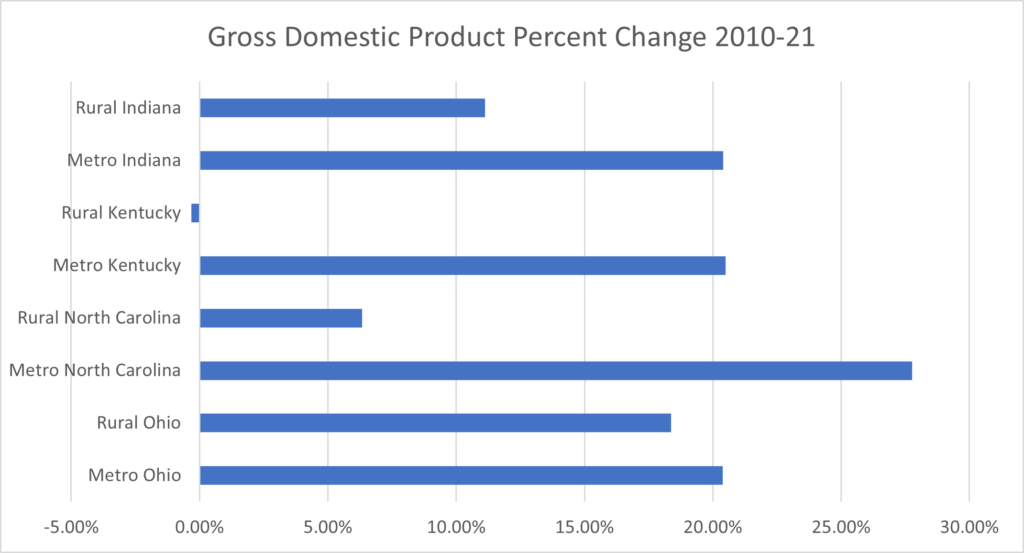

The overall economic growth in rural communities across America is on-par with large, legacy cities but they are not growing at the same rate as the mid-sized urban markets located in the same state. However, these rural markets are sizable and capable of serving a range of corporate site location projects. Measures of a region’s Gross Domestic Product (GDP) are the best measure of overall economic growth in a region. The rural markets in these target states in the aggregate illustrate large economies with

- Rural Indiana’s GDP in 2018 at $ $58,618,413,000,

- Rural Ohio’s GDP in 2023 at $96,177,174,000.

- Rural North Carolina’s GDP in 2018 at $ $67,057,773,000

- Rural Kentucky’s GDP in 2018 at $ $55,651,967,000.

These are substantial economic markets. As the table below illustrates, over a 10-year timeframe, counties in rural Ohio are growing economically faster than rural communities in Kentucky, Indiana, and North Carolina. However, most rural markets are not keeping space and are growing their economy at a slower pace than the mid-sized urban markets in their own state at a similar level as the table below illustrates comparing rural Indiana, Kentucky, North Carolina, and Ohio with urban markets in those states. Rural Kentucky is the outlier with negative growth in rural GDP. The metro regions in Indiana, Kentucky, North Carolina, and Ohio also illustrate economic growth.

Source: U.S. Bureau of Economic Analysis

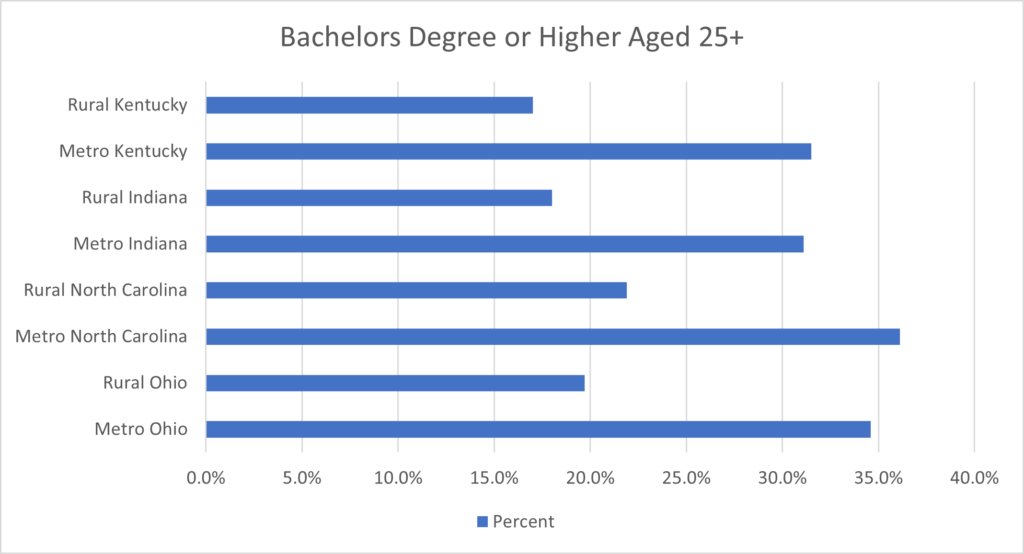

The level of education for a region impacts the industries in which the region can attract companies in particular industries. As an example, if a region lacks a large base of college-educated workers, it will struggle to attract advanced services/white-collar jobs that need a base of workers with a bachelor’s degree or higher. The same goes for the occupations of Science, Technology, Engineering, and Math (STEM) workers such as software engineers. Although educational attainment has increased in both metro and nonmetro areas since before the Great Recession, there remains a significant rural-urban education gap.[i] In metro areas as of 2018, 43 % of the prime working-age population has a four-year college degree or higher, compared with just 25 % of nonmetro populations.[ii] About 40 % of the nonmetro-prime working-age population lacks any postsecondary education; however, the share of nonmetro-prime working-age adults with associate’s or vocational degrees has increased at a faster pace than in metro areas since the start of the Great Recession in 2007.[iii]

As the table below shows, rural communities possess fewer holders of bachelor’s degrees on average compared to metro counties. This fall-off in college graduates is even more dramatic when examining successful mid-sized urban markets such as Raleigh-Durham which has half its population with a college degree, the Columbus MSA has a 37.9 bachelor’s degree or higher rate. Thus, urban markets in Ohio, Kentucky, North Carolina, and Indiana have an opportunity to retain and attract a base of advanced services and technology jobs that demand college-educated workers with bachelor’s degrees. Metro Ohio is second behind North Carolina in relation to the percentage of its residents with a college degree—the large university centers in this urban community help drive up the pool of college-educated workers. However, rural counties in all these benchmark states fall far short of the urban centers related to the percentage having a college degree. Not all jobs require a college degree, but a college-educated workforce is critical for advanced industry white-collar occupations that constitute most professional service firms. financial services that include banking and insurance, and higher-end computer software professionals.

Source: ESRI Demographics Rural communities remain thriving economic markets but generally lack the college-educated workers needed by advanced services and technology companies.

[i] https://www.investinwork.org/-/media/Files/reports/strengthening-workforce-development-rural-areas.pdf

[ii] Ibid.

[iii] Ibid.