While the location of large-scale EV battery production facilities may slow in 2024, the development of the EV battery supply chain for existing EV battery facilities will not.

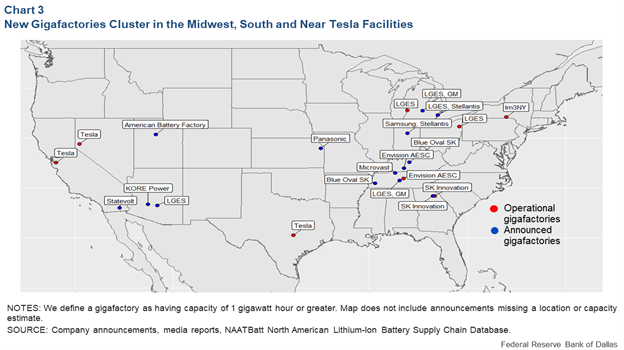

As the map of the EV Battery Belt from the Federal Reserve Bank of Dallas illustrates, EV battery facilities have been announced and are developing across the United States. The slower-than-anticipated adoption of EVs is slowing EV consumer adoptions; however, environmental, and regulatory structures will push for the greater use of EVs in the future. Existing EV battery facilities will need a supply chain to support their operation.

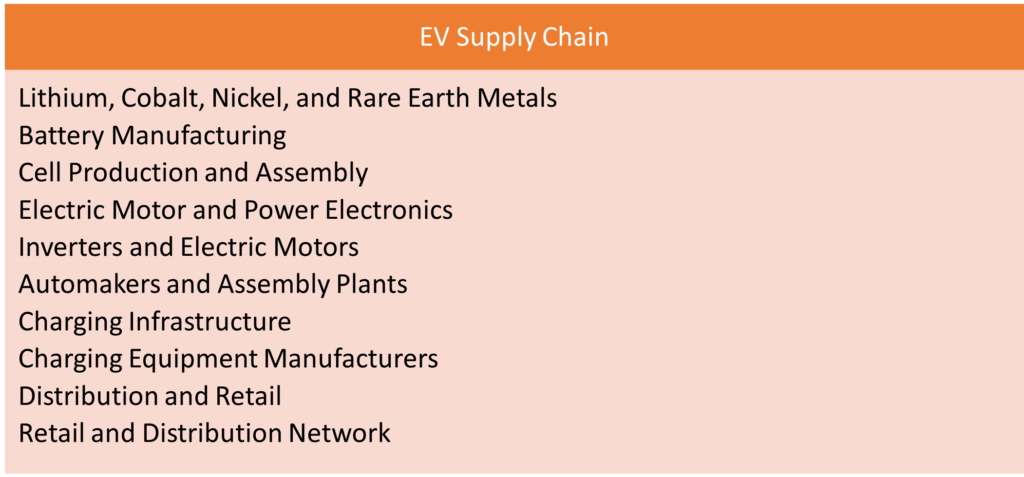

EV raw material suppliers will primarily come from global sources with lithium extracted from lithium mines in countries like Australia, Chile, and Argentina, cobalt mined primarily in the Democratic Republic of Congo, nickel mainly sourced from mines in Indonesia, the Philippines, and Canada, and rare earth metals obtained from mines in China, Australia, and the United States. Key EV battery manufacturers for cell production and assembly include Panasonic, LG Chem, and CATL which are based in Japan, South Korea, and China respectively. Electric motor and power electronics with inverters and electric motors produced by Siemens in Germany, ABB in Switzerland, and Bosch in Germany. EV auto assembly leaders include the entire global auto industry. EV charging infrastructure manufacturers include ChargePoint, Tesla Superchargers, and ABB are prominent. Finally, the distribution and retail network will be the existing auto dealer franchise network.

