The April 2019 US Treasury regulations published provide a clearer roadmap for the creation of Opportunity Zone Funds. The new federal government program provides substantial capital gains tax relief for longer term investors in one of 8700 census tracts designated as Opportunity Zones covering all fifty states and US territories. An original set of Treasury regulations was released in October 2018 that provides some answers as to how the program would operate but they also created substantial questions. Developers, regions, states and companies seeking to gain some of the $6.1 Trillion in capital gains will likely seek to create an Opportunity Zone Fund. Novogradac has 123 Opportunity Zone funds with a reported $27 B in assets listed on their website. This is clearly just the start, and the speed at which Opportunity Zone Funds blossom is going to be impacted by the recently published Treasury rules on the program.

The US Treasury Department will certify who is a “Qualified Opportunity Fund” but the tax reform law defines this as a partnership or corporation formed for the purpose of making investments in businesses located in low-income communities designated as “Qualified Opportunity Zones.” To gain the program benefits, an investor must invest proceeds from a sale or exchange of assets to an unrelated party into a Qualified Opportunity Fund within 180 days from the date of such sale or exchange. This investor may choose to reinvest only a portion of the proceeds from the original sale or exchange, in which case only a portion of the gain would be deferred. A Qualified Opportunity Fund is required to invest at least 90% of its assets in targeted businesses where substantially all of the tangible assets of each such business are used in a Qualified Opportunity Zone, and at least 50% of the gross income earned from each such business is from the active conduct of business in a Qualified Opportunity Zone.

Several key provisions are relevant for those seeking to start and/or operate an Opportunity Zone Fund. First, an Opportunity Fund Entity qualification includes those organized in Indian Territory if also in one of the fifty states. The regulations also address the meaning of “substantially all” throughout the Opportunity Zone program. The term substantially all is 70 percent for the “use in an Opportunity Zone” threshold that must be met for tangible property to be qualified Opportunity Zone business property. The term substantially all is also 70 percent for the tangible property “owned or leased” threshold that must be qualified OZ property for a business to be a qualified OZ business. The term substantially all is 90 percent when used to measure a QOF’s holding period of tangible property as qualified OZ business property, or an interest in a business as a qualified OZ partnership interest or qualified OZ stock, and 90 percent to measure the holding period of a qualified OZ business of tangible property as qualified OZ business property.

The proposed regulations provide Opportunity Funds six months to invest capital received from investors—not the one day that could have operated under the previous regulations—and the proposed regulations allow an Opportunity Fund to apply the test without taking into account any investments received in the preceding six months based upon those new assets being held in cash, cash equivalents, or debt instruments with terms of 18 months or less. Last year’s requirement that Opportunity Funds use GAAP to calculate compliance with the 90 percent and 70 percent asset tests was changed in the regulations to permit Opportunity Funds and Opportunity Zones Businesses to elect to use unadjusted cost basis to value tangible property regardless of whether or not they have an applicable financial statement. In addition, if an Opportunity Zone is sold for cash, it is no longer a qualified investment for the 90 percent test–but the Opportunity Zone statute allows a reasonable time to reinvest. Treasury has clarified that a “reasonable time,” is within 12 months, and the proposed regulations provide a special election for certain sales of assets of an Opportunity Fund partnership or S corporation. A taxpayer that holds a qualifying Opportunity Fund partnership interest or qualifying Opportunity Fund stock of an Opportunity Fund corporation may make an election to exclude from gross income some or all of the capital gain from the disposition of qualified Opportunity Zone property reported on Schedule K-1 of such entity, provided the disposition occurs after the taxpayer’s 10-year holding period. Importantly, the Treasury Department and the IRS intend to implement targeted anti-abuse provisions with respect to this election.

Finally, the proposed rules authorize Opportunity Fund real estate investment trusts (QOF REITs) to designate special capital gain dividends, not to exceed the QOF REIT’s long-term gains on sales of qualified OZ property. Clearly, the Treasury and IRS are trying to make it easy for a fund to hold multiple assets without an administrative burden and sale a single asset in the same fund structure without recognizing a gain. Most Opportunity Zone Funds created to date are real estate investors focused on individual properties. The REIT vehicle is made for the Opportunity Zone program and the new Treasury regulations attempted to spur their application to these 8700 census tracts that have created Opportunity Funds have done so only for individual properties thus far, with the exception of a vocal few REIT offerings.

When regions, communities, developers or companies are considering creating an Opportunity Zone Fund, several questions come to the top related not just to the Treasury regulations but related to the operation of the Opportunity Fund. Key questions that should be asked and answered include:

- What type of entity should be created or utilized to develop the sites in question through the federal Opportunity Zone Program?

- Should new Opportunity Zone Funds be created, or would the projects be more successful operating through an existing Opportunity Zone Fund?

- What are the prime operational issues of concern related to an Opportunity Zone Fund for this project?

- How can investment be attracted to these Opportunity Zone Funds and Opportunity Zone Property at these sites?

- What businesses and industries are best suited to locate at these sites and would be most attractive in particular for Opportunity Zone investors?

- What should the elements of an investment policy be for the Opportunity Zone Fund include?

- What other state and federal government programs should be a focus for application to these sites?

The creation of an Opportunity Zone Fund Plan is an important step that can not only answer there critical operational questions but also can provide a site development and transportation plan and an industry analysis to determine what is the best use for a specific Opportunity Zone under consideration.

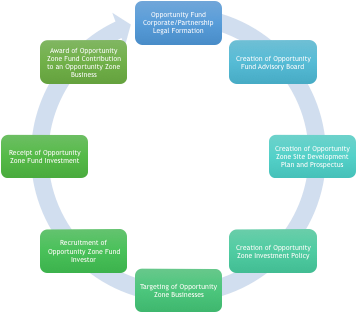

Montrose Group’s Opportunity Fund Creation Model

As the chart above illustrates, the new federal regulations matched with traditional community investment strategies, provide an outline for how a region, organization or company can create an Opportunity Zone Fund. The Montrose Group would recommend a holistic strategy tied to a solid business plan for regions, communities, developers and companies considering creating an Opportunity Zone Fund. Planning tied to site development, transportation assessment, marketing material such as a prospectus, development of an Opportunity Fund investment policy to guide decisions of the fund such as what industries and companies are the target for the fund and, of course, how the fund will gain investors. If done correctly, accepting and making the investments in Opportunity Fund Businesses should be the easy part. Please contact Nate Green at [email protected] if you have any additional questions about forming an Opportunity Fund.