With substantial economic development victories such as the $20B Intel “fab” facility, Honda LG EV battery facility and others across the state, Ohio Governor Mike Dewine is likely to want to focus on expanding the base of social services for areas such as mental health during his second term. However, the Ohio House of Representatives is in political chaos with the election of State Representative Jason Stephens with only 22 of the House’s 67 Republican members and the almost Speaker State Representative Derek Merrin controlling 43 House votes. State tax policy is in play.

Conservative lawmakers like Merrin and interest groups such as the Buckeye Institute have questioned the negative economic impact of the state and local income tax. Business groups such as the Ohio Chamber of Commerce are also calling into question whether the state’s gross receipts tax known as the Commercial Activity Tax is the best approach to state tax policy.

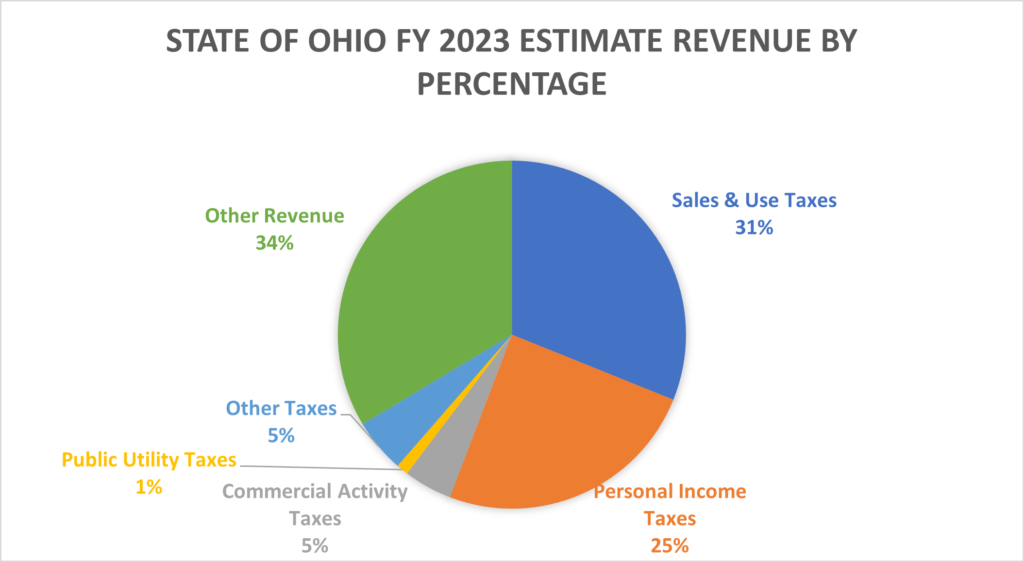

The state of Ohio operates with a personal income tax that generates $9.5 B in revenue for the state of Ohio—that is the second largest source of revenue for the state behind the sales tax that provides nearly $12 B in state revenue annually.

As the chart above illustrates, the state of Ohio’s personal income taxes generates 25% of the state government’s revenue. Ohio has a Constitutional requirement for a balanced budget. Shifting to a flat income tax or even eliminating the income tax must be accompanied by massive reductions, in spending focused likely on K12 education, higher education, and prisons and corrections. Funding cuts in these programs will impact the state’s effort to provide a workforce needed for economic growth and fail to address the rising crime rates in many parts of the state. Ohio’s Medicaid program constitutes half of the state operating budget, but it runs primarily on federal funding, and cuts to programs including eliminating the Obamacare Medicaid Expansion will save some state money but not in the billion-dollar category eliminating the income tax will impact.