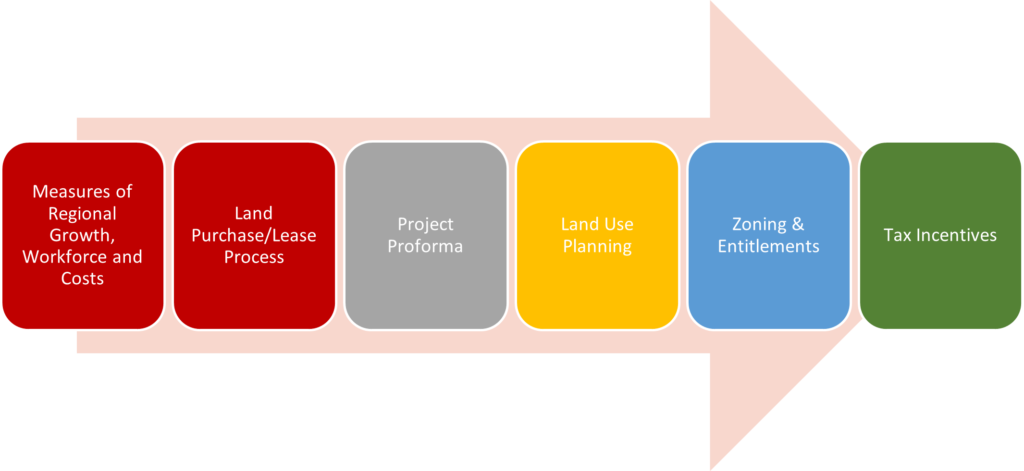

Companies considering joining the supply chain of an EV or other large-scale industry in a region start with an understanding of the site development process. The first step in the site development process is to understand the region’s potential for economic growth, availability of a skilled workforce, and the costs of doing business as compared to other regions and states of equal business value. Measures of economic growth will center on a comparison of GDP growth, personal income, demographic measures such as population growth, poverty rates, median home values, and other measures that define the equity of a region for a wide range of potential workers. Cost of doing business measures should also be created to better understand the wages key workers will require, the costs of real estate, taxes, utilities, and other major cost factors for competing regions.

Once the region survives the economic, workforce and cost of doing business comparison, a company’s supply chain partner needs to move to negotiate local real estate options. If the company wishes to purchase a site before it gains control of the site, the company needs to complete due diligence on the site such as confirming the zoning, determining if environmental contamination exists, if the title of the land is marketable, and if the project has tax incentives. [i] Before the final land purchase, the potential buyer needs to gain all the necessary governmental approvals such as zoning, tax incentives, and Brownfield remediation protection. With buying, building, or renting, a company considering a site for an economic development project needs a pro forma to determine whether the project makes or loses money and what economic development incentives can address potential project costs to make the site more attractive for investment. The pro forma is based on both expenses and revenues. The development cost budget addresses the expenses of the project and includes all the costs directly related to the project. Hard costs are those expenses directly incurred in connection with the construction of the building, tenant space, and other site improvements. They include the contractor, legal, engineer, appraiser, insurer, developer, and commercial realtor fees and the cost of all labor and materials provided to the project. Financing and utility charges, impact fees, marketing, and operating costs are also included. A contingency reserve is needed to cover any unexpected costs incurred during the development process.

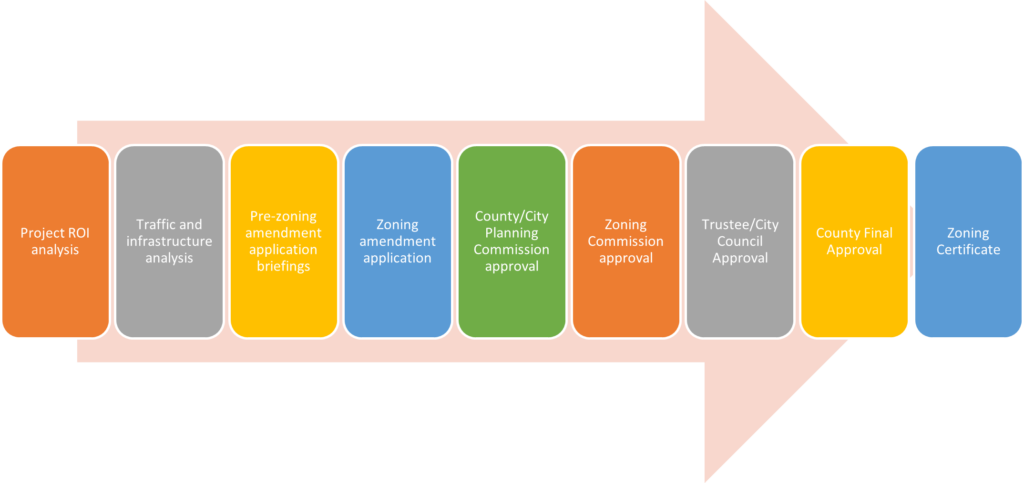

No company can locate a site without local government permission through the land use regulation process. The local government manages design, growth, and development typically through a comprehensive plan that can serve as a legally binding document that sets the overall goals, objectives, and policies to guide the local legislative body’s decision-making regarding the development of a region or community. Zoning is a key component of the basic system of land use regulation. Unincorporated land and rural communities operate with less zoning authority. Thus, these communities have few powers to regulate land use through the zoning process. Traditional zoning divides land within a jurisdiction into districts, or zones, with varying restrictions on uses that may be established and conducted in the different zones and standards (such as size and location of buildings, yard areas, and intensity) such uses must meet. Zoning regulations provide for orderly growth, generally in furtherance of comprehensive plans, limit the interaction of incompatible uses, and protect public health, safety, and welfare.

The EV supply chain needs to consider connections to large EV battery and assembly plants but also site development and land use regulation considerations.

Contact Wade Williams at [email protected] if you have any questions regarding the EV industry or other corporate site location matters.

[i] The Ten Steps to Real Estate Purchase discussion comes in large part from Ohio State University Law Professor Rick Daley’s class material developed for his real estate development class.