Illinois is the nation’s 6th largest state in the union with 12.7 M people but its strategic location in the middle of the United States relates to a global airport and driven by the U.S.’s third largest city positions Illinois for corporate site location projects.

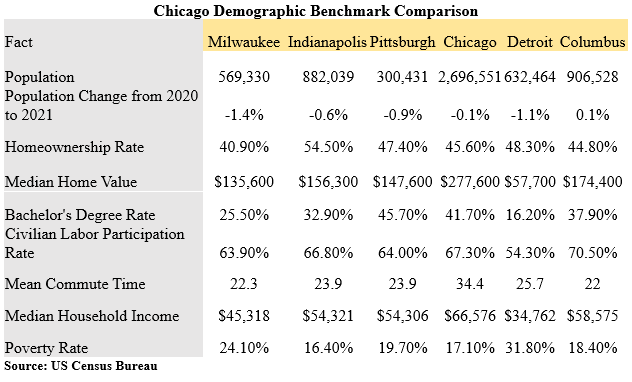

Key demographic measures that impact corporate site location decisions include total population and population growth which impact the ability of a region to provide skilled workers—the larger the population pool the more chances for creating a skilled worker. Also, homeownership and median home value illustrate whether workers will be able to afford housing. Labor issues such as the level of higher education degree attainment and how many workers are in the active workforce impact a region’s ability to attract certain types of companies and companies at all if they have no room for growth in the active labor market. Quality of life issues such as commute times to work matter as well and overall wealth measures such as median household income and poverty rate impact company location decisions.

The demographic measures of major cities in states like Illinois have a big impact on corporate site location decisions. The nearly 3 M residents of Chicago create a global hub for corporate headquarters and other economic development projects. Chicago’s large base of college-educated workers illustrates the city’s strength as an advanced services jobs center. Also, worthy of note is Chicago’s low poverty rate compared with other Great Lakes urban competitors.

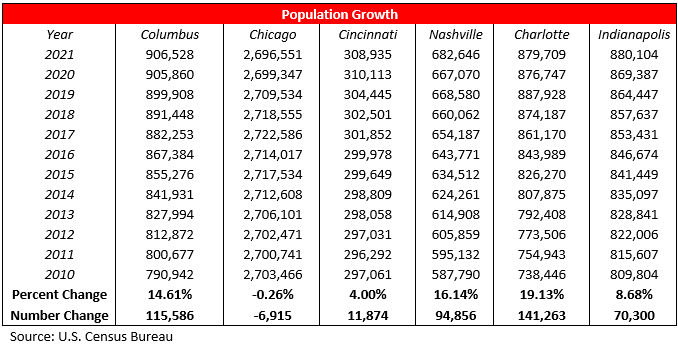

Population growth is a critical measure of economic success. Growing population centers attract companies struggling to find skilled labor. A growing population base creates a larger pool of workers for companies. As the table below illustrates, Chicago is not growing at the same pace as faster developing cities such as Columbus and southern markets such as Nashville and Charlotte. However, the sheer size of Chicago’s population continues to make this global city a prime corporate site location target.

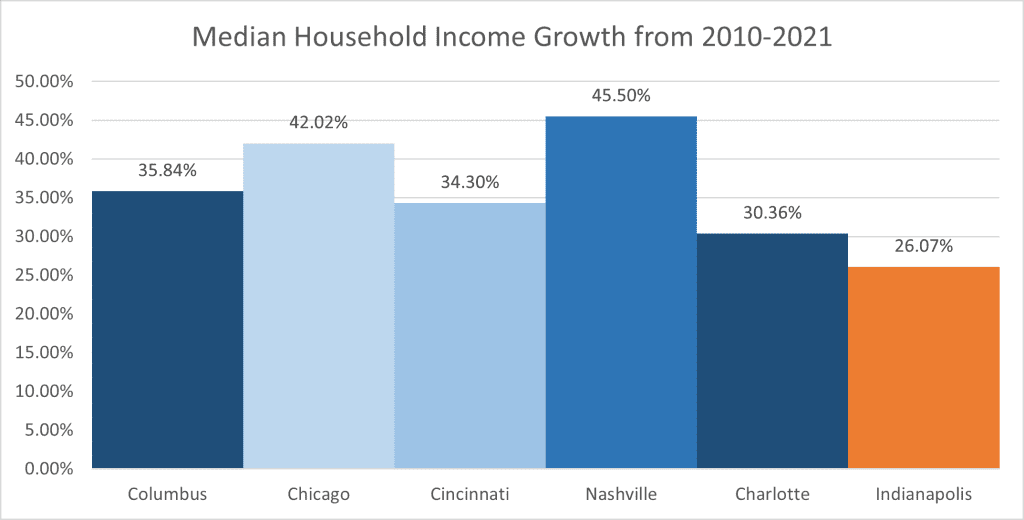

Median household income refers to the income level earned by a given household where half of the households in the geographic area of interest earn more and half earn less as measured by the U.S. Census Bureau. Median household income is an important demographic measure as it tells companies the relative wealth of a geographic region but also is an illustration of the general cost of doing business as it is one of the indicators of the potential wages of employees. The chart below compares the median household income of Chicago to competitor metro regions for corporate site location. Other than the hyper-growth market of Nashville, Chicago’s growth in median family income is leading the Great Lakes states and illustrates the stability of this large city.

