2023 will remain a year when successful workforce development strategies will impact corporate site location projects. Job openings have exceeded the number of unemployed workers in the United States since July 2021, suggesting an extremely tight labor market as the economy emerges from the pandemic-induced recession.[i] Much of the shortfall in the labor force has been attributed to a large decline in labor force participation rates as labor force participation plummeted in the early stages of the pandemic as many businesses closed, schools moved online, and individuals isolated due to health concerns.[ii] Although economic activity has since rebounded sharply and schools and businesses have reopened, labor force participation rates remain well below pre-pandemic levels in most states.[iii] Most that can retire have done so driven by COVID 19. However, labor force participation is not the only contributor to the size of the labor force—population growth is also significant.[iv] In particular, the size of the labor force equals the size of the population aged 16 and older multiplied by their labor force participation rate, and changes in the size of the labor force can be decomposed into changes in population size and changes in participation rates.[v] Growing regions can limit the damage of fewer residents in the workforce pool.

Companies and communities need to determine if their region has the workers needed for specific companies and industries to grow and prosper. Companies and communities need to analyze whether a region has a growing population, how demographics impact that regions workforce, whether a region has skilled workers for targeted industries and how the region’s labor costs compare as well.

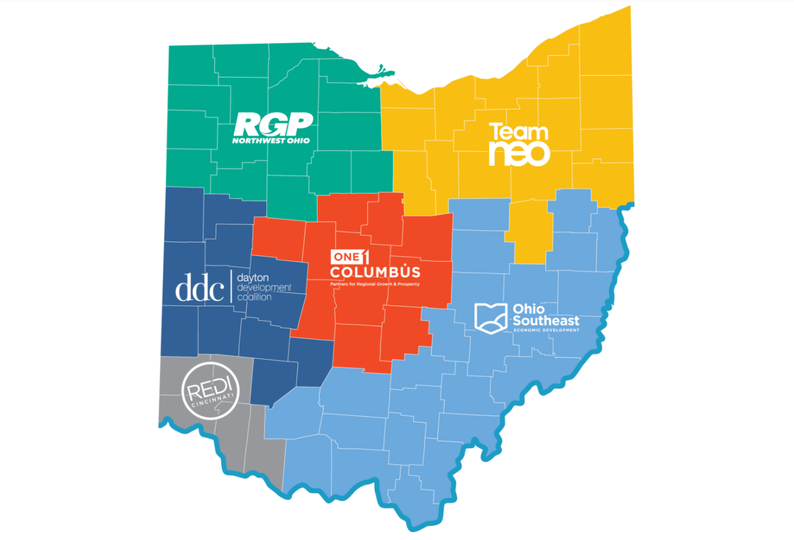

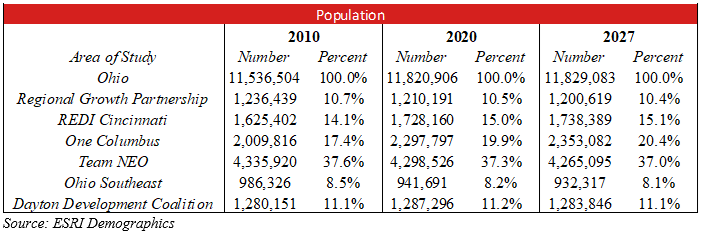

Ohio offers an interesting model for how Central Ohio’s growing and younger population base is driving economic development and corporate site location growth. First, let’s understand the Ohio marketplace. The population of Ohio, which is currently sitting at just under 12 M residents, has seen steady growth over the 2010 to 2020 decade. The population saw an increase of 2.3% from the 2010 to 2020 census. The state of Ohio benefits from three mid-sized urban markets that are roughly the same size- Columbus, Cleveland and Cincinnati. JobsOhio, the state’s private-sector economic development organization supports the operation of private-sector regional economic development organizations covering all 88 counties. The regions experiencing growth over this past decade were REDI Cincinnati with .9% population growth, One Columbus with 2.5% population growth, and the Dayton Development Coalition region experiencing .1% population growth. While the Regional Growth Partnership, Team NEO, and Ohio Southeast all experienced declines in population by 0.2%, 0.3%, and 0.3% respectively. As the table below illustrates, the Central Ohio region is the only growing region in Ohio.

Demographic trends also illustrate the advantage that Central Ohio holds in the Buckeye State. The current median age in Ohio is 40.6, which is a 1.9-year increase from the median level in 2010 with this number projected to increase by the year 2027 to 41.3. Ohio’s under-18 population is also experiencing a decline.

The Regional Growth Partnership currently has a median age of 40.4 for its residents. With 21% of its population under the age of 18. Over the next five years, the median age of its residents is projected to increase from 40.4 to 41.2. The region currently has 19.2% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 21.6% of the population by 2027.

REDI Cincinnati currently has a median age of 39 for its residents. With 22.2% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 39 to 39.7. The region currently has 17.1% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 19.4% of the population by 2027.

One Columbus currently has a median age of 37.4 for its residents. This is the youngest median age of all the JobsOhio regions. With 22.3% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 37.4 to 37.9. The region currently has 15.3% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 17.2% of the population by 2027. This region has the lowest percentage of its population in what is considered the retirement age. The

Dayton Development Coalition currently has a median age of 41.4 for its residents. With 20.9% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 41.4 to 42.1. The region currently has 20.1% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 22.5% of the population by 2027.

Ohio Southeast currently has a median age of 41.7 for its residents. With 20% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 41.7 to 42.8. The region currently has 20.1% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 22.8% of the population by 2027.

Team NEO currently has a median age of 42.9 for its residents. This is the highest median age of all the JobsOhio partner regions. With 19.9% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 42.9 to 43.6. The region currently has 20.8% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 23.8% of the population by 2027. This region is projected to have the highest percentage of its population in retirement age by 2027.

