The U.S. energy delivery system that ran the Industrial Revolution and made the United States a global economic powerhouse is facing substantial challenges that threaten the economic future of the nation, states, and regions.

For the last several years, utilities throughout the United States have been facing COVID-19-based supply chain challenges for the materials needed to distribute electricity to customer sites. Some of the primary areas of concern include distribution transformers, conductors, utility poles, and large transformers. Utilities seeking to acquire all these components are seeing significant delays and steep price increases: a pad-mount distribution transformer, for example, now costs close to three times more than it did pre-pandemic, and lead times for delivery have increased by 12 months. Large transformer manufacturing will also have major long-term issues, with demand expected to double by 2027 and the steel industry already hitting maximum capacity. According to Deloitte, a combination of disruptors is driving supply chain gridlock and impacting end-to-end operations in the electric power sector. Pre-pandemic supply chain vulnerability, due largely to the geographic concentration of component manufacturing and critical minerals mining, has been compounded by the effects of the pandemic and the Russian invasion of Ukraine. California is even considering state legislation that would mandate utilities to connect development projects to the electric grid within eight weeks. This backlog can be credited in part to a shortage in labor and parts, but it is being exacerbated by a growing need for equipment driven by population growth, an abundance of infrastructure funding, broadband deployment, and pole attachment shot clocks increasing demand at a level that production cannot maintain.

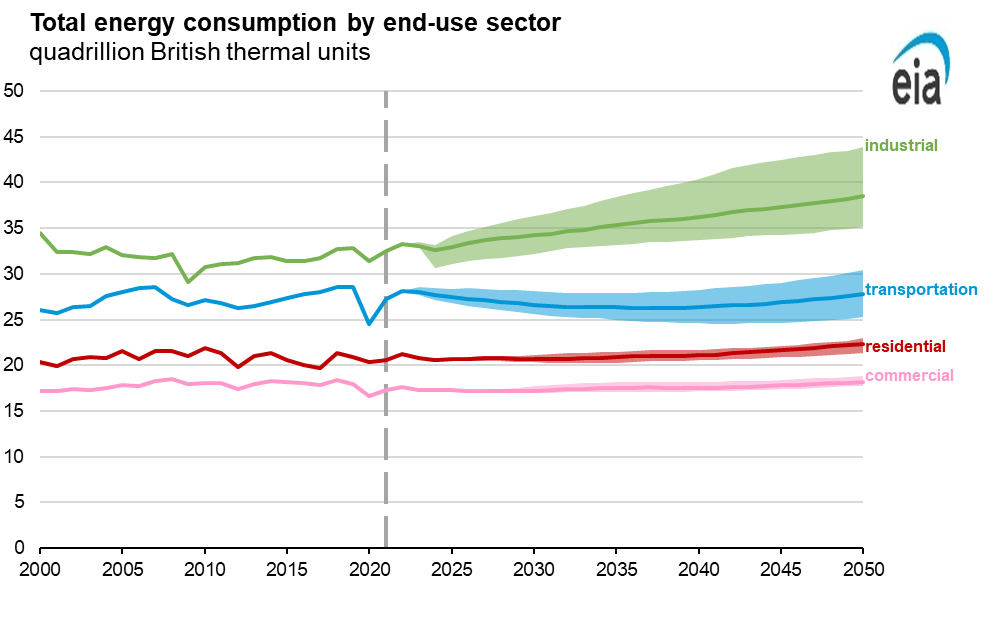

At the same time, electric utilities are facing distribution supply chain challenges, and the consumption of all forms of energy is increasing in the United States according to the U.S. Department of Energy. Combined energy consumption in four U.S. end-use sectors—industrial, transportation, residential, and commercial—includes primary energy consumption, electricity use, and electricity-related losses. In the industrial sector, energy consumption will increase between 5% and 32% between 2022 and 2050, and, in the transportation sector, energy consumption ranges from a decrease of 10% between 2022 and 2050 to an increase of 8% as outlined in the chart below. Both sectors are heavily influenced by assumptions of economic growth; as the economy grows, they consume more energy.