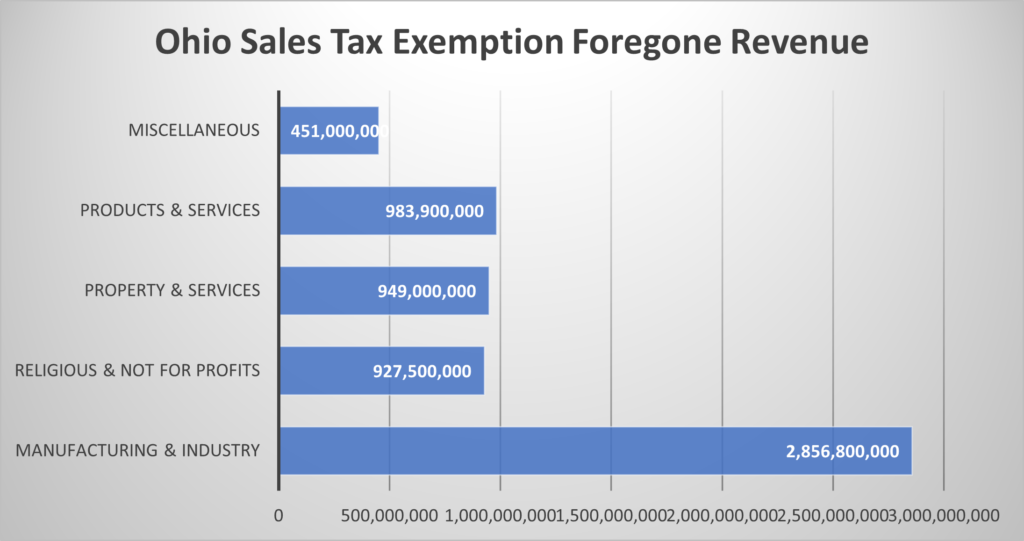

A more likely target to replace state income tax revenue is to reduce the number of sales tax exemptions. Items exempted from the state of Ohio sales tax constitute $6.1 B in foregone state of Ohio revenue but again getting rid of these exemptions is easier to say than do.

Non-religious or not for profit sales tax exemptions to Ohio sales tax include: property used primarily in manufacturing, packaging and packaging equipment, sales of TPP and services to electricity providers, TPP used in agriculture, TPP used in mining, agricultural land tile and portable grain bins, TPP used to produce printed materials, items used in storing, preparing, and serving food, property used in preparing eggs for sale, building and const materials used in certain structures, TPP used directly in providing public utility services, property used to fulfill a warranty or service contract, motor vehicles sold in Ohio for use outside the state, TPP used in research and development, TPP and services used in providing telecommunications services, qualified TPP used in making retail sales, property used in highway transportation for hire, qualified call center exemption, copyrighted motion pictures and films, equipment used in distribution warehouses, drugs distributed to physicians as free samples, property used in air, noise, or water pollution control, exemption for certain purchases by electronic publishers, prescription drugs and selected medical supplies, transportation of persons and property, newspapers, artificial limbs, prostheses, and other medical equipment, qualified used manufactured and mobile homes, aviation repair and maintenance services and parts, exempt flight simulators, sales of natural gas by a municipal utility, motor vehicle rental if payment reimbursed under warranty, feminine hygiene products, value of motor vehicle trade-ins, discount for vendors, food sold to students on school premises, value of watercraft trade-ins, sales of cable, video, and audio/audiovisual works bought or sold by cable or video service providers, $800 tax cap on qualified fractionally-owned aircraft, ships and rail rolling stock used in interstate commerce, sales of qualified property used in an eligible computer data center, sales of computers and computer equip to certified teachers, “Three-day sales tax holiday for specified

clothing, school supplies and school instructional material.” As this list illustrates, Ohio exempts a wide range of industries from the sales tax and the elimination of these exemptions would likely be portrayed as a tax increase by the impacted industry.

Finally, there is likely a substantial discussion that will go on related to the use of the Ohio municipal income tax. Ohio’s cities run primarily on income tax as it constitutes generally 70-80% of their revenue. In fact, a recent study conducted by the Ohio State University John Glenn Public Policy School found that Ohio’s 650 municipalities generated $5.86 B in revenue from the municipal income tax. Also, roughly 70-80% of municipal expenses are the public safety forces including police and firefighters—two highly thought of Republican constituencies. The General Assembly could push to permit cities to only apply the income tax to residents and not to include those who work in the city as is permitted now. This would reduce the amount of municipal income tax that is collected. However, this would not just impact the large cities but would negatively impact suburban and rural cities that operate as job centers. These communities will argue they will have to not only cut police and firefighter jobs, but they are being punished for actually developing jobs in their community.

The upcoming tax policy debate will surely be a titanic struggle with the General Assembly, Governor, and interest groups engaged to protect against tax increases and focus attention on the program implications of major tax policy changes.

Please contact Dave Robinson at [email protected] if you have any question regarding Ohio Statehouse matters.