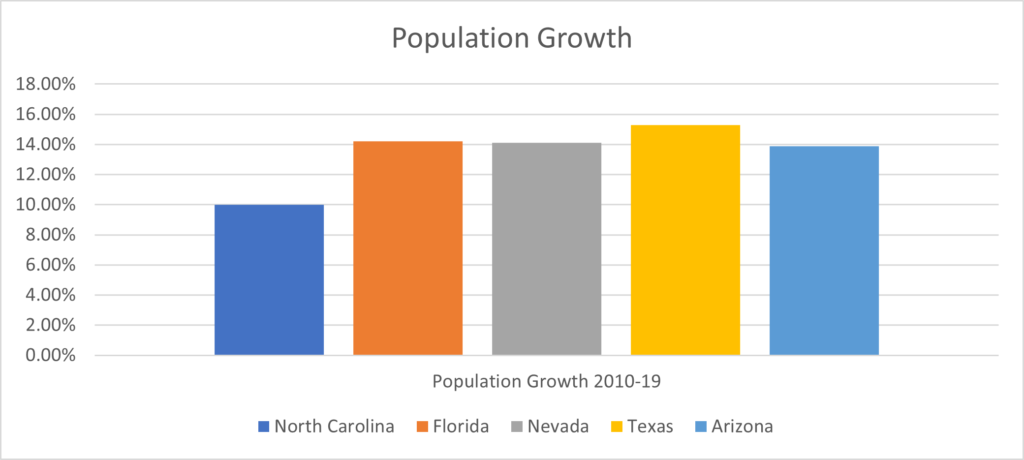

Arizona is booming and recent enacted tax legislation is likely to spur additional economic success. Arizona along with other Southwestern and Southern states continues to grow economically driven by population and macroeconomic expansion. As the chart below illustrates, Arizona enjoyed double digit population growth over the last decade.

Forbes ranks Arizona as the 5th fastest growing economy among the fifty states. Forbes noted the Arizona economy is the 19th biggest in the U.S., based on 2020 annual real GDP by state, with an average GDP of roughly $320.66 billion that year. That’s an increase of 54.3% since 2000, when annual Arizona GDP that year stood at roughly $207.77 billion. The Covid-19 pandemic gave Arizona a bit of trouble, but the state’s GDP only fell 0.9%, from about $232.59 billion in 2019, down to $320.66 billion in 2020. Currently, Arizona’s GDP has reached a historic high of $429 B Q4 2021. Arizona is a low-cost state from a business tax standpoint. As the table below shows, Arizona is in the top 10 for low-cost business tax state according to the most recent Council of State Taxation study.

Recently, Arizona took further steps to build a business-friendly tax code. Arizona Governor Doug Ducey and the Arizona legislature passed HB 2822, a historic tax reduction bill. HB 2822 simplifies the state’s business personal property tax law. The bill, introduced by Rep. Jeff Weninger, R-Chandler, aims to simplify the state’s business personal property tax law.[1] HB 2822 sets the full cash value of business and agricultural personal property initially classified during or after-Tax Year 2022 to 2.5% of the property’s acquisition cost.[2] For businesses considering Arizona, HB 2822 means a reduction in property taxes by lowering the assessed value of the personal property. Currently, a property’s valuation factor (“percent good”) is determined by the expected life of the property, with additional depreciation available for certain subclasses of property. Properties that can benefit from the new legislation include shopping centers, golf courses, manufacturers, and other personal property devoted to commercial or industrial use that is not classified elsewhere, agricultural property, and personal property in a foreign trade zone or military reuse zone. The Arizona Chamber of Commerce & Industry is applauding Gov. Ducey for signing HB 2822 into law. The Chamber says the bill was a top tax policy priority for 2022 because it encourages greater capital investment and dramatically improves Arizona’s tax climate for businesses of all sizes. The Chamber says compliance with business personal property tax had been notoriously cumbersome, especially for small businesses who don’t have a big team of accountants helping them navigate Arizona’s complex manual which instructed businesses on how to value items such as farm equipment and laptops. This legislation goes into effect 90-days after the current legislative session ends.

For more details on HB 2822, visit https://legiscan.com/AZ/text/HB2822/id/2562347/Arizona-2022-HB2822-Chaptered.html to read the bill in its entirety.

Tax policy is a critical tool states can use to retain and attract high-wage jobs and it appears that Arizona will continue their economic growth in the coming years.