The State Operating Budget is Done, so What’s Left on the Ohio General Assembly’s plate?

The Budget is Done, so what’s left on the General Assembly’s plate:

This week brought the long-awaited conclusion to the FY 20-21 operating budget. After failing to finish the budget by the end of June and passing a 17-day interim budget, the Ohio General Assembly sent the two-year operating budget to Governor DeWine for his signature.

From the beginning the budget focused on kids and economic development. Governor DeWine introduced the budget with a sizeable investment in children’s education initiatives with his Success & Wellness funding geared to additional supports and resources. The House and Senate kept big portions of this program providing millions more in resources for schools. Additionally, the operating budget provided long-needed investment in Higher Education with increases to both the State Share of instruction (SSI) funding and the Ohio College Opportunity Grant (OCOG). These investments are a good start to getting the state’s higher education institutions the support they need, while they continue to recover from funding reductions from the great recession.

It wouldn’t be a state operating budget without changes to Ohio’s tax policy. The budget brings to Ohio’s tax code a companion program passed by Congress, The Ohio Opportunity Zone tax credit remained as a component of the operating budget and now provides additional tools for economic development in some of Ohio’s most economically depressed areas.

The budget includes the water quality program H2Ohio, proposed by Governor DeWine. Funding included in the operating budget will go towards providing much needed resources to begin the process of cleaning up Lake Erie and tackling the source of the runoff which causes algal blooms in the lake. The funding is administered by three different agencies working with each other. The Ohio Department of Agriculture, The Ohio Environmental Protection Agency, and the Ohio Department of Natural Resources will all have dedicated sources of funding for programs and projects pertaining to improving water quality.

Another development coming out of the budget negotiations was a new way forward for pharmacy benefits for Medicaid recipients. The Ohio House and Senate had struck a deal that would have the Ohio Department of Medicaid contract with a single pharmacy benefit manager or PBM every four years. The change takes the pharmacy benefit out of the hands of the five Medicaid managed care companies and establishes the contract directly with the State of Ohio, having each of the state’s manager care companies contracting with the single PBM for services. Additional policy changes provide greater transparency into the process while providing additional funding to independent pharmacies as well. Governor DeWine issued a veto of parts of this budget item, saying the Department of Medicaid shared the goal of moving to a single PBM, but the budget language was too restrictive.

So, what’s left for the remainder of the General Assembly.

The Ohio Senate put out their priorities for the general assembly in early January and in the first half of the year passed many of their top 10 bills. Those priorities include efforts to combat Human Trafficking, Regulatory Reform, more investment in Ohio’s schools with additional infrastructure money, and creating the Opportunity Zone tax incentive; which has since been included in the budget.

Spring brought the Ohio House’s priorities for the general assembly including efforts to combat water quality issues on Lake Erie with a revamped program for Governor DeWine’s H2Ohio, efforts to help with foster care and kinship care, criminal sentencing reform, and workforce development.

Most likely the biggest lingering issue which is sure to attract a lot of debate is the Rep. Cupp and Rep. Patterson plan for overhauling Ohio’s K-12 school funding plan. Speaker Householder has said it is a priority to work towards a new K-12 school funding formula and beginning this fall hearings on the issue are slated to begin.

One item in the world of economic development, which remains to be taken up by the Ohio House is Senate Bill 39. Senate Bill 39 was recently passed by the Ohio Senate with near unanimous support, authorizes a nonrefundable insurance premiums tax credit for capital contributions to a transformational mixed-use development. According to the sponsor of the legislation, State Senator Kirk Schuring, the new incentive is designed to provide a unique tax credit that will help to transform Ohio’s downtowns with new and robust economic development. The new program will be administered by the Ohio Development Services Agency.

On the procurement side of state government, the biggest thing out there is the rebidding of the state’s managed care contracts for the Department of Medicaid. The process has started with a recent RFI distributed to users and providers of Medicaid services seeking information about what changes and improvements should be included in the forthcoming Request for Proposals or RFP.

Healthcare policy continues to be a big item of debate and will certainly drive a lot of the policy being looked at in both the General Assembly and the Administration.

Government Procurement Corner

Ohio Gas Tax Boost Creates Substantial Government Procurement Opportunity at ODOT

This year in Ohio brought with it a renewed effort to increase the state’s motor fuel tax. After a few months of negotiations, the Ohio General Assembly at the urging of Ohio Governor Mike DeWine increased the motor fuel tax by 10.5 cents for gasoline and 18 cents for diesel. What does all the new money mean. It means a continued opportunity to improve road and bridge infrastructure in Ohio, it means Ohio’s local governments will see an increase to their bottom line for road and bridge construction, it means more opportunities for Ohio’s construction and engineering industry that has seen a $16.4 billion investment between 2011 and 2018 at the state level.

