Housing is joining workforce development to become a major corporate site location issue. Regions not growing are failing to develop substantial residential growth. Finally, rural regions are losing population at an alarming rate and desperately need new residential products to retain existing employers and to keep their young people. No matter where you are in the United States, the availability of attainable housing that young and old alike can afford is needed. The simple fact is regions cannot retain and attract companies without workers—workers won’t go to regions where they cannot afford housing.

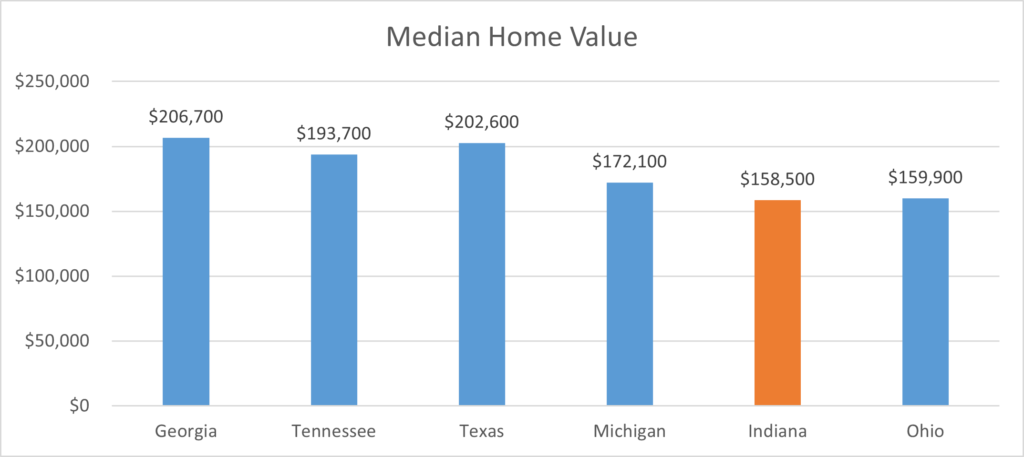

As the table above illustrates, the median home value in the state of Indiana is the lowest among regional Midwest competitors but is below faster-growing southern states such as Georgia, Tennessee, and Texas. While these southern states have grown substantially from a population and economic standpoint in recent decades, data such as the median home value indicate this fast-growth market is not keeping up with housing demand and this is impacting their cost of doing business from a residential standpoint.

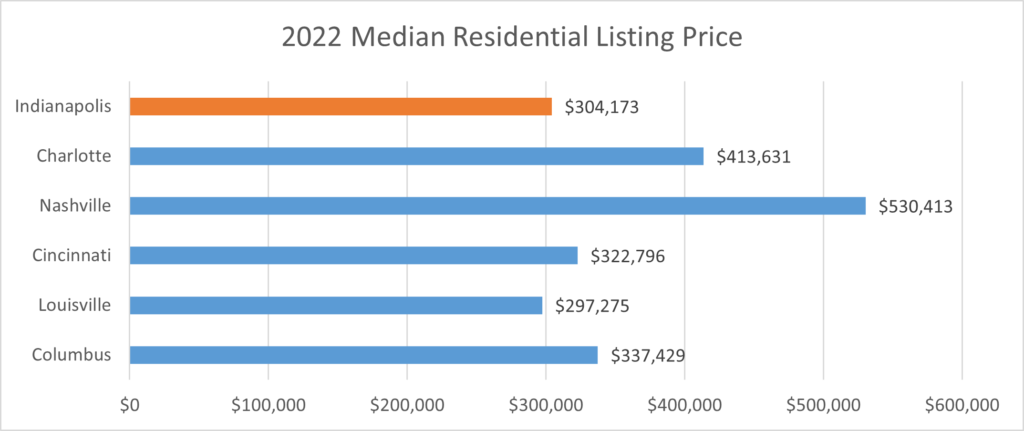

The median residential listing price is another important measure of the strength of the regional housing market. This is an indicator of the current and future strength of the housing market. Also, from a corporate site location standpoint, lower median residential listing prices illustrate markets where a company’s employees can afford to buy a home. Many fast-growing markets are simply not keeping up with the housing demand which is dramatically increasing the price of housing.

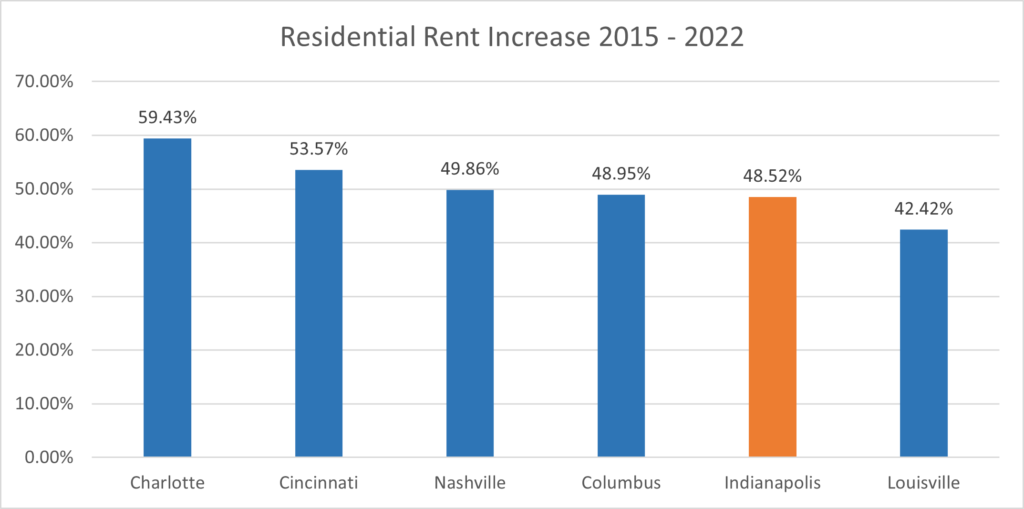

Indianapolis’ residential costs are lower than many competitors, their housing costs are still increasing- nearly 70% from 2010-2022. From 2010 to 2022, the median residential listing price in Cincinnati increased by 70.98%, Columbus increased by 59.83%, Cleveland increased by 43.03%, Austin increased by 32.97%, Charlotte increased by 32.97% and Nashville increased by 61.52%. Finally, Indianapolis’ residential rental rates are either in line with or slightly below national competitors. As the chart below illustrates, residential rental prices grew the most in Charlotte followed by Cincinnati, Nashville, Columbus, Indianapolis, and Louisville.

Growing housing that workers can afford is a critical corporate site location issue and Indiana’s major urban centers offer comparatively affordable housing that is experiencing price increases with a dwindling supply. Housing is a growing corporate site location issue for all regions of the nation and Ohio falls in line with this national trend.