Successful placemaking strategies do not just happen. It requires a thoughtful approach that capitalizes on current assets and utilizes a range of programs to create new public spaces and enhances private developments needed for housing, retail, office, and other private development to happen. The International Economic Development Council has defined placemaking as “the practice of enhancing a community’s assets to improve its overall attractiveness and livability.” Placemaking is defined as large-scale projects like the creation of new public or revitalized public spaces, alternative transportation infrastructure, pop-up retail, housing, or Downtown beautification projects. Bike trails, public beer gardens, parks, and other public spaces often mix uses and are attractive to residents and visitors alike. However, successful placemaking strategies require multiple projects as well as an overall improvement in the quality of life available to area residents and visitors.

Five tactics drive placemaking economic development strategies that transform communities, including:

- Historic preservation redevelopment;

- Parks and trail development;

- Landbanks that spur housing redevelopment;

- Housing development; and

- Economic development incentives drive Downtown district redevelopment.

Saving historic structures can be a key element to a placemaking economic development strategy. Historic preservation increases land values and enhances the regional economy. Ohio has benefited substantially from their state and federal historic preservation tax credit. Cleveland State University in partnership with TeamNEO recently completed an economic impact study of construction and selected operating impacts of all rounds of the Ohio Historic Preservation Tax Credit Program found that $1 M in tax credits creates $40 M in total economic impact. Historic preservation is a tool local communities can choose to revive neighborhoods, enhance environmental quality, and reduce infrastructure costs by promoting development in existing areas rather than sprawling out. It is estimated that historic preservation projects save 50-80 percent in infrastructure costs compared to new suburban development.

Tax credits and public finance programs can spur historic preservation based economic development. State and federal historic preservation tax credit programs incentivize placemaking investments. 41 of the 50 states offer some form of state historic preservation tax credit that can help transform structures over 50 years old from underutilized or abandoned buildings into housing, retail, office, or other productive uses. Ohio offers a worthy example of a successful state historic tax credit program. The Ohio Historic Preservation Tax Credit Program provides a tax credit to leverage the private redevelopment of historic buildings. The Ohio Historic Preservation Tax Credit Program provides a state tax credit up to 25% of qualified rehabilitation expenditures incurred during a rehabilitation project, up to $5 million. The tax credit can be applied to applicable financial institutions, foreign and domestic insurance premiums, or individual income taxes. Projects certified on or before June 30, 2021, can apply the tax credit against applicable commercial activity taxes. The program is highly competitive and receives applications bi-annually in March and September. With 28 rounds of funding complete, tax credits have been approved for 562 projects to rehabilitate over 795 historic buildings in 77 different Ohio communities. The program is projected to leverage more than $8.09 billion in private development funding and federal tax credits directly through the rehabilitation projects. Round 28 of the Ohio Historic Preservation Tax Credit Awards was announced on June 22, 2022. The Ohio Department of Development awarded $39.87 million in Ohio Historic Preservation Tax Credits to rehabilitate 39 historic buildings in 18 communities. Recently, the Ohio General Assembly made changes to Ohio’s Historic Preservation Tax Credit Program. The funding for the Ohio Historic Preservation Tax Credit was increased for State Fiscal Year 2023-2024 from $60 M to $120 M, permits temporary benefits for new awards during SFY2023-2024 and taxpayers who have already been awarded tax credits after June 30, 2020, who can apply for this improved credit so long as construction has not yet commenced. Also, these tax credits for projects in any county, township or municipalities with populations under 300,000 (per the 2020 census) are increased from up to 25% to up to 35% of qualified expenses, and the individual project cap increases from $5 million to $10 million for all projects and these credits are refundable—meaning if the credit claimed in any tax year exceeds the tax otherwise due, the excess is refunded to the taxpayer, similar to catalytic projects, and not subject to a cap. The Ohio Department of Development must also consider the rehabilitation of historic buildings previously used as theaters that will be rehabilitated and will be used as theaters, and they must consider the extent to which the rehabilitation will increase attendance and gross revenue at the theater.

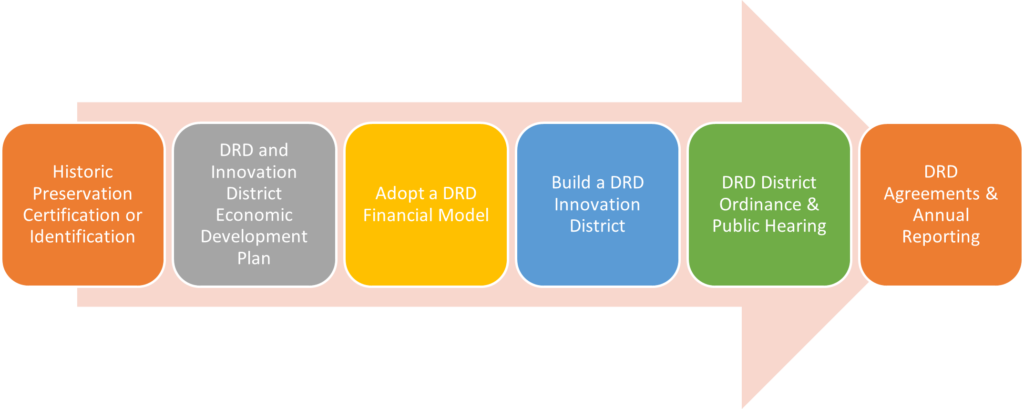

Ohio and Michigan also offer local public finance programs that can support historic preservation-based development. Ohio municipal corporations can create downtown redevelopment districts (DRDs) and innovation districts to promote rehab of historic buildings if a city has a certified historic structure, creates a district as large as 10 contiguous acres around that historic structure and develops a DRD economic development plan under recently enacted HB 233. Six steps exist to redevelopment historic property using DRDs.

