South and Southwestern Will Continue to Grow

Demographic and economic growth factors will continue to combine in 2022 to make corporate site location projects increase in the southern and southwestern United States. This is a long-term trend that continues over the last several decades as low-cost southern markets attract global manufacturing firms and manufacturing that would have typically remained in the east and Midwest but headed south for warmer, cheaper climates. The southwest is benefit from high-cost Pacific coast markets.

Demographic analysis is the study of a population-based on factors such as age, race, and sex. Demographic measures can be a major driver for corporate site location projects. States with growing, wealthier and better educated populations are attractive to companies seeking a bigger, more skilled workforce prepared for the 21st century marketplace. The growth of Southern and Southwestern states is dramatic as their demographic numbers below illustrate.

State Demographic Comparison

| Fact | Ohio | Missouri | Michigan | North Carolina | Florida | Nevada | Texas | Arizona |

| Population Growth 2010-19 | 1.30% | 2.50% | 1.00% | 10.00% | 14.20% | 14.10% | 15.30% | 13.90% |

| Median Home Value | $145,700 | $157,200 | $154,900 | $172,500 | $215,300 | $267,900 | $172,500 | $225,500 |

| Median Gross Rent | $808 | $830 | $871 | $907 | $1,175 | $1,107 | $1,045 | $1,052 |

| Bachelor’s Degree or Higher | 28.30% | 29.20% | 29.10% | 31.30% | 29.90% | 24.70% | 29.90% | 29.50% |

| Civilian Labor Participation Rate | 63.20% | 62.60% | 61.50% | 61.30% | 58.50% | 63.30% | 64.20% | 59.40% |

| Median Household Income | $56,602 | $55,461 | $57,144 | $54,602 | $55,660 | $60,365 | $61,874 | $58,945 |

| Poverty Rate | 12.60% | 12.10% | 12.60% | 12.90% | 12.40% | 12.50% | 13.40% | 12.80% |

As the table above illustrates, population growth in Florida, North Carolina, Texas and Arizona and other demographic measures illustrates the state’s success- particularly in comparison to competitors in the Industrial Midwest. These Southern and Southwestern states remain an economic hotspot heading into 2022 as population growth is a critical factor for companies deciding on economic investments—people create more customers and larger workforce pool.

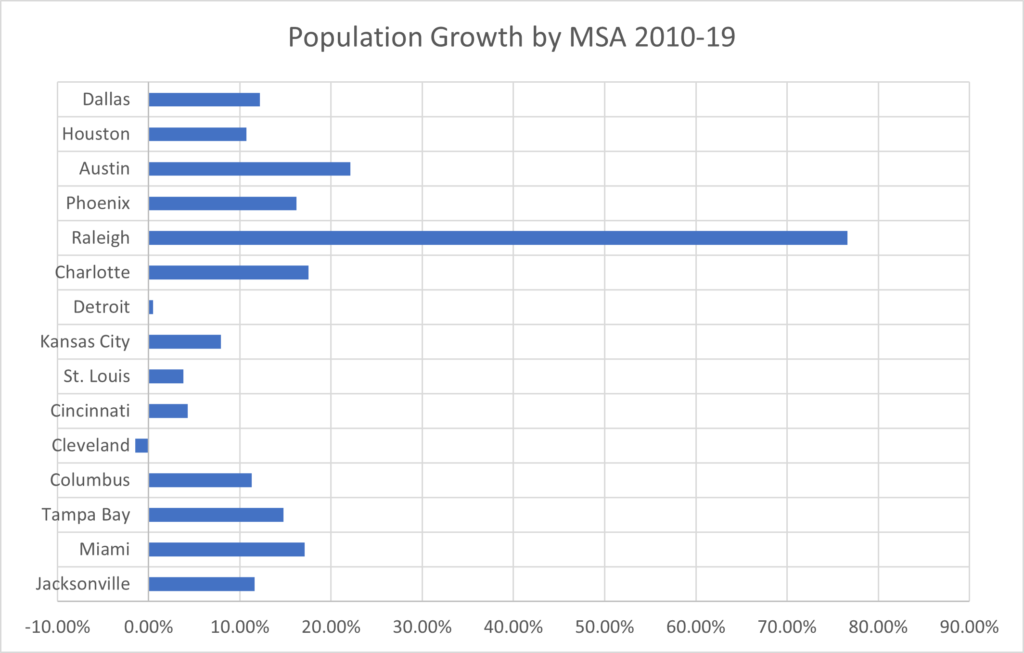

Measuring the growth of Metropolitan Statistical Areas (MSAs) illustrates an even more important story for companies seeking a corporate site location. Companies are generally not searching for a state but rather a market within 45-minute drive time of a facility—that is where they will get workers and connect to a supply chain. A comparison of the major metro markets in Ohio, Michigan, Missouri, Florida, North Carolina, Arizona and Texas illustrates again the strong market growth of the southern states compared to the Industrial Midwest.

Source: US Census Bureau

As the table above illustrates, Florida, North Carolina, Texas and Arizona’s metro centers are growing dramatically with the Raleigh, North Carolina’s growth almost flowing off the chart. Florida’s population growth driven by its metropolitan centers is a critical factor in the state’s overall economic success and guarantees a bright future in the days to come. Corporate site location projects in 2022 are likely to continue to follow growing population centers as they promise a large customer, supply chain and workforce base.

