The April 2019 US Treasury regulations published provide a clearer road map for the use of Opportunity Zone in corporate site location projects. The new federal government program provides substantial capital gains tax relief for longer term investors in one of 8700 census tracts designated as Opportunity Zones covering all fifty states and US territories. An original set of Treasury regulations was released in October 2018 that provides some answers as to how the program would operate but they also created substantial questions. The second wave of regulations published by the US Treasury Department on April 17, 2019 could well be the key to transforming the federal Opportunity Zone program from a way to develop housing, mixed use and retail projects into a tool for creating high-wage jobs. The practical impact of the first set of Opportunity Zone rules is that real estate projects tied to small, local retail (think coffee shop) and multi-family projects were likely to qualify for the program but projects that actually create high-wage jobs would not. Seeing the challenge to this approach, the US Treasury’s new set of regulations touch on a wide range of Opportunity Zone issues.

First, the April 2019 Treasury regulations establish clear rules for how leased property could benefit from the Opportunity Zone program. Many large-scale corporate site location projects involve companies expanding or locating into leased space. The new Treasury regulations treat leased property held by an Opportunity Zone Business, as lessee, as tangible property for purposes of the 70% substantially all test, and they apply the same rule for the 90% asset test for an Opportunity Fund. This rule will help those Opportunity Funds that conduct business directly as opposed to through an Opportunity Fund business as it will allow leased property to be included as a good asset for the 90% asset test. Leased property must have the same purchase date of 12/31/17, be at market rates in arm’s length transactions.

Second, the April 2019 Treasury regulations address questions about the original rule’s discussion of “substantial improvement” to the property. The Opportunity Zone program requires the property to be a “Qualified Opportunity Zone Business Property that either the Opportunity Fund or Opportunity Fund Zone Business is the original user of the property in the OZ or that the property be substantially improved—with a substantial improvement test requiring doubling the basis of the property over a 30-month period. The April 2019 Treasury regulations clarified there is no substantial improvement requirement with respect to unimproved land nor with respect to a building that has been vacant for an uninterrupted period of at least 5 years. Tangible property, providing that an Opportunity Fund or Opportunity Fund Business will be treated as the original user of such property if the prior use was not in an Opportunity Zone. The regulations established there are no original use or substantial improvement requirements for leased property between unrelated parties but the substantial improvement test is to be applied on an aggregate basis, and thus the test must be applied on an asset-by-asset basis. Thus, land with multiple buildings are acquired in an Opportunity Zone must separately satisfy the substantial improvement test.

Finally, the Treasury regulations addressed what many believe to the largest impediment to the successful use of the Opportunity Zone program through the discussion of several Safe Harbors related to the “50% test”. In an effort to present “shell corporations” from using Opportunity Zones without any economic investment, the October, 2018 Treasury regulations established that at least 50% of the gross income of an Opportunity Zone Business must be from the active conduct of a trade or business within the Opportunity Zone. The April 2019 Treasury regulations keep the 50% Test but create several Safe Harbors that should encourage corporate site location projects in Opportunity Zones.

- Hours of Services Safe Harbor. 50% of the services performed for the Opportunity Zone Business for the taxable year are performed in the Opportunity Zone as measured by the number of hours of work performed by employees or independent contractors;

- Amount Paid Safe Harbor. 50% of the services performed for the Opportunity Zone Business for the taxable year are performed in the Opportunity Zone as measured by the amount paid to the employees and independent contractors of the Opportunity Zone Business.

- HQ/Management Safe Harbor. The 50% Test will be deemed met if the tangible property located in an Opportunity Zone and the management or operational functions performed in an Opportunity Zone are each necessary for the generation of at least 50% of the gross income of the Opportunity Zone Business.

The 50% Test Safe Harbor regulations use industry examples from computer software to landscapers located in an OZ as well as a “catch all” test that the Opportunity Zone Business can work with the IRS to use a facts and circumstances test to determine where its gross income is derived. It is worthy to note what the Treasury regulations do not require—they do not require an Opportunity Zone Business to have 50% of their customers in the Opportunity Zone, do not make local employment requirements, nor do they have any requirements related to the company’s supply chain.

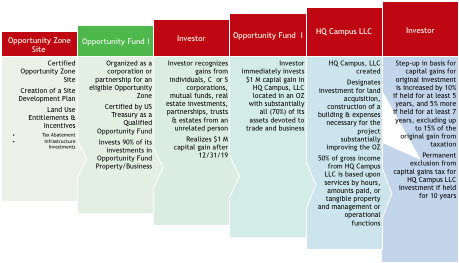

Based upon these new federal regulations, the Montrose Group created an Opportunity Zone model geared toward the implementation of a corporate site location project.

While this model is simplified for purposes of presentation, the chart above illustrates how a corporate site location project involving headquarters or substantial management services tied to the facility would work. This case study would involve the development of a campus which could be tied to nearly any industry as it would fall under the “Management Safe Harbor.”