This past year alone, the Ohio Department of Transportation (ODOT) spent approximately $2.3 billion on the state’s roads and bridge an increase over 2017 spending of $2.0 billion. ODOT achieved a record spending level in 2015 of $2.429 billion and the departments trend line for program spending continues to move up increasing from approximately $1.8 billion in 2013 to the current level of $2.3 billion. The increase in the motor fuel tax allows ODOT to continue with the strong investments to date.

How does ODOT decide projects?

Throughout the year ODOT issues what is referred to as the programmatic. The programmatic is a list of individual projects throughout the state, ranging from road resurfacing, interchange design and construction, bridge replacement, project studies, road safety projects, and acts as the primary list of transportation funded projects in the state. The list of projects is developed through a multi-step process which includes ODOT district office staff with input from district office engineering, and county managers, as well as central office engineering and planning staff. Each year projects put on the programmatic by ODOT for construction or planning vary throughout the state based on where the greatest need is, which results in different parts of the state receiving a greater share of investment than others year-to-year.

In addition to the programmatic project opportunities, ODOT through the Transportation Review and Advisory Council or TRAC makes the determination on which projects on the major new capacity projects list will receive funding each year. TRAC is an appointed commission created in 1997 to assist ODOT with the departments largest project investments. TRAC is made up of a nine-member commission who is appointed by Ohio’s governor and the director of ODOT serves as the chair of the commission.

What is considered a major new project? According to ODOT a major new capacity project are those projects greater than $12 million, which increase capacity of a transportation facility including, new interchanges proposed for economic development or local access, significant interchange modifications, bypasses, general purpose lane additions, intermodal facilities, major transit facilities, or intelligent transportation systems or projects that reduce congestion. TRAC projects can be submitted by County Engineers, Transit Authorities, County Commissioners, Municipalities, Port Authorities, Transportation Improvement Districts, and Metropolitan Planning Organizations. Local governments i.e. cities, villages, and townships have to utilize one of these options when submitting a project for TRAC consideration. Submitted projects are scored based on a set policy by the commission, a projects score has a determining factor in whether a project receives funding or not.

Although funding factors vary for the available revenue for major new capacity projects ODOT has maintained a program of approximately $200 million over the past 10 years and with the increase in the motor fuel tax a similar level of funding is expected to be achieved moving forward.

How can you position your company to compete?

Relationships matter when showing the value your company brings to a project. Whether it’s for an engineering study or managing a project it’s important for the ODOT to know that the quality of your work and the value you bring to a project will meet the high standards of ODOT and the high standards of tax payers and road users. ODOT’s 12 districts as well as the central office work hand-in-hand with one another to provide the best quality at the best value for each project funded by the department.

Whether your company is a new small business, a minority owned business, or a large construction and engineering firm, positioning yourself for the approximate $2 billion in annual projects is key to any firm’s success.

Contact the Montrose Group to learn more about how to best position your company to help ODOT with their stated mission to provide easy conveyance of people and goods from place to place.

Addressing the Rural Hospital Crisis

Rural hospitals, like their communities, are struggling to survive. In many communities the hospital is the economic anchor and, in many cases, the largest employer. Healthcare, driven by hospitals, is a major player in the American economy. The health care industry recently added an average of 28,000 jobs per month. A few economic data points are critical to understand:

- Hospitals nationally directly employ nearly 5,500,000 people, constituting the nation’s second largest source of private sector jobs and spend over $702,000,000,000 on goods and services from other businesses;

- Hospitals support 15,000,000 direct and indirect jobs or 1 of 9 jobs in America;

- Health care workers are paid higher wages than non-health care workers;

- Hospitals provide an economic ladder for workers lacking a college degree as well as for highly skilled and educated workers;

- Hospitals provide economic benefits to both rural and urban centers with a large number of jobs for these areas and they provide for the creation of a “service export” for the area as well with the substantial state and federal government and private payer funding of health care services; and

- Health care occupations are expected to grow by 29 percent from 2010-2020- the largest growth planned for any American occupation.

