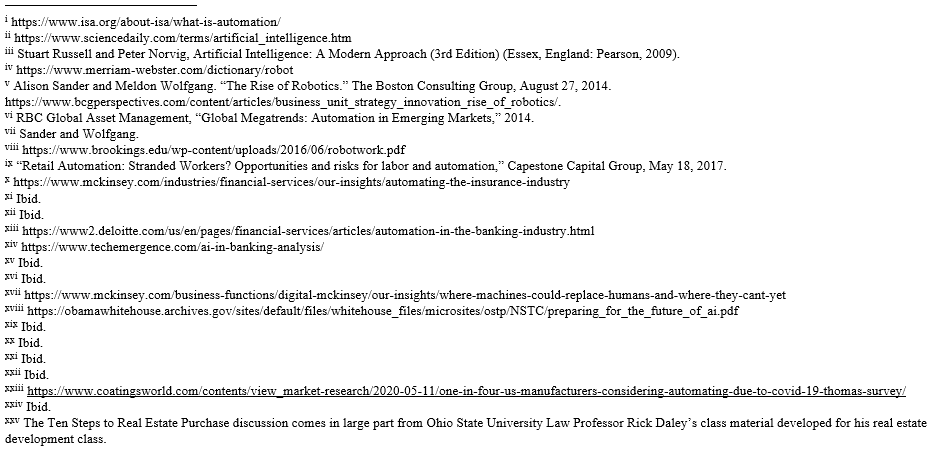

Attracting the supply chain of American companies closer to domestic facilities starts with an understanding as to how the supply chain companies can locate in sites primed and job-ready for development. The first step in the site development process is to understand the region’s potential for economic growth, availability of a skilled workforce and the costs of doing business as compared to other regions and states of equal business value. Measures of economic growth will center on a comparison of GDP growth, personal income, COVID 19 infections, demographic measures such as population growth, poverty rates, median home values and other measures that define the equity of a region for a wide range of potential workers. Cost of doing business measures should also be created to better understand the wages key workers will require, the costs of real estate, taxes, utilities and other major cost factors for competing regions.

Once the region survives the economic, workforce and cost of doing business comparison, a company’s supply chain partner needs to move to negotiate local real estate options. If the company wishes to purchase a site, before they gain control of the site, the company needs to complete due diligence on the site such as confirming the zoning, determining if environmental contamination exists, if the title of the land is marketable, and if the project has tax incentives. [i] Prior to final land purchase, the potential buyer needs to gain all the necessary governmental approvals such as zoning, tax incentives, and Brownfield remediation protection. With buying, building or renting, a company considering a site for an economic development project needs a pro forma to determine whether the project makes or loses money and what economic development incentives can address potential project costs to make the site more attractive for investment. The pro forma is based upon both expenses and revenues. The development cost budget addresses the expenses of the project and includes all the costs directly related to a project. Hard costs are those expenses directly incurred in connection with the construction of the building, tenant space and other site improvements. They include the contractor, legal, engineer, appraiser, insurer and developer and commercial realtor fees and the cost of all labor and materials provided to the project. Financing and utility charges, impact fees, marketing and operating costs are also included. A contingency reserve is needed to cover any unexpected costs incurred during the development process.

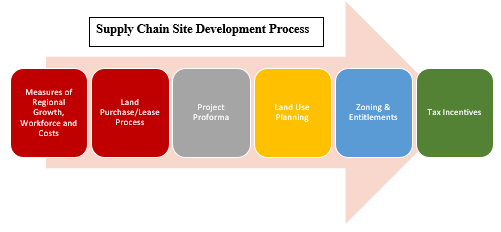

No company can locate at a site without local government permission through the land use regulation process. Local government manages design, growth and development typically through a comprehensive plan that can serve as a legally binding document that sets the overall goals, objectives and policies to guide the local legislative body’s decision making in regarding to the development of a region or community. Zoning is a key component of the basic system of land use regulation. Unincorporated land and rural communities operate with less zoning authority. Thus, these communities have few powers to regulate land use through the zoning process. Traditional zoning divides land within a jurisdiction into districts, or zones, with varying restrictions on uses that may be established and conducted in the different zones and standards (such as size and location of buildings, yard areas and intensity) such uses must meet. Zoning regulations provide for orderly growth, generally in furtherance of comprehensive plans, limit the interaction of incompatible uses, and protect the public health, safety, and welfare.

Working in conjunction with the negotiations of local and state incentives and land use regulations, supply chain partner projects may also involve the negotiations of local, state and federal financing to prepare a site for development. Federal funding can be a source of financing for public infrastructure associated with economic development projects creating jobs and making capital investments. The Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law on March 27, 2020, provides the Economic Development Administration (EDA) with $1.5 B for economic development assistance programs that help communities prevent, prepare for, and respond to the impacts of coronavirus. EDA has determined that all communities throughout the United States are eligible for CARES Act funding, the EDA created an approximate tenfold increase in the funding ceiling for EAA awards, taking the ceiling up to a maximum of $30 M for projects, but public works infrastructure funding from the EDA will still likely require a company end user to gain funding.

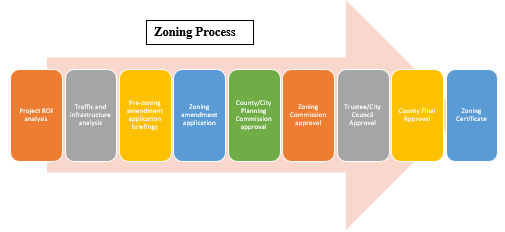

TIF Example

| Step | Description | Value |

| Base Value | Market value of real property prior to TIF | $1,000,000 |

| New Value | New market value after TIF and investment | $11,000,000 |

| Growth in Market Value | Base Value minus New Value | $10,000,000 |

| Assessed Value | 35% of new market value | $3,500,000 |

| Annual Tax Increment/PILOT | Assessed value times tax rate on an annual basis | $262,500 |

Local and state governments are the central provider of site development infrastructure used by the companies during a corporate site location project. Forty-nine states with New Jersey being the lone holdout offer infrastructure finance programs implemented at the local or state level tied to economic development projects. Tax Increment Financing (TIF) is the prime local public finance program that can support site-based infrastructure development. While TIF program rules vary by state, they all primarily operate to capture future property tax gains created by a capital investment in a defined district. That increment or growth in the property tax is captured over a period of time and the funding is spent on legislatively defined uses. In most states, that defined TIF funding use is limited to public infrastructure within a statutorily defined district. Some states permit the TIF funding to used for more than public infrastructure, and Illinois offers an interesting example of such as program. Illinois Tax Increment Financing captures future property tax growth in a defined district for the redevelopment of substandard, obsolete, or vacant buildings, financing general public infrastructure improvements, including streets, sewer, water in declining areas, cleaning up polluted areas, administration of a TIF redevelopment project, property acquisition, rehabilitation or renovation of existing public or private buildings, construction of public works or improvements, job training, relocation, financing costs, including interest assistance, studies, surveys and plans, marketing sites within the TIF, professional services, such as architectural, engineering, legal and financial planning, and demolition and site preparation.

Other economic development incentives such as the tax credits, tax abatements, grants or loans discussed earlier are prime opportunities for a company’s supply chain considering an economic investment in the United States. The Montrose Group Economic Development Incentive Guide indicates, well over 600 local and state economic development incentive programs operate in all fifty states. Most of these programs are triggered by high-wage job creation and capital investment and are competitively awarded through a multi-state corporate site location process. These programs offer tax credits, tax abatements, grants and loans to generally non-retail companies considering the state for an economic retention, expansion or attraction project.