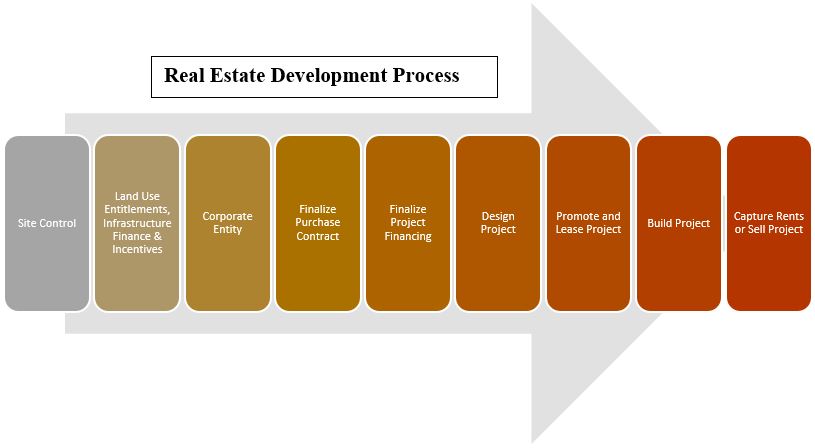

How real estate is developed is critical to the successful implementation of a corporate site location project. With sites available and ready to develop, companies cannot locate in a region. The steady flow of the real estate development process is a step often taken for granted but those that overlook the process do so at their own peril.

The first step in the real estate development process is that a potential buyer gains control of the site and completes due diligence on the site such as confirming the zoning, determining if environmental contamination exists, if the title of the land is marketable, and if the project has tax incentives. Prior to final land purchase, the potential buyer needs to gain all the necessary governmental approvals such as zoning, tax incentives, and Brownfield remediation protection. Next, a corporate entity is formed to develop, own, and operate the property to address tax issues, limit personal liability for the developer, empower the developer to control the entity, provide a method for receiving outside equity if needed, and create an easy exit outcome for the developer. A purchase contract is then signed to memorialize the land purchase and addresses due diligence, marketability of the land title, and governmental approvals. The real estate purchase contract acts as a validation of all representations and warranties made in the contract by the seller/landowner. Developers then must finalize financing for construction debt from a commercial bank or some other financial institution.

The developer works on a project design, which is attractive to the targeted customer, both aesthetically and functionally, that can be built “on budget” and “on time” by professional architecture and construction firms. Beyond design, the financial success of a project is directly tied to three lease negotiation objectives. The project is leased at rents consistent with or better than the project’s initial financial projections, and the lease-up of the project should occur within the timeframe set forth in the business plan. Finally, the project is leased on business and legal terms consistent with the expectations of institutional investors who ultimately invest either debt or equity into the project. Once the project is fully leased and cash is flowing, the developer can sell the project or retain full or partial ownership to gain from lease rents. Projects then are operated to maximize and stabilize the project’s annual positive cash flow and enhance the long-term residual value of the project by keeping the project full of paying tenants and holding down project costs. A project’s sale must be timed to maximize profit by picking the optimal time and is generally the last stage of a real estate development project.