The Great Lakes region’s housing stock is a critical corporate site location advantage. Housing is joining workforce development to become a major corporate site location issue. Regions not growing are failing to develop substantial residential growth. Finally, rural regions are losing population at an alarming rate and desperately need new residential products to retain existing employers and to keep their young people. No matter where you are in the United States, the availability of attainable housing that young and old alike can afford is needed. The simple fact is regions cannot retain and attract companies without workers—workers won’t go to regions where they cannot afford housing.

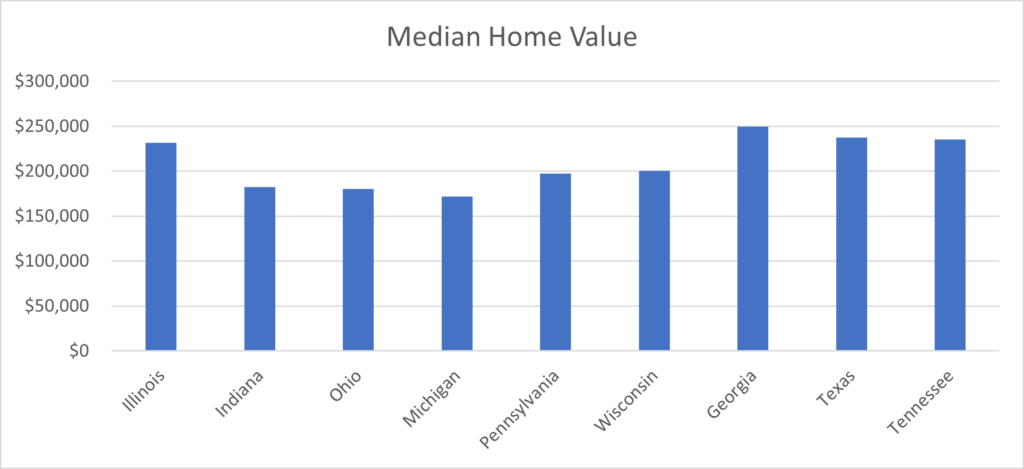

Source: U.S. Census Bureau

As the table above illustrates, the median home value in the Great Lakes states compares well from an affordability standpoint to faster-growing southern states such as Georgia, Tennessee, and Texas. While these southern states have grown substantially from a population and economic standpoint in recent decades, data such as the median home value indicate this fast-growth market is not keeping up with housing demand and this is impacting their cost of doing business from a residential standpoint.

The median residential listing price is another important measure of the strength of the regional housing market. This is an indicator of the current and future strength of the housing market. Also, from a corporate site location standpoint, lower median residential listing prices illustrate markets where a company’s employees can afford to buy a home. Many fast-growing markets are simply not keeping up with the housing demand which is dramatically increasing the price of housing.

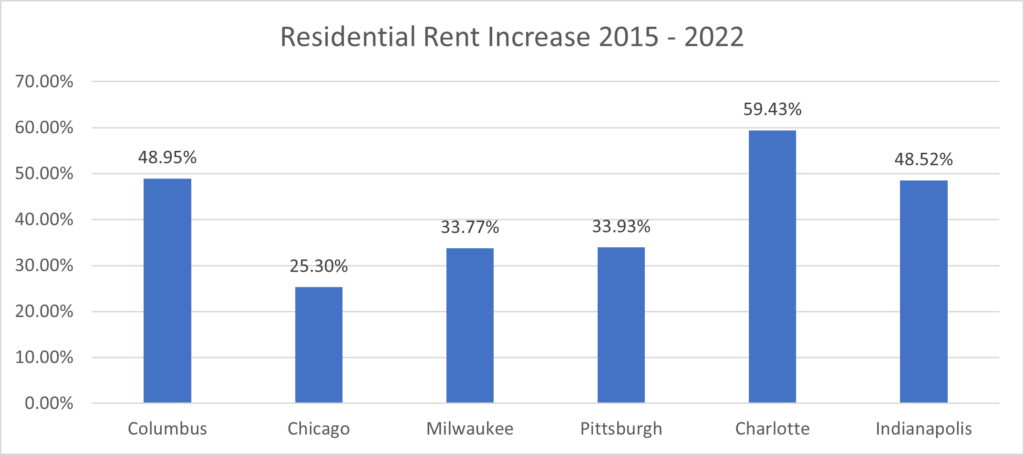

Source: St. Louis Federal Reserve

Pittsburgh’s residential costs are below its Great Lakes as well as faster growing southern markets like Charlotte as illustrated by the chart above. However, all the Great Lakes states, even mega-city Chicago offer residential listing prices below faster-growing southern markets offering a housing advantage for the Great Lakes. The housing advantage for the Great Lakes is even clearer when examining the residential rent increases. As the chart below illustrates, residential rental prices grew the most in Charlotte but the Great Lakes states urban centers such as Chicago, Pittsburgh, and Milwaukee remain competitive for housing costs. Faster-growing Great Lakes markets such as Columbus and Indianapolis have higher rental rate increases than regional peers but again below southern competitors.

Source: Zillow.com

Growing housing that workers can afford is a critical corporate site location issue and Illinois’s major urban centers offer comparatively affordable housing that is experiencing price increases with a dwindling supply. Housing is a growing corporate site location issue for all regions of the nation and Ohio falls in line with this national trend.