Housing is joining workforce development to become a major corporate site location issue. Regions not growing are failing to develop substantial residential growth. Finally, rural regions are losing population at an alarming rate and desperately need new residential products to retain existing employers and to keep their young people. No matter where you are in the United States, the availability of attainable housing that young and old alike can afford is needed. The simple fact is regions cannot retain and attract companies without workers—workers won’t go to regions where they cannot afford housing.

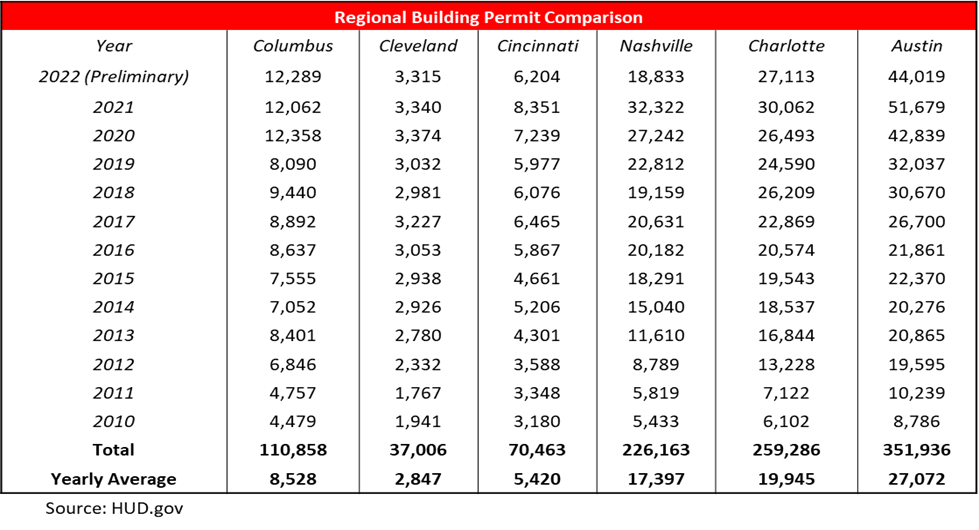

Following population growth trends, Ohio’s major cities are not developing new housing units as fast as competitors in the South and Southwest. As the table below illustrates, over a 12-year timeframe from 2010 to 2022, Austin has an average of 27,072 building permits per year, Charlotte has an average of 19,945 building permits per year, Nashville has an average of 17,397 building permits per year, Columbus has an average of 8,528 building permits per year, Cincinnati has an average of 5,420 building permits per year, and Cleveland has an average of 2,847 building permits per year.

The lower number of building permits for Cleveland and Cincinnati are not troubling considering the comparatively smaller population size of these cities compared to Nashville, Charlotte, and Austin. However, Columbus is as large or larger than these competitors. Growing regions like Central Ohio are developing 2.5 jobs for every 1 residential permit creating a housing shortage. Columbus is not producing the housing needed for its growing economy.

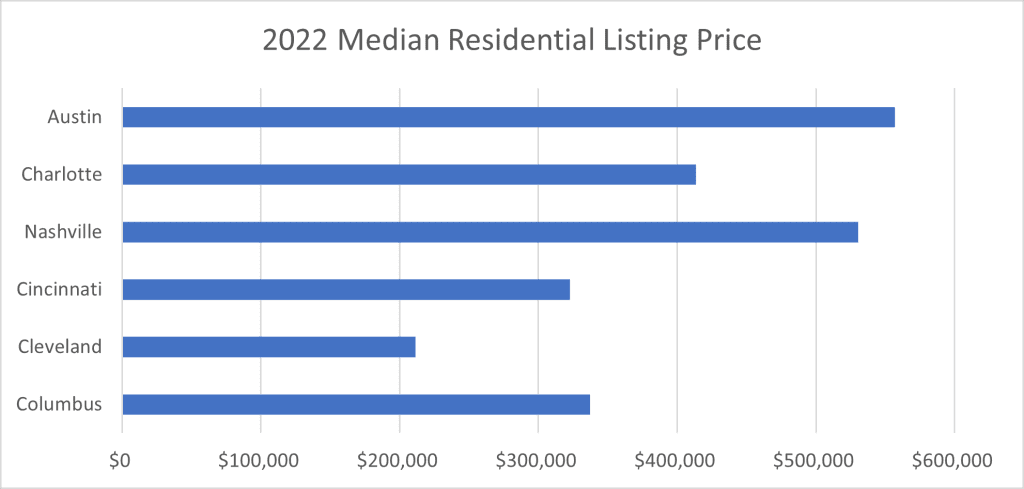

However, the cost of housing in Ohio is much lower than its major urban competitors who have experienced dramatic population growth. As the chart below illustrates, the 2022 median residential listing price of Cincinnati, Cleveland and Columbus is substantially lower than competitors in Austin, Charlotte, and Nashville. This data point is even more valuable for Ohio as a key to Southern and Southwest growth has been their lower costs compared to the Midwest.

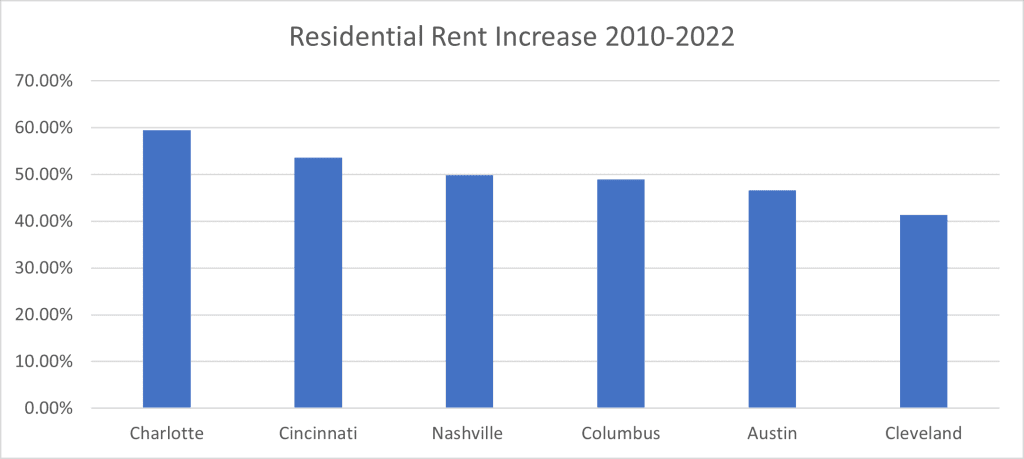

However, while Ohio’s residential costs are lower than many competitors, their housing costs are still increasing. From 2010 to 2022, the median residential listing price in Cincinnati increased by 70.98%, Columbus increased by 59.83%, Cleveland increased by 43.03%, Austin increased by 32.97%, Charlotte increased by 32.97% and Nashville increased by 61.52%. Finally, Ohio’s major cities’ residential rental rates are either in line with or slightly below national competitors. The average rent from 2015 to 2021 increased in Charlotte by 59.43%, Nashville by 49.86%, Austin by 46.58%, Cincinnati by 53.57%, Columbus by 48.95%, and Cleveland by 41.31% as illustrated by the chart below.

Growing housing that workers can afford is a critical corporate site location issue and Ohio’s major urban centers offer comparatively affordable housing that is experiencing price increases with a dwindling supply. Housing is a growing corporate site location issue for all regions of the nation and Ohio falls in line with this national trend.