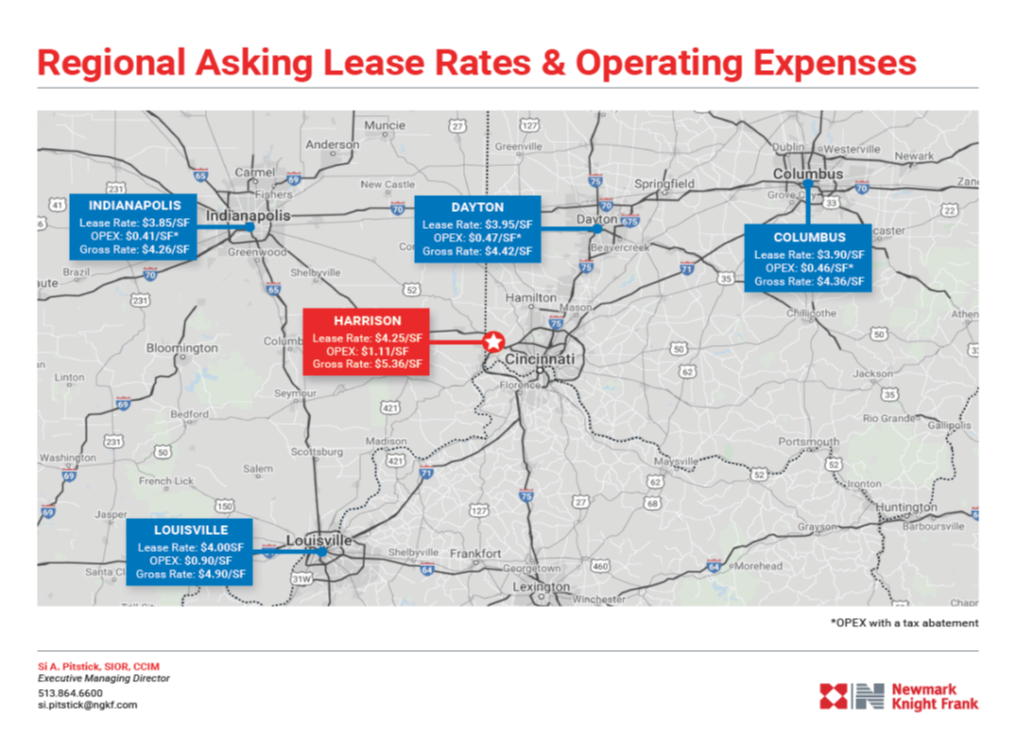

A company’s costs of real estate, construction, energy, and taxes are typically the major cost drivers at a site other than its workforce. Real estate costs vary depending on decisions about whether the company wants to buy or rent real estate and is dictated by regional market issues such as available land, market regulation, vacancies, rental, and absorption rates. The map below illustrates the range of real estate market costs in regions that compete for industrial projects in the Ohio-Indiana-Kentucky marketplace.

Construction costs are driven again by global and regional factors such as the availability and cost of building supplies and construction labor. Thirty different federal government measures can assist in comparing the costs of construction in given regions by reviewing measures of inflation, occupational wages, materials costs, and other aspects of building construction. Of course, gaining quotes from regional construction companies is the truest method of determining construction costs related to an economic development incentive project.

Energy costs can be dictated by either state regulators (roughly half the states operate with electric and natural gas utilities regulated) or by energy marketing firms that sell retail electric services on the open market. Many states offer energy economic development incentives that permit public utilities to seek reduced power rates based upon an energy-intensive user who is proposing a project with high-wage jobs associated with it.

Taxes by the state and local governments are a critical component of measuring the cost of doing business in a region. Different local and state governments tax businesses differently. What and how much local and state governments tax business is a policy decision not just to collect the revenues needed to pay for schools, roads water, public safety, and other essential services but is also a public policy decision impacting a company’s economic development incentive.

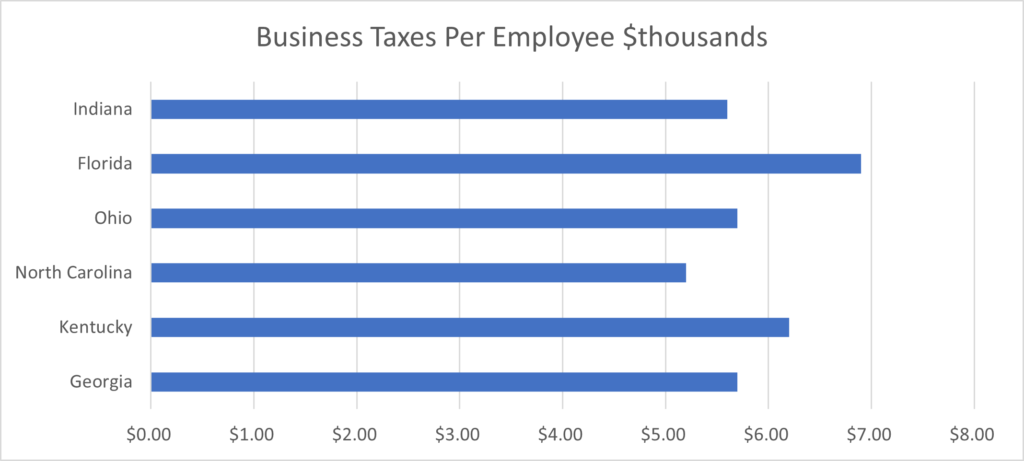

Ultimately, how much taxes a company pays at a location impacts its decision as to whether to locate in the region and defines the critical role of economic development incentives. The specific taxes a company will pay at a site is a critical cost of doing business factor the local and state government can directly impact through tax incentives. As the table below illustrates, companies in Kentucky, Indiana, and Ohio compete well with the southern states of Florida, Georgia, and North Carolina from a business tax burden standpoint.

Successfully gaining economic development incentives in any state requires an understanding of the process local and state governments as well as regional and state private sector economic development organizations follow.