Taxes levied by local and state governments have a major impact on a company’s corporate site location decisions. Taxes by the state and local governments are a critical component of measuring the cost of doing business in a region. Different local and state governments tax businesses differently. What and how much local and state governments tax business is a policy decision not just to collect the revenues needed to pay for schools, roads, water, public safety, and other essential services but is also a public policy decision impacting a company’s corporate site location.

Source: Council of State Taxation

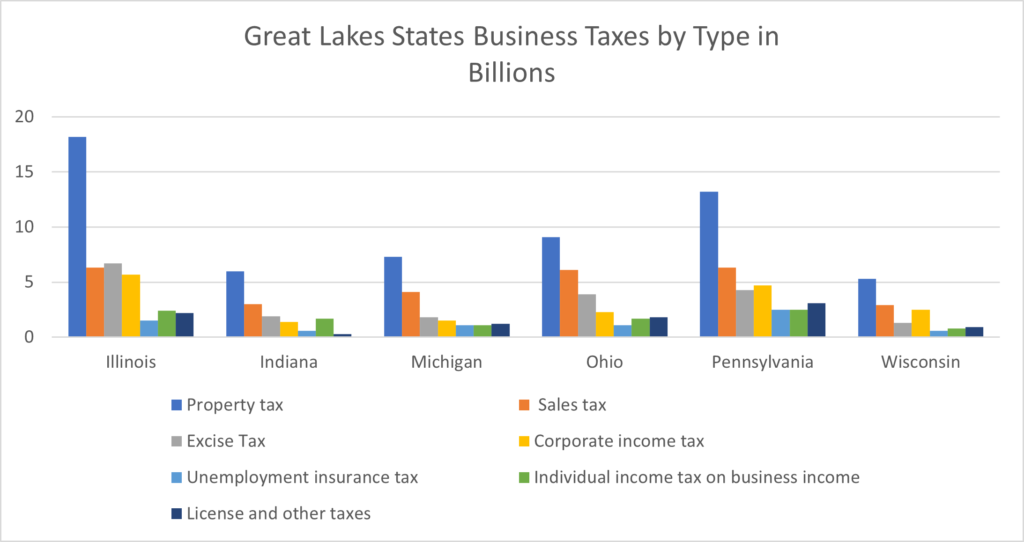

Ultimately, how much taxes a company pays at a location impacts its decision as to whether to locate in the region and defines the critical role of economic development incentives. The specific taxes a company will pay at a site is a critical cost of doing business factor the local and state government can directly impact through tax incentives. As the chart below illustrates, Illinois leads the Great Lakes states when it comes to taxing business. Illinois taxes business, according to the Council of State Taxation a total of $43 B which is $7B more than Pennsylvania and $17 B more than Ohio both of which are of similar size. Smaller states such as Illinois and Wisconsin in the Great Lakes charge businesses substantially lower taxes than the larger states. It is worthy of note that property taxes are the highest business tax in nearly all the states and all these states also have some form of an income tax. However, an important factor for companies to consider when reviewing this state and local tax data is what taxes will their company pay more. Large-scale industrial investments will drive up property taxes if the state taxes equipment. Some states have property taxes on inventory again which impacts different companies differently. Finally, companies in the advanced service or white collar or technology industries may not really care about property tax as they have moved to a near virtual office presence and won’t pay substantial property taxes.

Source: Council of State Taxation

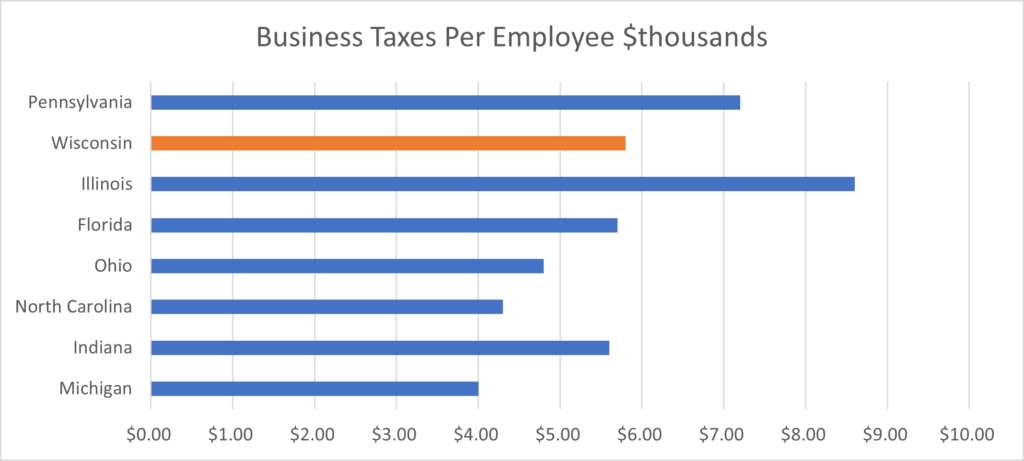

Measuring business taxes on a per-employee basis is a method that can provide a company considering a corporate site location project with a good basis for a state’s overall business-friendly attitude. This approach addresses population differences in the states. As the table below illustrates, companies in Illinois land in the middle compared to other Great Lakes states with Illinois and its global mega-city Chicago having the highest taxes on a per-capita basis on businesses while southern states like North Carolina and Florida tax business less than many Great Lakes states. More troubling for Illinois is that Michigan and Ohio companies pay less taxes than companies in Illinois. Wisconsin’s business taxes are lower than Great Lakes competitors Pennsylvania and Illinois and more aligned with Indiana.