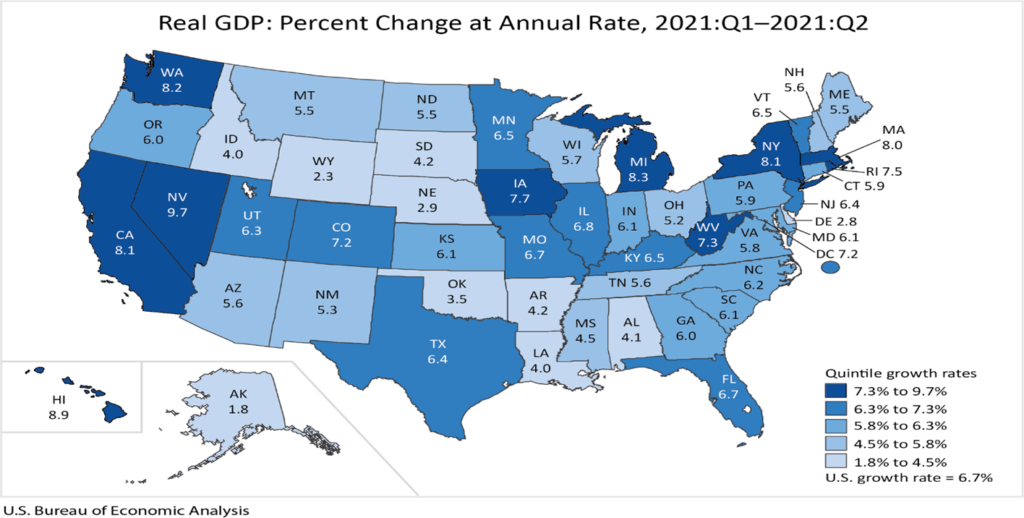

Gross domestic product (GDP), the featured measure of U.S. output, is the market value of the goods and services produced by labor and property located in the United States. GDP size and growth is a critical measure of economic success that makes regions more or less attractive to companies considering a corporate site location decision. GDP serves as a gauge of our economy’s overall size and health. GDP measures the total market value (gross) of all U.S. (domestic) goods and services produced (product) in a given year. When compared with prior periods, GDP tells us whether the economy is expanding by producing more goods and services or contracting due to less output—which ultimately defines whether the economy is in a recession. The US GDP is $23.1 T which is massive. China is the next largest global economy with nearly $17 T in GDP but the U.S. economy remains larger than Japan, United Kingdom, Germany, France and Italy combined. GDP as measured at the state level provides an important measure of the size of markets as well as the growth potential all impacting company corporate site location decisions. As illustrated by the map below, real GDP increased in all 50 states and the District of Columbia in the second quarter of 2021, as real GDP for the nation increased at an annual rate of 6.7 percent.

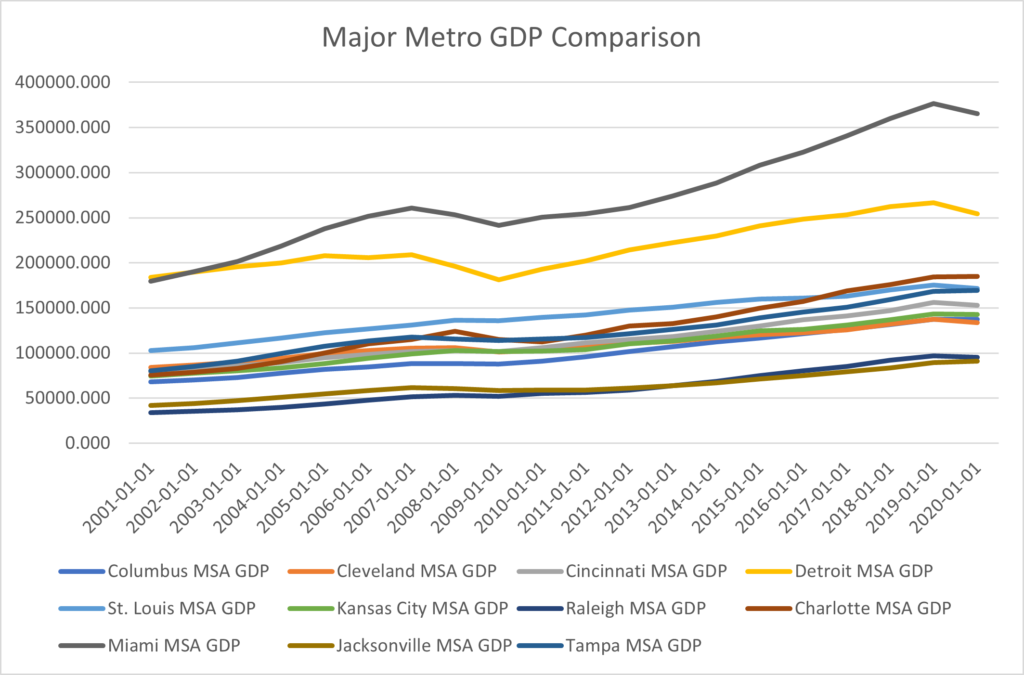

Real GDP increased in 864 counties, decreased in 2,234 counties, and was unchanged in 14 counties in 2020.[v] As the chart below illustrates, southern U.S. states have had more economic growth over the last twenty years than counterparts in the Industrial Midwest as major metro regions in North Carolina and Florida. Raleigh’s GDP has nearly tripled since 2000 while Jacksonville, Tampa and Miami have grown substantially. Columbus is a bright spot in Ohio but its growth only compares well against other Midwest competitors.

Macroeconomic growth in the Southern and Southwestern regions of the United States will continue into 2022 and make them prime spots for corporate site location projects.