Population growth and the age of a region’s population are just two measures that a company would consider when deciding where to locate. However, regions with younger, growing populations are going to move to the top of the list for consideration as to whether they should move to the next step in the corporate site location process.

Beyond general regional population growth and demographics characteristics of that region, companies next focus on whether that region has the skilled workers in their industry. Industry Clusters are a regional concentration of related industries in a particular location consisting of companies, suppliers, and service providers, as well as government agencies and other institutions that provide specialized training and education, information, research, and technical support enhance productivity and spur innovation by bringing together technology, information, specialized talent, competing companies, academic institution, and other organizations with close proximity, and the accompanying tight linkages, yield better market insights, more refined researches agendas, larger pools of specialized talent, and faster deployment of new knowledge.

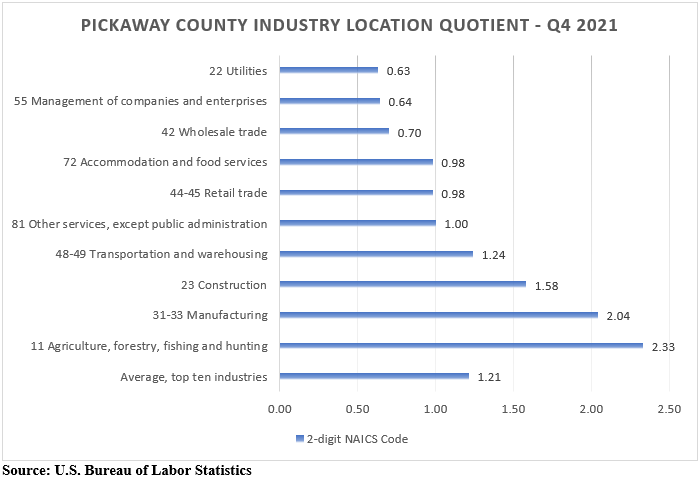

A location quotient is a method of using Federal industry cluster data to identify the economic concentration of a certain industry in a state, region, or county compared to a base economy, such as a state or nation. A location quotient greater than 1 indicates that a locality has a higher concentration of companies in a specific industry sector than the rest of the nation. Pickaway County, Ohio, and its county seat of Circleville offer an interesting data set to understand how a location quotient impacts a company’s corporate site location decisions.

Agriculture, forestry, fishing, and hunting have the highest location quotient in Pickaway County at 2.33 meaning the County has a 2.33 times greater concentration of Agriculture, forestry, fishing, and hunting operations than does the rest of the country. The county’s agricultural landscape and rich agricultural history is well reflected in this leading industry sector. Manufacturing has a 2.04 location quotient, with major manufacturers such as DuPont Interconnect Solutions, Trimold LLC, and PPG Industries calling Pickaway County home. Construction has a location quotient of 1.58, while Transportation and warehousing have a location quotient of 1.24. The county’s location along the U.S. 23 north-south corridor is likely a contributing factor to a higher concentration of these industry sectors. The strong presence of distribution/fulfillment and logistics operations in the northern portion of the county near Rickenbacker Intermodal Facility is represented across multiple industry sectors, including Transportation and warehousing, which had 588 employees in Q4 2021, and Retail trade, which had 1,525 employees in Q4 2021. Manufacturing, logistics and agriculture should find Pickaway County, just south of Columbus’ Franklin County, as a prime location based upon the availability of skilled labor in their industries.

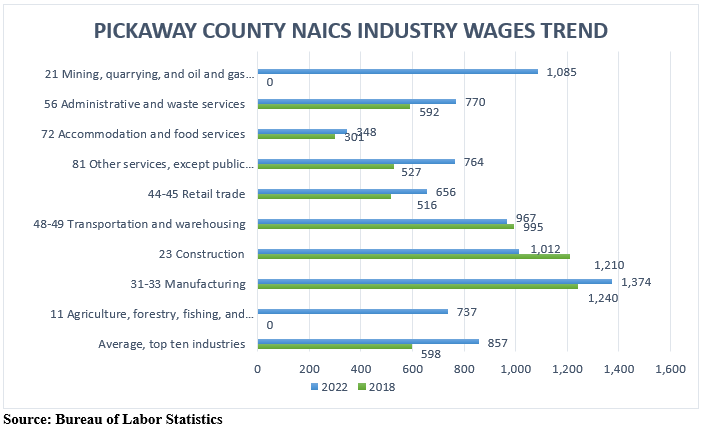

When analyzing trends in employee wages across all industry sectors, Pickaway County experienced significant wage growth of 43.31% in the four-year period of 2018 to 2022. Drilling down into the County’s leading employment sectors we see similar wage growth over the same four-year period. Wages in the Other services, except the public administration sector saw the largest growth in wages with a $237 per week increase, likely due to the high demand for healthcare workers. Administrative and waste services saw the second largest weekly wage increase of $178 and the Retail trade sector saw the third largest weekly wage increase over the four-year period of $140, which includes employers in the consumer products distribution and fulfillment sectors such as Amazon Fulfillment Centers in northern Pickaway County. Manufacturing also saw a healthy weekly wage increase of $134 from $1,240 in 2018 to $1,374 in 2022, which is the highest-paying sector in Pickaway County. Increases in wages over the four-year period point to increased wealth and buying power of employees working in Pickaway County, which ultimately will benefit the city of Circleville businesses and tax base as employees are able to increase spending and consumption habits across all sectors and including residential housing buying power.

Growing markets with younger workers with success in targeted industries and competitive wages are best positioned for the location of company retention or expansion projects. The research and analysis behind defining these regions is a critical step from a workforce development standpoint. Please contact Dave Robinson at [email protected] if you need assistance with a workforce development analysis.