Source: Council of State Taxation

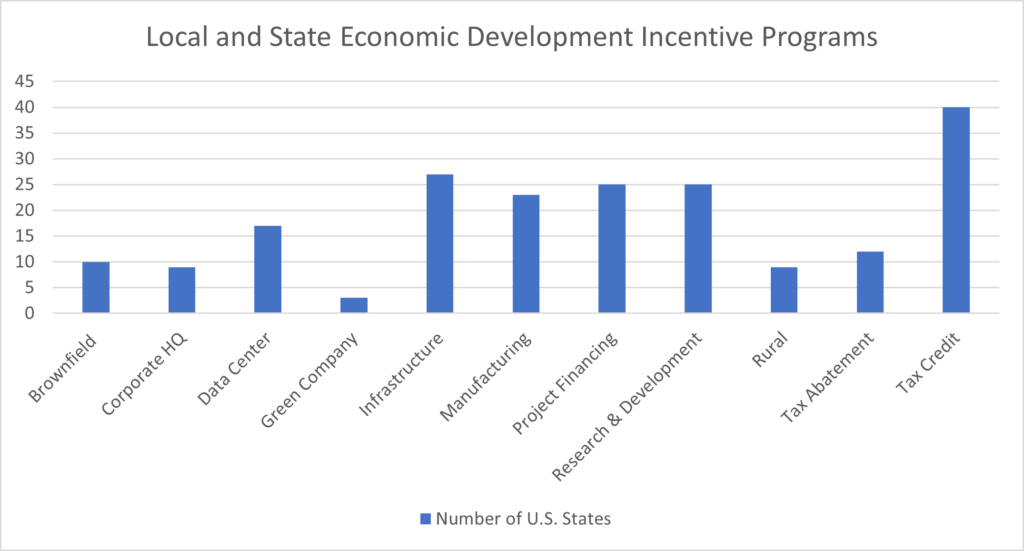

According to the Council of State Taxation, businesses paid $951.4 B in state and local taxes in FY21, which was 43.6% of all tax revenue at the state and local levels. Businesses paid $493.7 B in state taxes in FY21, which was 17.0% higher than the prior fiscal year, and $457.6 B in local taxes, which was 10.2% higher, for a combined year-over-year growth rate of 13.6% over FY20. To address the regional cost of doing business factors, all fifty states offer some form of economic development incentives. As the chart below outlines, infrastructure incentives are provided by all the states in the union followed by tax credits as the second most popular tax incentive program in the nation with efforts to attract data centers and using general tax abatements tying for third. Princeton Economics estimates that state and local governments invest about $30 B dollars in economic development incentives annually.

Wisconsin has many economic development incentives offered to companies looking to create jobs and make capital investments in the Badger state.

Wisconsin Economic Development Incentives

- Wisconsin’s Department of Transportation’s State Infrastructure Bank Program is a revolving loan program available to communities to preserve, promote, and encourage economic development via efficiency and safety in public transportation initiatives. SIB loans carry lower than market rate interest, and longer payback periods, and may be used in conjunction with other programs or to finance a project entirely. Counties, cities, villages, and towns may apply on a first-come, first serve basis for projects improving access to nearby industrial sites, or improvements to, and construction of, roads and bridges.

- Wisconsin’s Department of Transportation’s Transportation Economic Assistance (TEA) program provides matching state grants to governing bodies for road, rail, harbor, and airport projects that help attract employers to Wisconsin or encourage businesses and industry to remain and expand in the state.

- Wisconsin Business Development Tax Credit Program offers refundable tax credits to reduce the eligible businesses’ income tax liability for newly created jobs equal up to 10% of annual wages paid to employees earning at least 150% of the federal minimum wage, may cover up to 50% of eligible job training costs, up to 3% of capital investment in business personal property (5% in real property), and up to 10%. of annual wages for positions created or retained at corporate headquarters.

- Wisconsin Enterprise Zone Program awards refundable tax credits up to 7% of annual wages for newly created jobs, up to 100% of job-training costs, up to 10% for capital expenditures, and up to 1% of supply chain expenses for up to 12 years to eligible companies for job creation, job retention, capital investment, and training to reduce state income tax liability or provide a refund in locally designated EZs designated on a case-by-case basis.

- Wisconsin Tax Increment Financing permits a local government to define a Tax Increment District (TID), the entity identifies projects to encourage desired development, as property values rise, the municipality uses the property tax above a frozen base to pay for the identified public improvement projects until the project costs are paid and the TID is closed.

Wisconsin competes for the retention and attraction of business on a global scale with competitive business tax policy as well as core of economic development incentives.