The Ohio General Assembly added another $500 million into Ohio Department of Development funding while maintaining key tax credit programs in the state of Ohio operating budget recently enacted. Key programs funded below include:

Ohio Brownfield Remediation Program. $350 Million for the Ohio Brownfield Remediation Program was added in the state operating budget. The Ohio Brownfield Remediation Program is designed to provide grants for the remediation of brownfield sites across Ohio to clean up the sites and prepare them for future economic development. The program is allocating nearly $350 Million with most funds awarded on a first come, first serve basis but all 88 counties are provided with a $1 M allocation only in FY 2024 of program funding if they have eligible projects. Properties applying for the program must meet the definition of brownfield. A brownfield is defined as an abandoned, idled, or under-used industrial, commercial, or institutional property where expansion or redevelopment is complicated by known or potential releases of hazardous substances or petroleum. Units of local government, including counties, townships, municipal corporations, port authorities, or conservancy districts or park districts, or other similar park authorities, are eligible to apply. Other eligible applicants include county land reutilization corporations, nonprofit organizations, or organizations for profit. These entities must have entered into an agreement with a unit of local government to work in conjunction on the project for the purposes of this program.

Building Demolition and Site Revitalization Program. $150 Million in FY 2024 for the Ohio Building Demolition and Site Revitalization Program was provided by the Ohio General Assembly in the state operating budget. This program is designed to provide grants for the demolition of commercial and residential buildings and revitalization of surrounding properties. Previously, nearly $150 M was made available. Most of the funds, approximately $106 Million, were available on first-come, first-served basis statewide as provided for in statute. The balance of the funds available is on a $500,000 set-aside per county that were being awarded on a first-come, first served basis. Blighted, vacant or abandoned structures are eligible for demolition. Lead entities should utilize the local governments’ strategic plan and/or Community Housing Improvement Strategy to identify blighted, vacant, or abandoned structures must if available. Commercial and residential buildings on sites that are not brownfields are eligible properties. Commercial properties include buildings that were used for retail, office, manufacturing, industrial, industrial warehousing, institutional, or other non-residential or mixed-use (meaning any mix of these uses or a mix of residential and commercial uses) purposes. Non-vacant and blighted structures are not eligible unless they are contiguous and/or connected to vacant and blighted structures that are necessary to demolish. Counties must establish one “Lead Entity” that will be the applicant and award recipient. A county land reutilization corporation shall be the lead entity if one is established. If a county has not created a county land reutilization corporation, the Board of County Commissioners must submit a lead entity letter of intent and grant user access for to identify a lead entity. A subrecipient agreement between the lead entity and other end users (i.e. other local governments, nonprofit organizations, community development corporations, regional planning commissions, community action agencies, etc.) must be submitted as part of the application, if applicable. Any remaining funds in the county set-aside will be added to general fund and made available for grants throughout the state on a first-come, first-served basis.

Changes to the current building demo program included in the state operating budget focuses on who can apply for funding from the Ohio Brownfield Remediation and Building Demolition and Site Revitalization Programs. Under the changes included in the budget, county Land Banks would be the lead applicant and funder in counties where they operate. Ohio currently has 66 county land banks across the state. In the counties without land banks, county commissioners would recommend to the Department of Development a lead applicant on behalf of the county. Further changes restrict who can be a sub-recipient of the funding, designating local governments, nonprofit organizations, community development corporations, regional planning commissions, county land banks, and community action agencies as such recipients. This language appears to exclude private entities from being sub-recipients of funds in the absence of a development agreement with one of the other designated entities listed above.

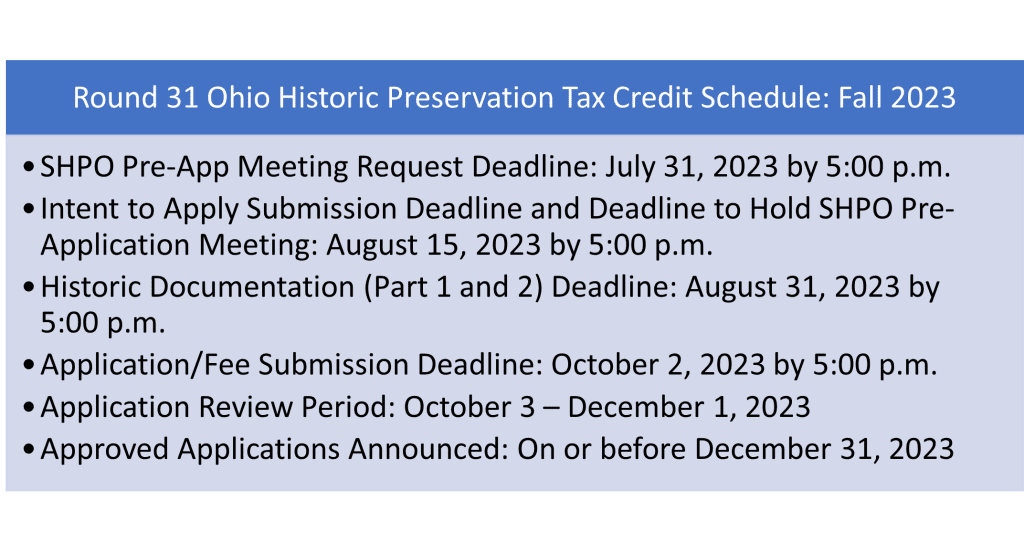

Ohio Historic Preservation Tax Credit Program. The Ohio Historic Preservation Tax Credit Program that provides a tax credit to leverage the private redevelopment of historic buildings. The program is highly competitive and receives applications bi-annually in March and September. With 30 rounds of funding complete, tax credits have been approved for 625 projects to rehabilitate more than 878 historic buildings in nearly 100 different Ohio communities. The program is projected to leverage more than $8 billion in private development funding and federal tax credits directly through the rehabilitation projects. The Ohio Historic Preservation Tax Credit Program provides a state tax credit up to 25% of qualified rehabilitation expenditures incurred during a rehabilitation project, up to $5 million. The tax credit can be applied to applicable financial institutions, foreign and domestic insurance premiums, or individual income taxes. Projects certified on or before June 30, 2021, can apply the tax credit against applicable commercial activity taxes. Projects certified after this date will not be able to apply the tax credit in that way. Owners and long-term lessees of historically designated buildings who undertake a rehabilitation project may apply for the Ohio Historic Preservation Tax Credit. A building must be individually listed on the National Register of Historic Places; contribute to a National Register Historic District, National Park Service Certified Historic District, or Certified Local Government historic district; or be listed as a local landmark by a Certified Local Government to be eligible. Properties that will be used as a single-family residence or multi-family residential condominiums are not eligible. Applications are received bi-annually in March and September.

Applicants file an application with Development and applicable historic rehabilitation documentation with the State Historic Preservation Office. All applicants are required to schedule a pre-application meeting with the State Historic Preservation Office prior to application submission. The Ohio Historic Preservation is one of the state’s most successful redevelopment programs that have dozens of successful success stories.

Ohio’s state operating budget changes continues efforts to spur redevelopment in rural and urban areas throughout the state.