In Ohio’s rural communities’ hospitals are facing even bigger obstacles and in many cases are forced to close or consolidate. According to The National Rural Health Association, 60 rural hospitals have closed between 2010 and February 2016 nationally. In Ohio 2 rural hospitals have closed in recent years and a number of others have merged or consolidated into larger organizations.

If rural regions lose their hospitals economic calamity is likely to follow as these institutions are not only large employers but serve as a magnet for other employers who wish their workers to have quick access to quality healthcare. What we do know, is that if no efforts are made to protect these vital community and regional assets the trend of rural hospital plight through closure and consolidation will continue. According to the U.S. Census Bureau, approximately 2.4 million Ohioans live in rural Ohio, which is equal to a quarter of the state’s population.

What can be done?

America needs to adopt a rural hospital public policy agenda. Local, state and federal governments in partnership with leading rural hospitals need to address rural hospitals workforce development, regulatory compliance, federal and state reimbursement rate, and taxes and fees all focused on providing the economic support needed for these institutions to survive. Ohio is starting to take steps in this direction when Governor DeWine and Lt. Governor Husted supported the enhanced use of telemedicine. However, let’s face it, telemedicine alone is not a panacea for the challenges of rural hospitals and public policy efforts to support their growth and retention needs to think bigger.

https://www.ruralhealthweb.org/advocate/policy-documents

Develop Rural Healthcare Workers

Throughout the country 60% of the health professional shortage areas are in rural or partially rural areas. Federal and state governments need to have a specific workforce development focus on helping rural communities with retention and recruitment to fill these gaps. Without a separate specialized program for these workers, rural hospitals will continue to struggle to attract and retain the doctors, nurses, and other health professionals these areas need to provide high quality healthcare.

Address the Opioid Crisis & Other Addiction and Mental Health Issues

Rural hospitals are many times on the front lines in the nation’s and certainly in Ohio’s fight against opioid and other drug addiction. There needs to be better alignment with rural hospitals, state, and federal efforts to provide access to treatment and care through specific programs and funding. Additionally, barriers to providing behavioral health services and eliminating information-sharing restrictions to have better coordinated care would be an important step in Ohio and at the federal level.

Flexible Regulation for Rural Hospitals

Hospitals face a number of regulatory requirements at both the state and federal levels of government. The annual cost of non-clinical regulatory compliance for hospitals in the U.S. is $39 Billion, according to the American Hospital Association. These mandates have an even bigger impact of the rural hospital systems and should be reformed to provide relief from what are outdated and burdensome regulations, which are not focused on patients.

Higher Medicaid and Medicare Fees for Rural Hospitals

Rural hospitals tend to have a higher per capita patient rate who are receiving healthcare coverage from either Medicaid or Medicare. Additionally, rural hospitals generally serve populations who are indigent or uninsured. For these reasons Ohio’s rural hospitals as well as those around the country are more vulnerable when reimbursements are either held flat or in some cases decreased.

The federal government along with states should look to boost program assistance through the Hospital Care Assurance Program (HCAP). HCAP helps hospitals with unpaid bills for individuals who are below the federal poverty level and who are ineligible for Medicaid coverage. The program also provides funding to hospitals who have a disproportionately high share of uncompensated care costs. Funding levels as well as eligibility adjustments should be considered.

Additionally, Congress should look to create a specific rural hospital reimbursement structure, which reflects the nature of the patients who use the facilities. At the state level a similar approach should be undertaken to help support rural hospitals and their efforts to keep their doors open.

Congress and states should eliminate site-neutral policies which seek to reduce reimbursement for non-emergency services provided at a hospital’s off-campus provider-based department or PBD’s. These policies attempt to match the cost for these services to the same reimbursement cost as if they were provided in a physician’s office. Rural hospitals feel the pinch from these types of policies in light of the fact that PBD’s are used more frequently as health-care access points in more remote areas.

Data Security

Data protection is a long emerging area of concern not only in the information technology field, but throughout the whole economic sphere. As medical records and billing continue to become more digitally driven processes protecting an individual’s data is very important. This area is another example of an increased cost associated with providing critical access to care, and both Congress and states should begin to look at providing support to entities who may struggle with these resources. We have discussed the challenges rural hospitals face and their limited access to additional revenue and resources. Adding an additional cost to protect patient data continues to erode the core functions of the hospital which is to provide healthcare.

These are just a few of the public policy areas Ohio and Congress should be considering. Without a specific focus on support and policy changes for our rural hospitals, Ohioans who live in rural areas will continue to lose access to healthcare along with the economic benefits which come along with having a strong thriving community anchor.

