2023 will remain a year when successful workforce development strategies will impact corporate site location projects. Ohio offers an interesting model for how Central Ohio’s growing and well-educated population base is driving economic development and corporate site location growth.

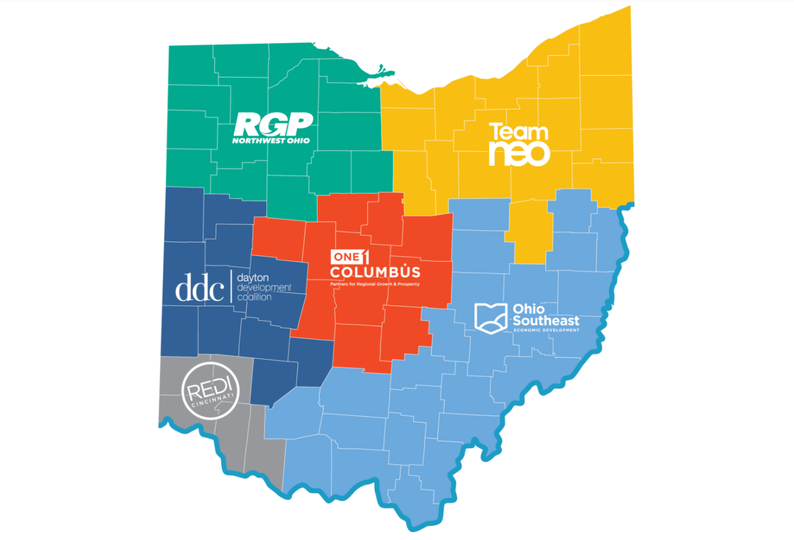

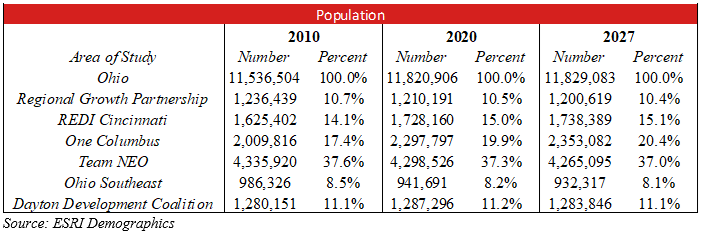

First, let’s understand the Ohio marketplace. The population of Ohio, which is currently sitting at just under 12 million residents, has seen steady growth over the 2010 to 2020 decade. The population saw an increase of 2.3% from the 2010 to 2020 census. The state of Ohio benefits from three mid-sized urban markets that are roughly the same size- Columbus, Cleveland and Cincinnati. JobsOhio, the state’s private-sector economic development organization supports the operation of private-sector regional economic development organizations covering all 88 counties. The regions experiencing growth over this past decade were REDI Cincinnati with .9% population growth, One Columbus with 2.5% population growth, and the Dayton Development Coalition region experiencing .1% population growth. While the Regional Growth Partnership, Team NEO, and Ohio Southeast all experienced declines in population by 0.2%, 0.3%, and 0.3% respectively. As the table below illustrates, the Central Ohio region is the only growing region in Ohio.

Demographic trends also illustrate the advantage that Central Ohio holds in the Buckeye State. The current median age in Ohio is 40.6, which is a 1.9-year increase from the median level in 2010 with this number projected to increase by the year 2027 to 41.3. Ohio’s under-18 population is also experiencing a decline.

The Regional Growth Partnership currently has a median age of 40.4 for its residents. With 21% of its population under the age of 18. Over the next five years, the median age of its residents is projected to increase from 40.4 to 41.2. The region currently has 19.2% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 21.6% of the population by 2027.

REDI Cincinnati currently has a median age of 39 for its residents. With 22.2% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 39 to 39.7. The region currently has 17.1% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 19.4% of the population by 2027.

One Columbus currently has a median age of 37.4 for its residents. This is the youngest median age of all the JobsOhio regions. With 22.3% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 37.4 to 37.9. The region currently has 15.3% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 17.2% of the population by 2027. This region has the lowest percentage of its population in what is considered the retirement age. The

Dayton Development Coalition currently has a median age of 41.4 for its residents. With 20.9% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 41.4 to 42.1. The region currently has 20.1% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 22.5% of the population by 2027.

Ohio Southeast currently has a median age of 41.7 for its residents. With 20% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 41.7 to 42.8. The region currently has 20.1% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 22.8% of the population by 2027.

Team NEO currently has a median age of 42.9 for its residents. This is the highest median age of all the JobsOhio partner regions. With 19.9% of its population under the age of 18. Over the next five years, the median age of its residents is projected to slightly increase from 42.9 to 43.6. The region currently has 20.8% of the population in what is considered the retirement age, 65 years of age and older. This number is expected to increase to 23.8% of the population by 2027. This region is projected to have the highest percentage of its population in retirement age by 2027.

