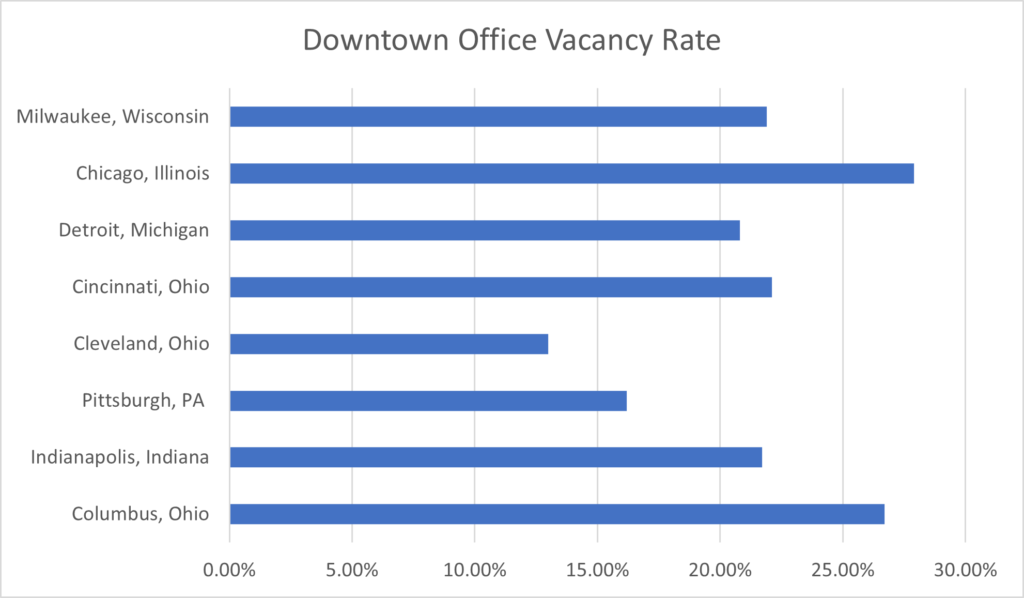

The urban Downtown office market is facing a crisis which is only going to get worse. The Downtown office vacancy rates from Cushman and Wakefield’s 2023 analysis as outlined in the chart below in the major urban markets throughout the Great Lakes illustrate substantial struggles with the current Downtown office markets. This data is of more concern when looking at the number of tenants attempting to sublease their current space—which is very high across the United States. It is clear the U.S. Downtown office market is not in good shape and is going to get worse as many companies will not renew Downtown office leases and seek much smaller spaces.

To solve this challenge companies and communities need to understand what the urban Downtown office market is in the dumps. COVID-19, demographics, and Artificial Intelligence (AI) all spell the launch of urban doom loops in Downtown urban markets across the United States. COVID-19 continues to provide a substantial hangover for the U.S. economy—that is devasting the U.S. office market. Forbes reported that 12.7% of full-time employees work from home, while 28.2% work at a hybrid model. Currently, 12.7% of full-time employees work from home, illustrating the rapid normalization of remote work environments. Simultaneously, a significant 28.2% of employees have adapted to a hybrid work model. Researchers from Ladders have been carefully tracking remote work availability from North America’s largest 50,000 employers since the pandemic began. Remote opportunities leaped from under 4% of all high-paying jobs before the pandemic to about 9% at the end of 2020, and to more than 15% today.

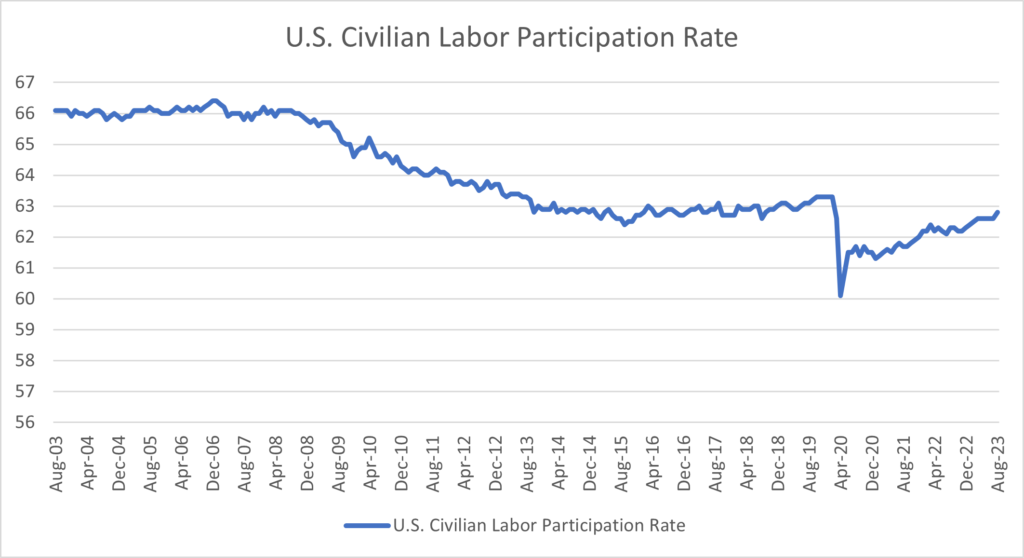

Demographics are also working against the growth of office workers. The Baby Boom generation which has been fueling the U.S. workforce for decades is retiring. The U.S. civilian labor participation rate is a full six points lower than in 2003. Fewer Americans are working and the economy is struggling to provide the workforce companies need to succeed. This lack of workforce creates substantial leverage for current employees to demand to work from home. Companies remain unable to bring these workers back to the office and indicate a permanent shift for this generation to have a sizable portion of their employees to work at home long term.

AI is going to impact the U.S. office market as well. AI is going to be the next great disruption of the global economy. Just as automation disrupts the global manufacturing industry, AI is going to disrupt the advanced services or white-collar industries. A Pew Research study found that workers with a bachelor’s degree or more (27%) are more than twice as likely as those with a high school diploma only (12%) to see the most exposure. Jobs are considered more exposed to artificial intelligence if AI can either perform their most important activities entirely or help with them. AI could well replace the tasks of “getting information” and “analyzing data or information,” or it could help with “working with computers.” These are also among the key tasks for lawyers, software engineers, accountants, customer service representatives, and other white-collar workers—all these occupations currently fill many global offices. AI will likely create more jobs than it eliminates but in the near term, AI will have a negative impact on urban office markets. Urban Downtown office markets are in trouble and companies and communities seeking to reverse this trend need to first understand the scale and scope of the challenge that shapes how best to adopt strategies to address this issue.