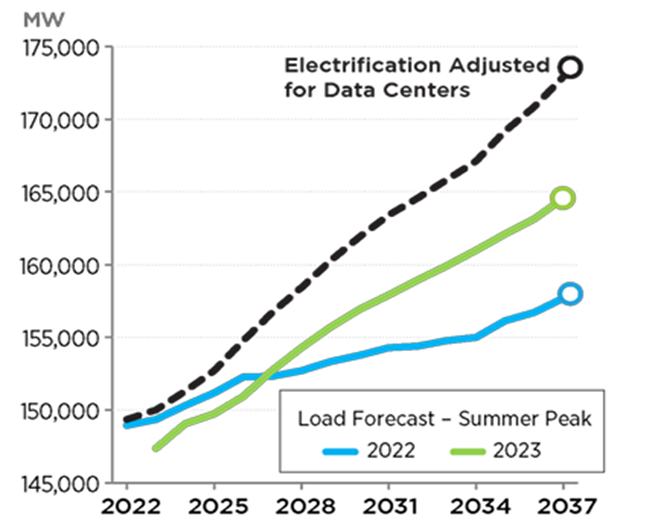

Data centers have the potential to double their energy usage by 2026, according to a recent International Energy Agency (IEA) report. IEA forecasts that data centers’ total electricity consumption could reach more than 1,000 terawatt-hours (TWh) in 2026 with the electricity demand for data centers driven by new Artificial Intelligence (AI) applications roughly equal to the energy consumption of Japan. In 2022, 460 terawatt-hours (TWh) were consumed by data centers, representing 2% of all global electricity usage—that amount is expected to jump to 6% by 2030. The share of U.S. electricity consumed in the transportation sector is also increasing as electric vehicles enter the marketplace. In 2022,

electric vehicles made up about a 6%–7% share of the U.S. vehicle market. As the adoption of EVs increases, electricity purchased for transportation reaches between about 0.6 quads and 1.3 quads in 2050, from 0.1 quads of purchased electricity in 2022, about a 900% to 2,000% increase across all cases. Due to the rise in electrification, PJM is forecasting significant long-term and medium-term load increases – more than 40,000 MW in the next 15 years.

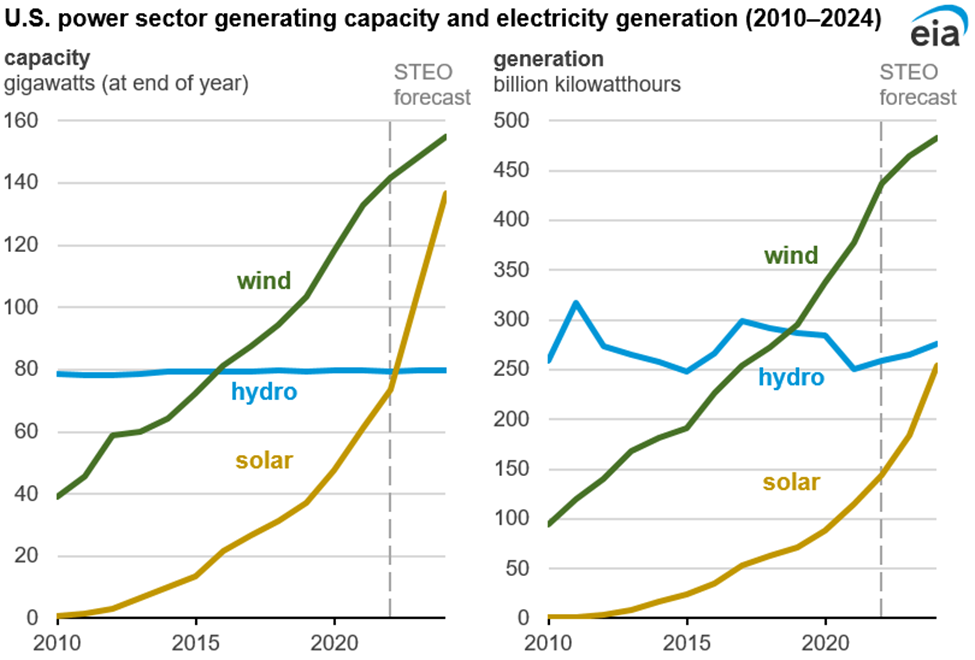

At the exact time that electricity demand is dramatically on the rise, public policymakers are driving a transition of the U.S. sources of energy. According to the U.S. Department of Energy, in 2022, about 4,231 billion kilowatt-hours (kWh) (or about 4.23 trillion kWh) of electricity were generated at utility-scale electricity generation facilities in the United States. About 60% of this electricity generation was from fossil fuels—coal, natural gas, petroleum, and other gases. About 18% was from nuclear energy, and about 21% was from renewable energy sources.

The U.S. Department of Energy expects that new renewable capacity—mostly wind and solar—will reduce electricity generation from both coal-fired and natural gas-fired power plants in 2023 and 2024. Wind and solar accounted for 14% of U.S. electricity generation in 2022, and their growth is expected to be 16% of total generation in 2023 and 18% in 2024. Electricity generation from coal falls from 20% in 2022 to 17% in both 2023 and 2024. Natural gas accounted for 39% of electric power sector electricity generation last year, and we forecast its share to be similar in 2023 and then fall to 37% in 2024 according to the U.S. Department of Energy.