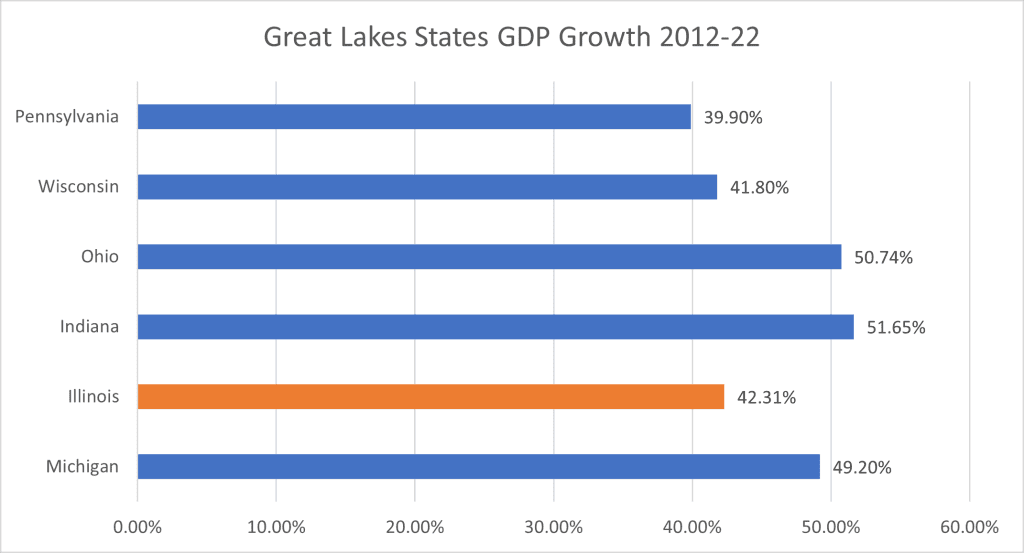

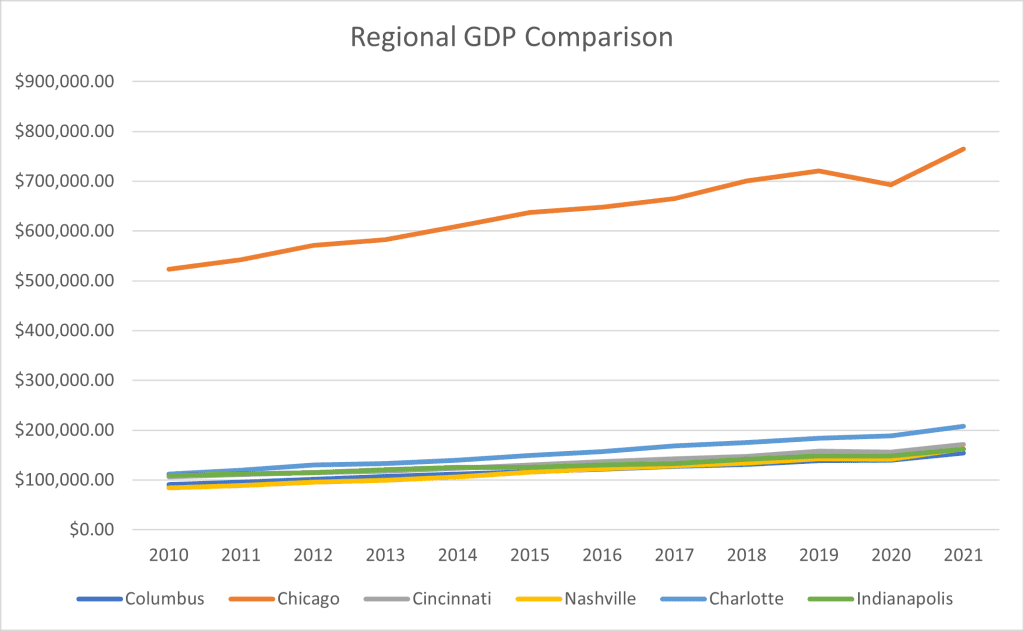

Comparing regional gross domestic product growth is another critical economic development measure that companies consider. A region’s gross domestic product is the sum of its total economic output for the public and private sectors. Regions with growing economies are generally more attractive to companies considering a corporate site location decision.

As the table above illustrates, Illinois has enjoyed growth in their GDP from 2012 to 2022 but the state overall does not compare well to other Great Lakes states- barely edging out Wisconsin and Pennsylvania.

As the chart above illustrates, the Chicago region remains much larger from a total economic output standpoint than many peer cities with Charlotte growing at a faster pace than other mid-sized urban markets.

Demographic and economic data for Illinois and Chicago provides a mixed bag from an economic and demographic performance standpoint. The regions constitute large and growing economic markets but, again like most of their Midwest urban markets, are growing at a slower rate than booming southern regions.