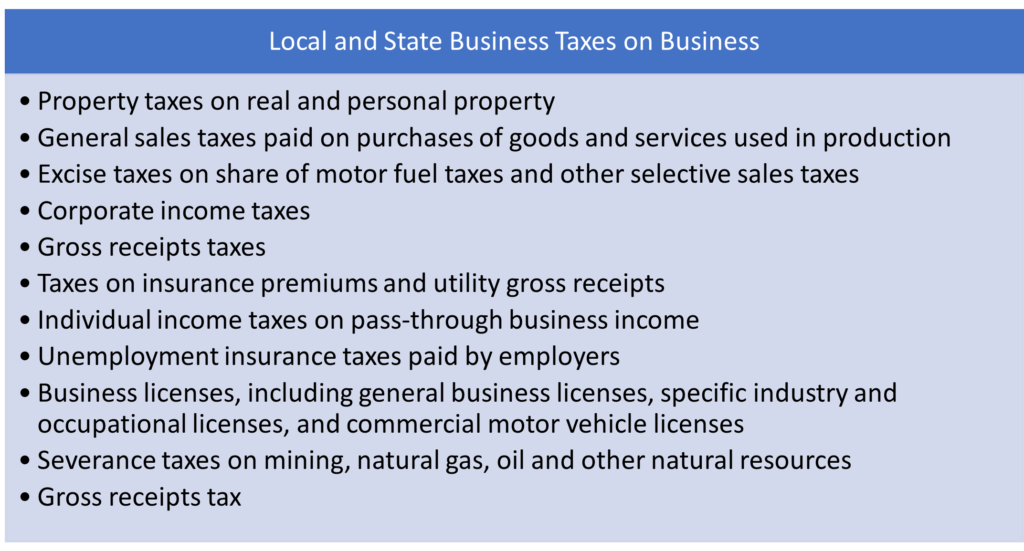

Taxes levied by local and state governments have a major impact on company’s corporate site location decisions. Taxes by the state and local government are a critical component of measuring the cost of doing business in a region. Different local and state governments tax businesses differently. What and how much local and state governments tax business is a policy decision not just to collect the revenues needed to pay for schools, roads, water, public safety, and other essential services but is also a public policy decision impacting a company’s corporate site location.

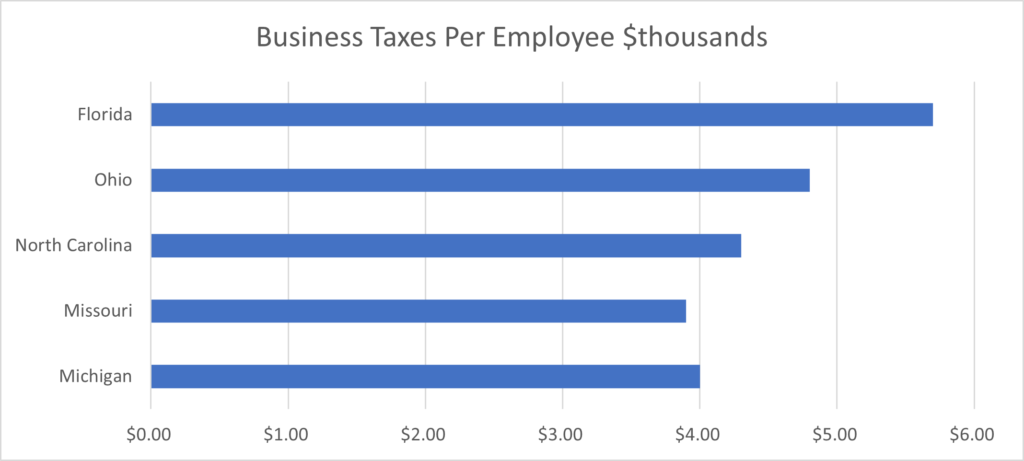

Ultimately, how much taxes a company pays at a location impacts its decision as to whether to locate in the region and defines the critical role of economic development incentives. The specific taxes a company will pay at a site is a critical cost of doing business factor the local and state government can directly impact through tax incentives. As the table below illustrates, companies in Michigan and Missouri pay a lower effective tax rate than companies in Florida, Ohio, and North Carolina. Ohio’s higher business tax rates are not driven by the state tax code as Governor Mike DeWine following the lead of successive Ohio Governors and General Assembly has continued to reduce the state’s income tax, eliminated the state corporate income tax, and relied more on consumption taxes such as the sales tax and created a gross receipts tax known as the Commercial Activity Tax. However, Ohio, as a mature state, has many layers of local governments that have substantial taxing authority that includes municipal income tax, county sales tax, and property taxes that fund about half of Ohio’s public schools through voter-approved levies. Ohio is a state where they don’t have the highest tax rate for any tax but they seem to utilize every tax that exists.