$920 M in ODOT TRAC Requests Creates Substantial Competition and Interest

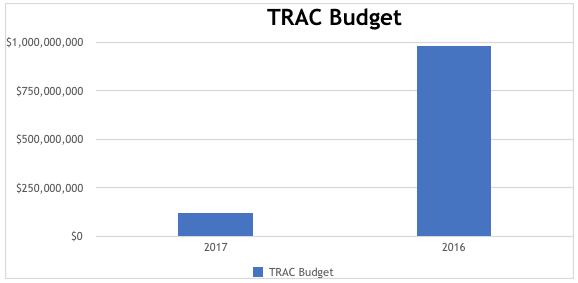

Funding for “major new capacity projects” with the Ohio Department of Transportation (ODOT) are awarded through the Transportation Advisory Council (TRAC). The next round of applications for TRAC funding will be due in the spring of 2020. Funding request for 2019, which were due to TRAC by May of this year included 27 projects for a total of approximately $920 million. The Ohio Transportation Budget, House Bill 62 recently enacted, increased the states motor fuel tax by 10.5 cents for gasoline and 18 cents for diesel. The legislation also allocated approximately $170 million in funding for Major New Program funding per year in the FY 2020 well short of the $920 million in request. The high demand for state transportation funding creates substantial competition for funding through the TRAC process as well as interest in exploring alternative funding options.

This year’s application request is an increase over the previous year and one of the highest numbers of requested projects over the last 6 years, with the total cost of those projects exceeding the total cost of any year over the past 6 as well.

With the increase in the motor fuel tax ODOT through the TRAC process has been able to replace a portion of the loss of funding from the Ohio Turnpike proceeds authorized through the Ohio Jobs and Transportation program in 2013. What is clear is the demand for infrastructure spending from TRAC will continue. While TRAC applicants is up from previous years a significant increase in funding from the past few years is not anticipated (as illustrated by the chart below).

First, communities hoping to gain funding for their transportation project through the ODOT TRAC process need to fully implement a project financing program. Successful project financing strategies will involve advocating aggressively for TRAC funding, increased ODOT support for the TRAC budget, forming Transportation Improvement Districts (TIDs) and alternative funding sources from private infrastructure financing through Public-Private-Partnerships (P3s) and EB-5 funds.

Highway transportation project financing needs to start with efforts to gain TRAC funding. TRAC funds Major New Capacity projects greater than $12 million which increase the capacity of a transportation facility or reduce congestion, impact economic development, have local financing and a strong overall financing plan. All projects that cost ODOT greater than $12 million, request Major New funding, and add capacity to a transportation facility must come before the TRAC. This definition includes all new interchanges proposed for economic development or local access, any significant interchange modifications, bypasses, general purpose lane additions, intermodal facilities, major transit facilities, or Intelligent Transportation Systems (ITS). TRAC put out specific limiting criteria for this round of funding focused on projects with non-ODOT funding commitments in the amount of 30% or greater of the total project cost and:

- Projects that are an existing TRAC funded project (Tier I, II or III) and additional funds are needed to advance the project to the next stage of development; or

- new projects that demonstrates significant impact to jobs, regional economic impact and has significant non-ODOT funding commitments.

ODOT Program Management Staff reviews the applications submitted and scores applications in accordance with TRAC policy to provide a draft project score based upon four factors- transportation, economic, local investment and project financing. Draft scores are shared with project sponsors to determine if any additional information is needed. Once a final score has been assigned, ODOT Program Management Staff provides the information to TRAC for their evaluation and consideration. Also, the TRAC will hold public hearings around the state in September and October, providing project sponsors with the opportunity to convey information about their respective projects that may not be captured as part of the on-line application process. After the public hearing process, TRAC will develop a DRAFT funding list which is published for public comment. Once public comment has been received and reviewed, TRAC will move to adopt a FINAL Major New Construction Program Funding List. From application submission to adoption of a FINAL Major New Construction Program Funding List is approximately six months to allow for sufficient time for review, questions, and public comment.

The fact is TRAC is not allocated the funding it needs to support all the applications filed. In fact, the TRAC tier I, II, and III list exceeds the total of the entire highway construction budget for ODOT. Additionally, ODOT has pursued the financing of large Major New projects through P3 agreements in recent years. This has led to the private financing and building of the Portsmouth Bypass, estimated to cost $1.2 billion. This financial arrangement allows the state to make payments over a negotiated period of time, reducing the amount of upfront outlays needed to pay for these types of projects. P3s are driven by global private infrastructure companies that fund highway construction projects. The Portsmouth Bypass proves they will work in Ohio and P3s are an option for major highway construction projects.

