The Ohio General Assembly passed a significant reform that will make sweeping changes to the state’s real property tax law. HB 126, once signed by Governor Mike DeWine in the coming weeks, will effectively end practices that have impacted Ohio property owners for years. Currently, Ohio school districts are able to challenge property values to increase the assessed value or fight property owners’ attempts to lower their assessed values. Essentially, school districts can file complaints to make property owners pay more money in real estate taxes to increase the school district’s funding.

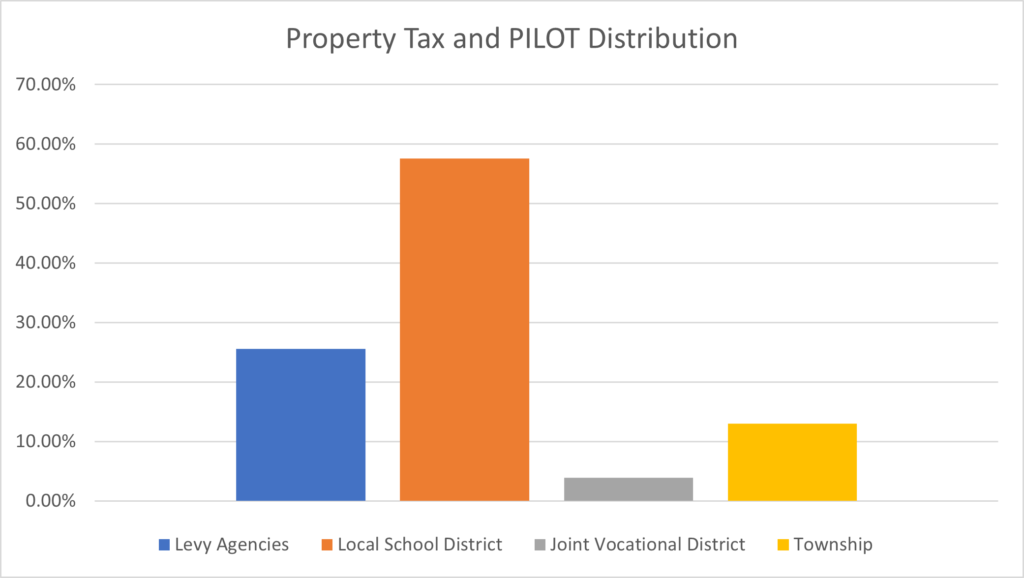

The Ohio local property tax process is governed by the Department of Taxation which ensures uniformity through its oversight of Ohio’s county auditors’ appraisal work. Auditors conduct a full reappraisal of real property every six years and update values in the third year following each sexennial reappraisal. The department’s Division of Tax Equalization then compares the assessed property values to sale prices, then uses these “sales ratios” to evaluate assessments and, if necessary, seeks changes. The real property tax base, according to Ohio Revised Code 5713.03 and 5715.01, is the taxable (assessed) value of land and improvements. The taxable value is 35% of market value, except for certain land devoted exclusively to agricultural use. Under Ohio Revised Codes 319.301, 5705.02-.05, and 5705.19, real property tax rates are levied locally and vary by taxing jurisdiction. The total tax rate for any parcel includes all levies either enacted by a legislative authority or approved by the voters of all taxing jurisdictions in which the property is a part. Some examples include school districts, counties, municipalities, townships, and special service districts. Each unique combination of these taxing jurisdictions creates a separate taxing district. Each taxing district has its own unique way of divvying up property taxes and PILOTs to different entities. Below is an example of how a taxing district distributes these dollars.

Ohio is one of only a few states in the country that permits school districts to challenge the county auditor’s valuations. Additionally, according to WalletHub, Ohio has the 13th highest property taxes in 2022 with an average annual property tax of $2,271 on homes priced at the state’s median value. There has been growing concern among state representatives that by continuing to allow school districts to use these tactics, it would take away money from Ohio’s economy and funding for other taxing authorities and social service programs. HB 126 aims to fix this issue by changing the structure of Ohio real property tax valuation contests such as:

1) Limiting the filing of property tax complaints by boards of education and other subdivisions to instances where (i) the property was sold in a recent arm’s length transaction in the year before the tax year for which the complaint is filed, (ii) the sale price of the property is at least 10% and $500,000 more than the auditor’s value, and (iii) the subdivision first adopts a resolution authorizing the complaint with notice sent to the property owner at least seven days before adopting the resolution. These limitations would end the practice of retroactive tax increases attributable to years in which a sale occurs. The $500,000 threshold also is indexed to increase each year with inflation.

2) Ending private pay settlement agreements between a property owner and a board of education after the effective date of the bill. Currently, property owners would make a settlement payment to the board of education to dismiss, not file, or settle a complaint by agreeing to new value for the property that is not reflected on the tax list. HB 126 would also prohibit a subdivision’s standing to appeal a board of revision decision to the Board of Tax Appeals. Although the bill is silent on whether a subdivision could enter as an appellee in a BTA appeal from a BOR decision.

3) Removing the requirement that school districts receive notice of a complaint.

4) Modifying the timeline in which school districts can file a counter-complaint to 30 days after the initial complaint is filed. Currently, a school district may file a counter-complaint within 30 days after receiving notice of the owner’s complaint.

5) Requiring that a county Board of Revision dismiss a complaint filed by a subdivision within one year after the complaint was filed if the Board of Revision does not render a decision within that timeframe.

HB 126 specifies that most of its changes will apply to complaints or counter-complaints filed for tax year 2022 and thereafter, except for provisions regarding private payment agreements which will apply on or after the bill’s effective date. The bill is expected to affect each property owner differently. For more details on HB 126, visit https://www.legislature.ohio.gov/legislation/legislation-documents?id=GA134-HB-126.