Companies who have decided on launching a corporate site location process should start with an analysis of a list of regions economic market performance and whether those markets are home to companies of like industries in which they can share public policy, infrastructure and workforce benefits. Market research begins to define growing economic, industry cluster, labor shed, transportation networks and supply chains of targeted regions and to develop potential real estate site options for each of these markets. Regional economic performance, common industry clusters to the company, the availability of a skilled workforce and the cost of doing business for the company are all researched and reviewed for the development of a market research report.

Overall macroeconomic performance of a region is a critical measure for companies considering a corporate site location site. Generally, companies seek out growing markets that attract industry and talent. Key measures of regional economic performance will include the measures noted in the table below.

Key Regional Economic Performance Measures

| Measure | Definition |

| Gross Domestic Product by County, Metro or Other Areas | A comprehensive measure of the economies of counties, metropolitan statistical areas, and some other local areas. Gross domestic product estimates the value of the goods and services produced in an area. It can be used to compare the size and growth of county economies across the nation. |

| Real Consumer Spending by State | Regionally price-adjusted statistics on the goods and services purchased by, or on behalf of, people living in each state and the District of Columbia. These statistics, officially known as real personal consumption expenditures by state, are adjusted using BEA’s regional price parities and the national PCE price index. |

| Personal Income by County, Metro or Other Area | Income that people get from wages, proprietors’ income, dividends, interest, rents, and government benefits. A person’s income is counted in the county, metropolitan statistical area, or other area where they live, even if they work |

| Regional Price Parities | Allows comparisons of buying power across the 50 states and the District of Columbia, or from one metro area to another, for a given year. Price levels are expressed as a percentage of the overall national level. |

| Employment by County, Metro and Other Areas | A count of full-time and part-time jobs in U.S. counties and metropolitan areas, with industry detail. Nonmetropolitan areas and rural counties are also included. These statistics cover wage and salary jobs and self-employment |

| Population Growth | Regional population growth from 2010-20 illustrates whether the region is growing or not. |

| Home Ownership | Regional owner-occupied housing rates from 2015-19 illustrates neighborhood stability. |

| Home Value | Regional median home value illustrates the affordability of a market for workers. |

| Educational Attainment | Regional percentage of the population above the age of 25 that has a four year college or bachelor’s degree illustrates the pool of available educated workers for advanced services, technology and other “white collar” occupations |

| Civilian Labor Participation | Population 16 and above in age that is working in civilian occupations illustrates the regional workforce pool |

| Poverty Rate | Income of $25,520 or below for one person in a household and $8,960 per person in the household is defined as persons in poverty. |

Industry clusters are regional concentrations of related industries. Clusters consist of companies, suppliers and service providers, as well as government agencies and other institutions that provide education, information, research and technical support to a regional economy. Clusters are a network of economic relationships that create a competitive advantage for the related firms in a particular region, and this advantage then becomes an enticement for similar industries and suppliers to those industries to develop or relocate to a region. Clusters exist in all types of economies and are more prevalent in locations that achieve better performance relative to their overall stage of development. It is useful to view economies through the lens of clusters rather than specific types of companies, industries, or sectors because clusters capture the important linkages and potential spillovers of technology, skills, and information that cut across firms and industries. Viewing a group of companies and institutions as a cluster highlights opportunities for coordination and mutual improvement.

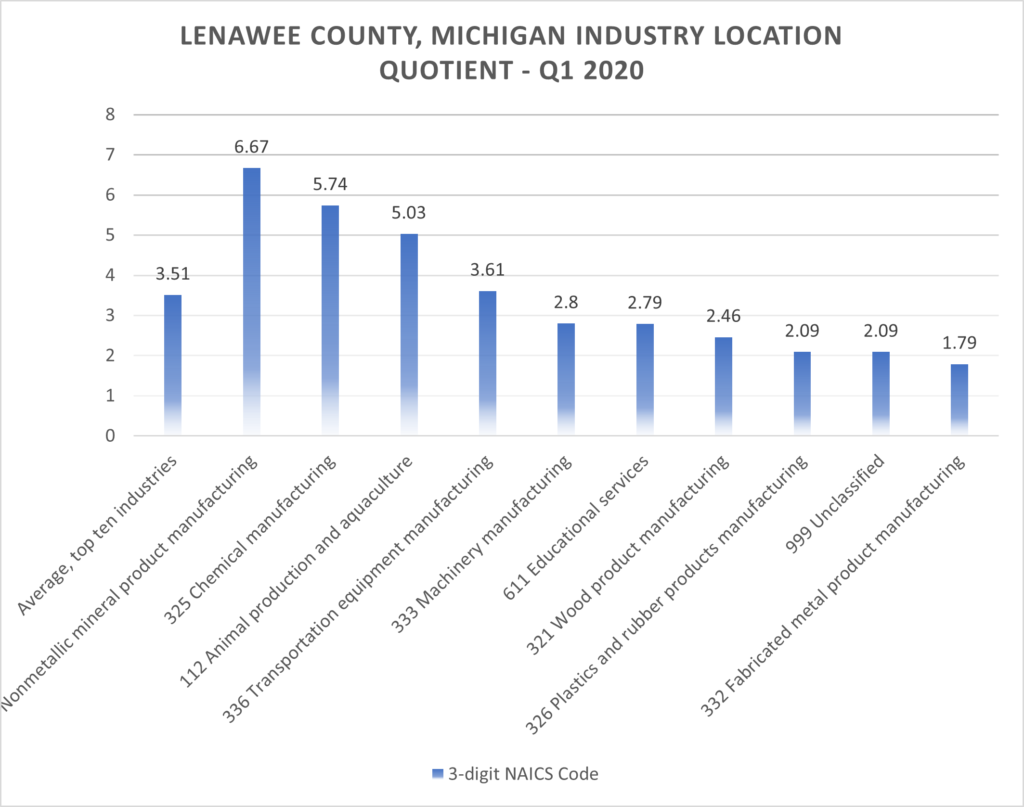

A Location quotient is an indicator of the economic concentration of a certain industry in a state, region, county, or city compared to a base economy, such as a state or nation that measures industry clusters in a region. A location quotient greater than 1 indicates a concentration of that industry in the area. A location quotient greater than 1 typically indicates an industry that is export oriented. An industry with a location quotient of 1 with a high number of jobs present is likely a big exporter and is bringing economic value to the community feeding the retail trade and food services sectors.

As the table above illustrates, Lenawee County, Michigan is home to a number of substantial industry clusters. Market growth and industry clusters research is not the end of the corporate site location process but it is a critical beginning point.