Forming a Transportation Improvement District (TID) could also provide additional major highway financing options. Multi-local governmental entity reaching agreement on funding for a specific transportation project. TIDs fund improvements to streets, highways, parking facilities, freight rail tracks and necessarily related freight rail facilities, or other transportation projects that are newly constructed or improved as well as the administrative, storage, and other buildings or properties, and facilities the district needed for the operation of the TID. The recently passed ODOT budget has funding for TID projects but it is capped at $250,000 per project. However, TIDs ability to develop local financing options through a multi-jurisdictional revenue model offer substantial funding sources.

Finally, major transportation projects have been funded by EB-5 funds in Pennsylvania that may provide a new model for transportation funding in the Buckeye state as well. Entrepreneurs (and their spouses and unmarried children under 21) are eligible to apply for a green card (permanent residence) if they: make the necessary investment in a commercial enterprise in the United States; and plan to create or preserve 10 permanent full-time jobs for qualified U.S. workers and transportation projects have qualified for EB-5 investments as construction jobs qualify as job creation. A major interstate project in Pennsylvania was funded through the use of EB-5 funds and may provide a model for major highway financing for Ohio projects searching for funds.

Ohio brings back vital program for Rural Economic Development

One of the biggest challenges for locating jobs in rural Ohio is the lack of site-ready parcels of land which are ready for development. A site-ready parcel of land is property that has all of the necessary infrastructure in place so construction and development can begin on day one. Think of infrastructure as access to water and sewer lines, adequate access to electricity or natural gas, as well as the road infrastructure that can support the increase in traffic associated with job growth.

The recreation of an old program in Ohio has set-out to solve a portion of this problem. The Ohio Rural Industrial Park Loan fund was re-established in House Bill 166 the recently signed state operating budget. House Bill 166 appropriates $25 million into the fund, which is designed to help rural communities with the expenses associated with getting a piece of land ready to be developed.

In conjunction with other programs in the state, most notably the site-ready program operated by Ohio’s not-for-profit economic development entity JobsOhio, this program administered by the Ohio Development Services Agency will fill a gap in Ohio’s efforts to attract and retain jobs in the rural parts of the state.

The lack of site-ready sites in Ohio is a key issue affecting the rural areas of the state and with this program reinstated an effective tool is being added to the tool box when it comes to helping rural communities have a chance at being competitive.

Who’s eligible? According to Ohio Revised Code Section 122.23 projects within an Ohio county with a population of less than 125,000 and are designated as distress qualify for eligibility. To meet the distress designation a county has to meet the following:

(1) Its average rate of unemployment, during the most recent five-year period for which data are available, is equal to at least one hundred twenty-five per cent of the average rate of unemployment for the United States for the same period.

(2) It has a per capita income equal to or below eighty per cent of the median county per capita income of the United States as determined by the most recently available figures from the United States census bureau.

(3) In intercensal years, the county has a ratio of transfer payment income to total county income equal to or greater than twenty-five per cent.

If your project is in a distressed county, who can apply?An eligible applicant is any of the following:

(1) A port authority as defined in division (A) of section 4582.01 or division (A) of section 4582.21 of the Revised Code;

(2) A community improvement corporation as defined in section 1724.01 of the Revised Code;

(3) A community-based organization or action group that provides social services and has experience in economic development;

(4) Any other nonprofit economic development entity;

(5) A private developer that previously has not received financial assistance under section 122.24 of the Revised Code and that has experience and a successful history in industrial development.

The program is administered by the Ohio Development Services Agency. ODSA is required by the Ohio Revised Code to establish rules governing the program as well as rules to determine the governing criteria for evaluating applications. The Director of ODSA also is required to determine the fees, interest rates, payment schedules, and local match requirements; require each applicant for assistance to develop a project marketing plan and management strategy, inform local governments of the availability of the program, and issue an annual report regarding the program activities.

Some questions remain to be answered.

What will be the additional criteria for evaluating projects?

How will projects be awarded within eligible counties?

Will there be geographic consideration when awarding loans?

Are the loan amounts capped?

These questions and more are policy decisions the Ohio Development Services Agency will be tasked with moving forward to re-establish this beneficial program.

1 Bureau of Labor Statistics, Growing Occupations Report retrieved from http://www.bls.gov/ooh/About/Projections-Overview.htm.