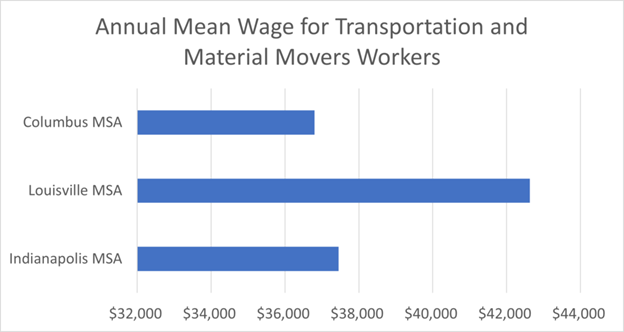

Wage rates for critical industries also illustrate the advantage for Central Ohio.

Finally, capturing jobs in the advanced services/white-collar industries such as financial services and technology sector is another advantage for Central Ohio as illustrated by comparisons of the availability of workers with a four-year bachelor’s college degree.

Companies are using a variety of workforce development strategies. First companies are focused on upskilling existing employees with 42% of companies launching upskilling or reskilling initiatives. In 2019, Amazon announced a major initiative to upskill 100,000 U.S. employees by 2025, focusing on software engineering, cloud, machine learning, and IT workers. Companies are also reimagining training with most HR professionals support removing 4-year degree from qualifications and moving towards specialized on-the-job training. Tech apprenticeships provide one training alternative – LaunchCode trains people without college degrees for tech jobs and connects them to job opportunities. Also, apprenticeships gaining traction in U.S., with the new National Apprenticeship Act, which earmarks $3.5 billion to expand apprenticeship programs across many industries, including tech. Finally, Work-from-Home (WFH) and remote work is part of the future of work. Across all industries, ‘remote work’ job listings have increased 457%, according to recent LinkedIn data, with the tech sector a leader in job listings. Companies that fail to figure out how to offer this flexibility simply won’t be able to attract the talent they need.

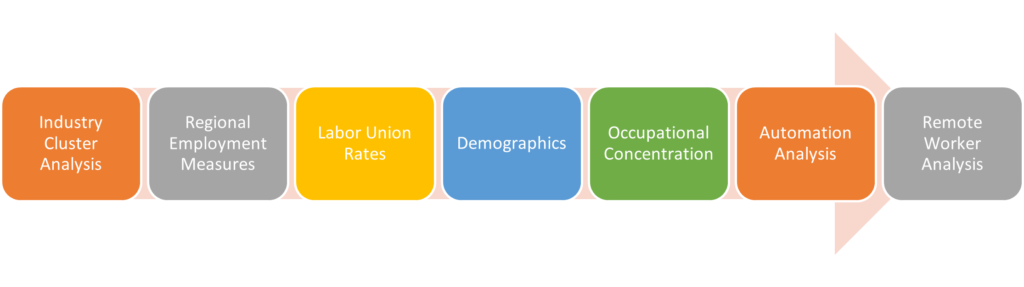

Corporate site location projects often require the development of a workforce study to determine the availability and costs of a region’s workforce prior to a company making an investment in the region. Key research topics for this workforce analysis include:

- An industry cluster analysis through a Location Quotient analysis that defines the industry strength of a region as measured by its workforce occupational concentration in a chosen industry compared to a national average for that specific industry workforce occupation in three regions.

- Unemployment Rate, Civilian Labor Participation Rate, Commuting Patterns, Population Age and Growth Rates by region, and total size of the labor force to define the pool of available labor in three regions.

- Labor union rates and union activity in three region as measured by Labor Representations & Petition Filings from the National Labor Relations Board, with a search capability based on region or state to determine union activity in the areas of study.

- Demographic measures for three regions as measured by Educational Attainment Levels, Poverty Rate, and Occupational Data that measures the ability of a region to provide skilled workers the company demands and potentially upskill other workers to define the workforce skills capability of a region.

- Occupational concentration and wage rates through an Employment Location Quotient analysis to determine the ratio of the area concentration of occupational employment to the national average concentration by SOC and Annual Mean Wages of targeted occupations.

- Potential for automation of the occupations outlined by the company to predict the numbers of workers that could be automated.

- Remote work occupational analysis that defines the number of occupations capable of remote work and the number of remote workers a region is capable of using occupational data and adequate workforce housing and broadband services.

The availability of workforce development programs in a region will also be consider as they can assist in the development of skilled workers in a region but as the chart below illustrates regional occupational rates also are very important to a company considering a site for a corporate site location project.

As the chart above illustrates, the Columbus, Ohio region has a cost advantage with the workforce classification tied to the logistics industry which assists the region in competing for these jobs. Workforce remains a critical issue for companies considering a corporate site location project consider when determining where to grow and expand operations.