Economic growth can be driven by the availability of real estate and facilities. Often, the development of speculative industrial space provides an economic spurs growth in this sector. However, what comes up must go down… the growth in the speculative industrial logistics and fulfillment center market over the past several years has been meteoric but that growth will dramatically slow in 2023. Increases in interest rates, rising costs and a market that has aggressively built product the past several years will see this industrial market slowdown in 2023. The slowdown in the development of speculative industrial logistics and fulfillment centers is driven by a decline in the overall economy as well as a large supply of these facilities that have been developed in the past several years.

Declining consumer demand and retailers coping with excess inventories at overstuffed warehouses drove down global container volumes by 8.6% in September of 2022 according to maritime data group Container Trade Statistics. The Wall Street Journal reported this is the lowest level since February, 2022 and during a period when shipping is usually at its strongest. In fact, Descartes Datamyne reported container imports from China into the U.S. were down nearly 23% in October of 2022 from the annual high in August. The Shanghai Containerized Freight Index, which measures shipping prices out of China, recently dropped to $1,443.29, which is about one-third the level it hit in early June again according to the Wall Street Journal. The Drewry Worldwide Container Index, which measures the average price to ship a 40-foot container, reached $2,773 in early November, the lowest level in two years.

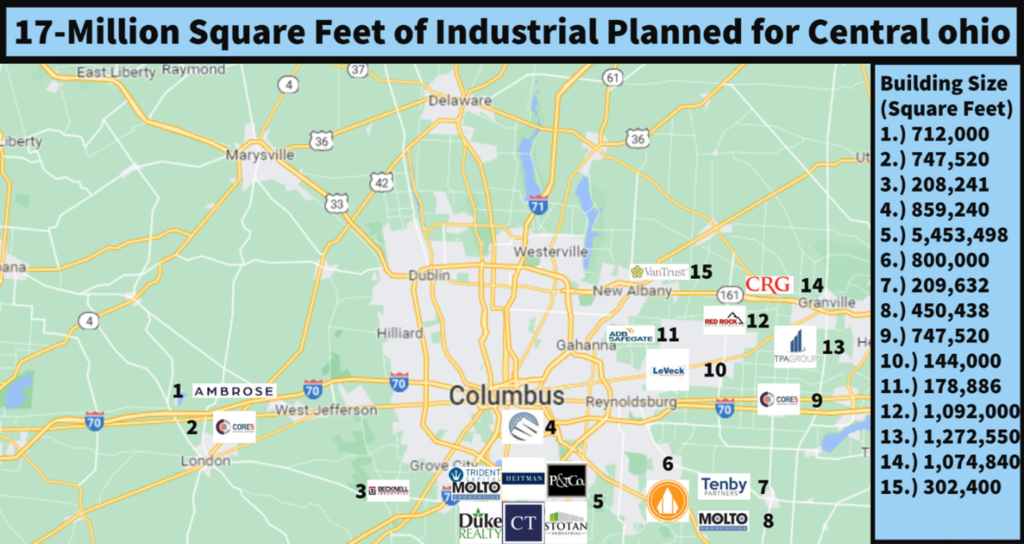

The industrial real estate market also illustrates that the speculative industrial logistics market is going to slowdown in 2023. Look at the Central Ohio marketplace. Central Ohio has seen a boom in the logistics industry with over 70,000 jobs in this growing market created over the past several years. Driven by a strategic location within 600 miles of 1/3 of the U.S. population, flat land ready for development connected to transportation infrastructure and an aggressive tax abatement strategy to overcome a high local tax rate, Central Ohio has become a logistics leader in the Midwest. That has spread to other parts of Ohio including Dayton, Wood County just south of Toledo and other parts of the state jumping into the logistics game. However, an aggressive buildout of speculative industrial space focused on the logistics industry in Central Ohio is going to lead to a slowdown of new developments in 2023. Central Ohio has over 17 M square feet of industrial space planned or developed in 2022 including eight 1 M square foot industrial buildings. The law of supply and demand will slowdown the development of new industrial space.