- Historic Preservation Certification and Renovation Plan. The DRD process begins with the identification of a certified historic structure or undertakes the process of gaining that historic certification. DRD historic certification is accomplished through four different routes including if a building is on the National Register of Historic Places, contributes to a National Register Historic District, located in a National Park Service Certified Historic District or a Certified Local Government Historic District. Historic preservation certification also requires an approved renovation plan to keep historic building “historic.”

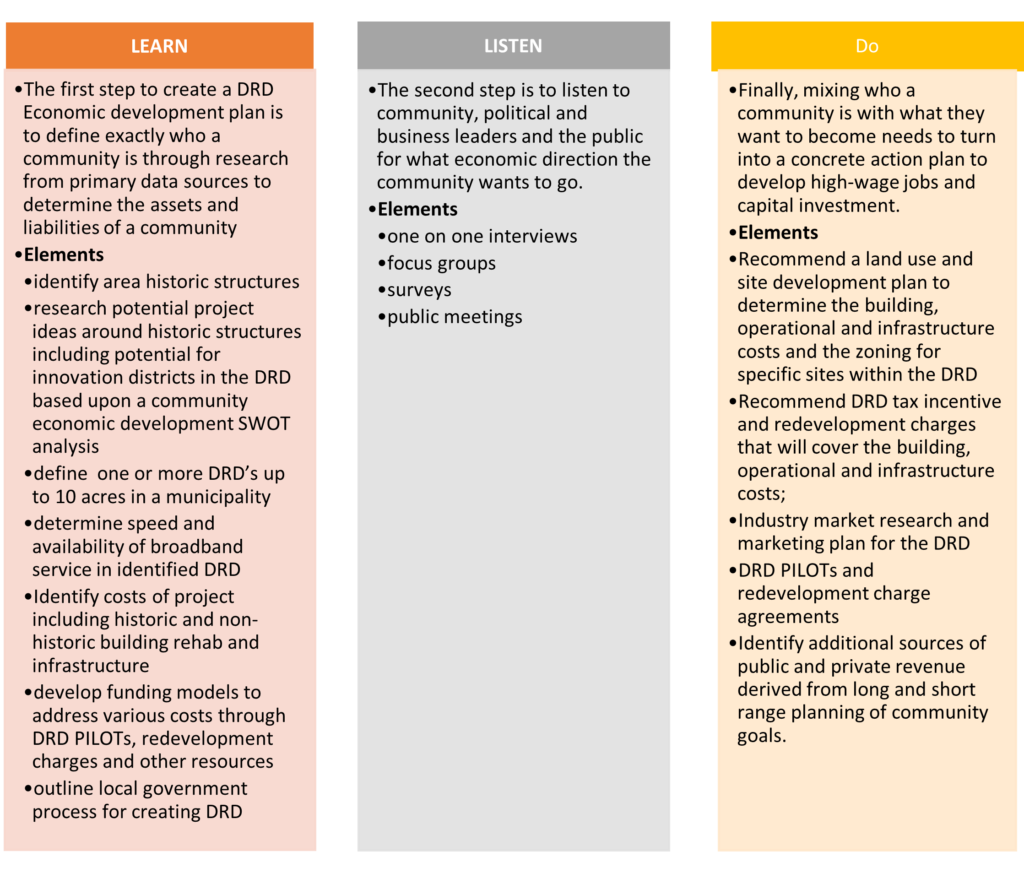

- Complete a DRD and Innovation District Economic Development Plan. DRD districts must have an economic development plan. A DRD economic development plan should identify the redevelopment project costs including building, infrastructure and operations, financial modeling of the parcels within 10 acres around the historic structure and review of other tax credits, grants, loans and private contributions to address those costs, a site development plan that considers the economic potential of the DRD through commercial, mixed use and research market research, determines the DRD broadband service to see whether the DRD qualifies as an Innovation District, and outlines that local government process and agreements needed to formally create a DRD.

3. Adopt a DRD financial model. Next, the municipality must adopt a DRD financial model addressing the building, infrastructure, and operational costs through a tax exemption up to 70% of the increased value of real property in the DRD providing the collection of service payments in lieu of taxes from the property owners and redevelopment charges assessed to property owners within the DRD- both of which may be levied without property owner approval. The DRD may not be exclusively residential and last for 10 years or 30 years with school board approval. Additional funding for the DRD can be gained from federal and state historic preservation and new market tax credits and state Capital Bill funding.

4. Build a DRD Innovation District. DRDs with a 100-gigabit broadband level or higher can become an Innovation District. Innovation Districts can use DRD generated funds to give grants and loans to high-tech companies. The Innovation District designation can ignite a tech-based economic development project by providing the capital needed for early-stage capital tech companies.

5. Adopt the DRD District Ordinance, Public Hearing & File Annual Reports. DRDs are created through a city ordinance describing the area included in the district, the number of years the DRD will exist, the economic development plan, ID of the historic building (s) in the district, potential designation of an innovation district within a DRD, establishment of a special fund for the deposit and dispersal of service payments and redevelopment charges, and acknowledgement that city must file an annual DRD report to the Ohio Development Services Agency. Finally, the city must hold a public hearing on the proposed DRD ordinance and give notice of the hearing to each property owner in the district.

6.Negotiate DRD Agreements with building owners, school board and other funders. Following passage of a DRD ordinance, municipalities should enter into various agreements with building owners, school board and other funders of the project. Examples of these agreements include local government and school board revenue sharing agreements, development agreements with DRD participants to outline funding terms of the public-private-partnership and grant and loan agreements from other outside public and private sector funding sources.

DRDs and Historic Preservation Tax Credits can be important tools to support placemaking initiatives.

Please contact Dave Robinson at [email protected] if you have any questions about redeveloping historic properties.