxes by an average of 17% and pay for it by increasing taxes on abandoned buildings, parking lots, scrapyards, and other similar properties. This measure is being considered by the Michigan legislature and would only be enacted if approved by the voters of Detroit. Detroit’s Land Value Tax Plan would cut tax mills on buildings by 14 mills, and more than double taxes on land giving more than 97% of Detroit homeowners a tax cut while spurring owners of abandoned buildings, parking lots, scrapyards, and other similar projects an incentive to redevelop those sites. Arts, sports, parks, retail, housing, reborn offices, and other new industries can all revitalize Downtown neighborhoods.

[i] https://businessfacilities.com/downtown-indianapolis-to-transform-with-eleven-park/

[ii] Ibid.

[iii] Ibid.

[iv] Ibid.