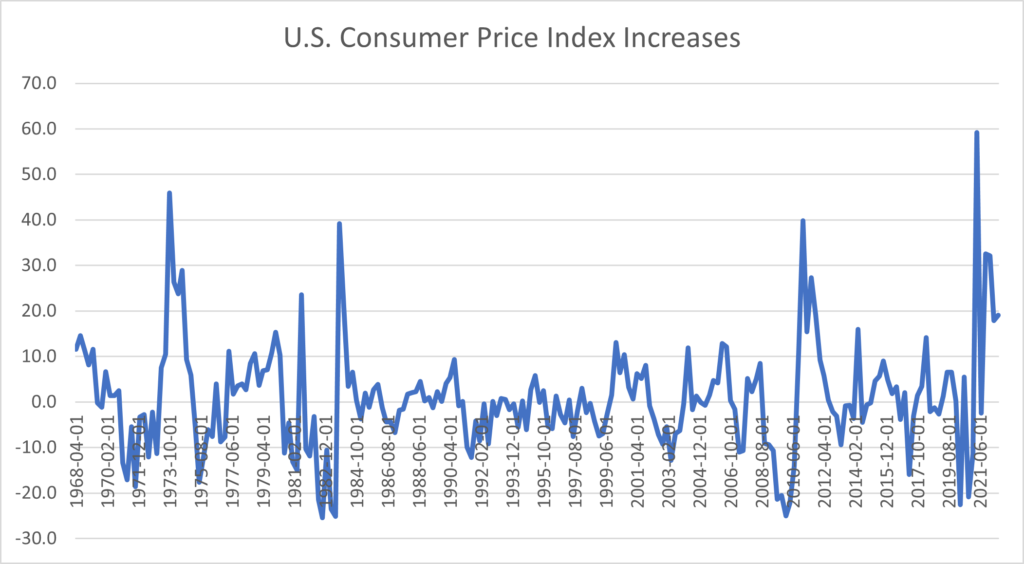

Rising inflation is another driver slowing industrial facility production. As the table below illustrates, driven by massive federal government spending and an economy running at full capacity, U.S. inflation increases reached levels in 2022 not seen since the early 1980s. In the industrial development marketplace, increasing inflation is illustrated by rising construction costs. CBRE’s new Construction Cost Index forecasted a 14.1% year-over-year increase in construction costs by year-end 2022 as labor and material costs continue to rise.

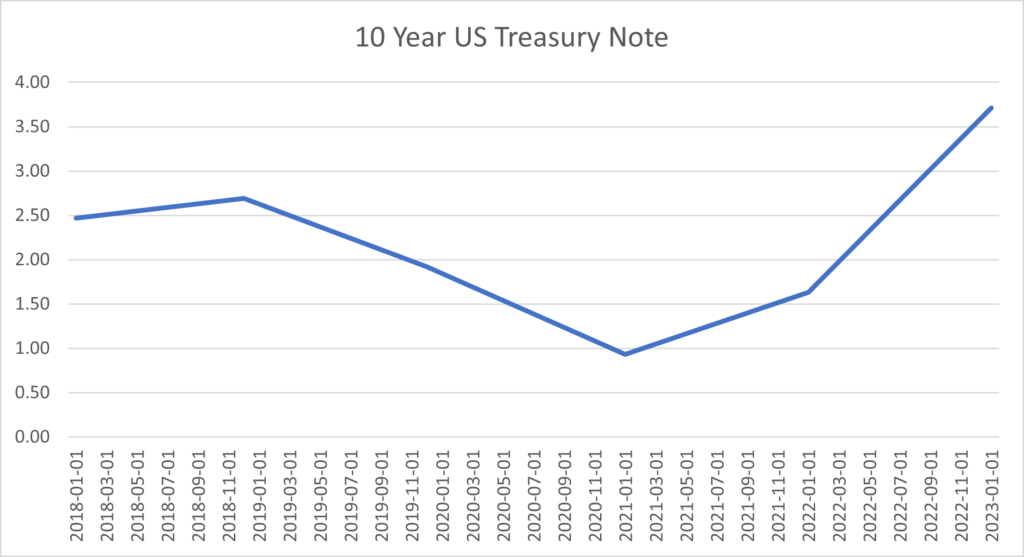

Dramatic increases in the cost of debt will also lead to a decline in the development of speculative industrial projects. As the chart below illustrates, the Federal Reserve has implemented an aggressive rate increase to address rising inflation fears.

Speculative industrial space development will continue in 2023 but not at the rates of the past several years.