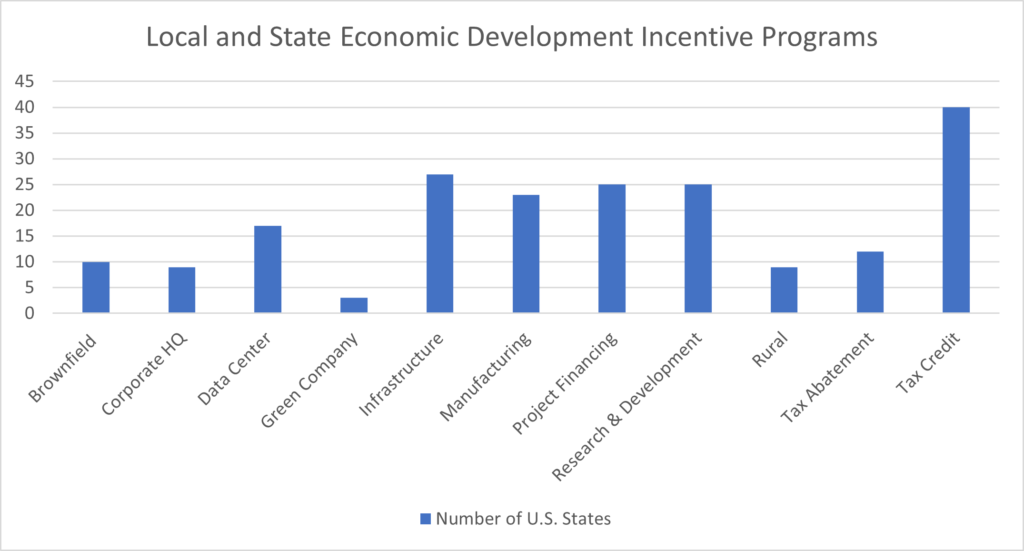

According to the Council of State Taxation, businesses paid $951.4 B in state and local taxes in FY21, which was 43.6% of all tax revenue at the state and local levels. Businesses paid $493.7 B in state taxes in FY21, which was 17.0% higher than the prior fiscal year, and $457.6 B in local taxes, which was 10.2% higher, for a combined year-over-year growth rate of 13.6% over FY20. To address regional cost of doing business factors, all fifty states offer some form of economic development incentives. As the chart below outlines, infrastructure incentives are provided by all the states in the union followed by tax credits as the second most popular tax incentive program in the nation with efforts to attract data centers and using general tax abatements tying for third. Princeton Economics estimates that state and local governments invest about $30 B dollars in economic development incentives annually.

As the table below illustrates, Ohio offers a wide range of economic development incentives to companies considering the state for a corporate site location project.

Ohio also created a new Megaproject economic development incentive program to attract large scale industrial, headquarters, office and research and development projects. Before a business may qualify for any of enhanced Megaproject incentives, it must either operate a “megaproject” or sell tangible personal property to one. A Megaproject is a development project that satisfies all of the following conditions:

Wages. The operator must compensate the project’s employees at 300% of the federal minimum wage or more with a federal minimum wage is currently $7.25 per hour for nonexempt employees this income threshold would equal $21.75 per hour and this wage threshold is calculated exclusive of employee benefits and must be met at the time the project is approved for an Ohio Jobs Creation Tax Credit (JCTC).

Capital Investment and Payroll. The operator must either make at least $1 billion in fixed-asset investments in the project or create at the project at least $75 million in annual Ohio employee payroll, i.e., payroll subject to Ohio income tax. If the project qualifies based on Ohio employee payroll, the operator must maintain at least $75 million in annual payroll at the project throughout the term of the JCTC.

Sites and Workforce. The project requires “unique sites, extremely robust utility service, and a technically skilled workforce.”

In addition to the megaproject’s operator, certain suppliers of a megaproject are eligible for the bill’s incentives. Specifically, any business that sells tangible personal property may qualify for the incentives if it satisfies both of the following requirements: the business makes at least $100 million in fixed-asset investments in Ohio, and the business creates at least $10 million in annual Ohio employee payroll and maintains that level of payroll throughout the term of the JCTC.

Finally, Ohio Governor Mike DeWine has proposed to the Ohio General Assembly the development of a $2.5 B All Futures Ohio Fund whose goal will be to create mega sites primed for large-scale economic development projects across the state. Debate on this potential new program is ongoing and is likely to be included in the state’s upcoming operating budget which must be adopted by July 1, 2023. Ohio has no shortage of economic development incentives used primarily to address taxes applied to companies primarily at the local government level.