The Great Lakes states are primed for an economic renaissance. The Great Lakes Region includes eight states (Minnesota, Wisconsin, Illinois, Indiana, Michigan, New York, Ohio, and Pennsylvania) and two Canadian provinces (Ontario and Quebec) that surround the five interconnected freshwater bodies known as the Great Lakes. The area is home to 107 million people, 51 million jobs, and a GDP of US$6 trillion – making the Great Lakes Economy a powerhouse on an international level. The GDP of the Great Lakes of Indiana, Illinois, Michigan, Ohio, and Wisconsin has grown by 22% since 2018.

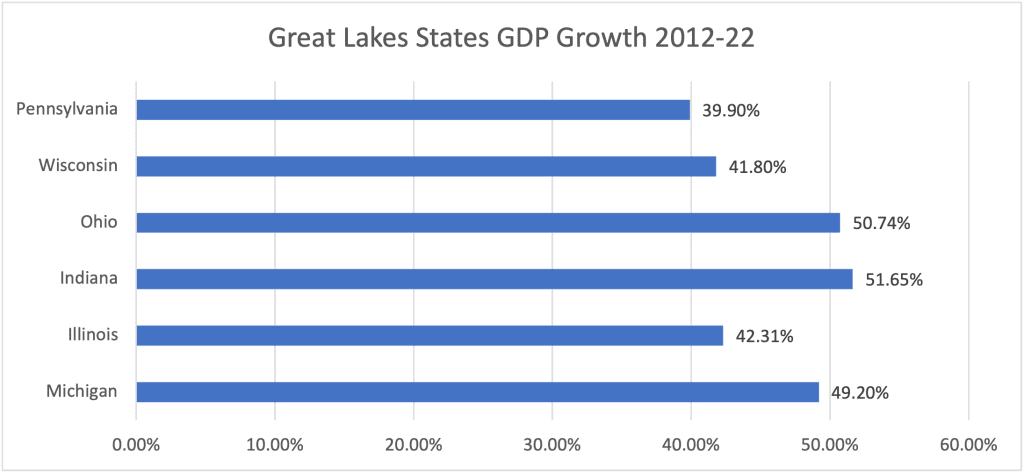

As the table above illustrates, Pennsylvania, Wisconsin, and Illinois enjoyed growth in their GDP from 2012 to 2022 but the state’s overall does not compare well to other Great Lakes states such as Ohio, Indiana, and Michigan.

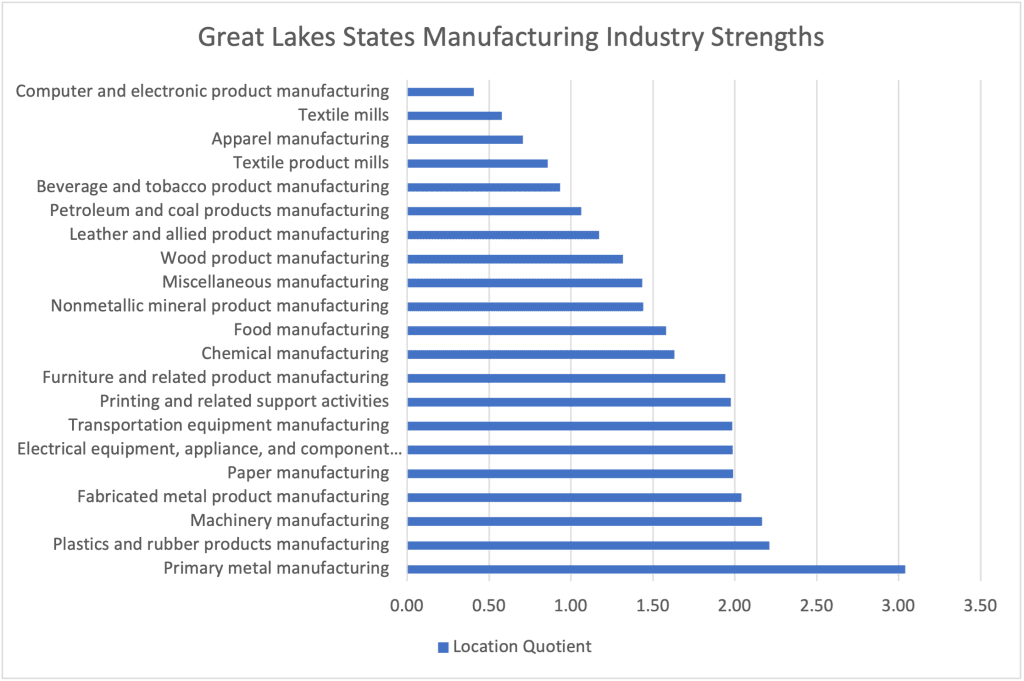

The Great Lakes states remain a manufacturing powerhouse. Manufacturing remains at the center of the Great Lakes economy. An important measure for these regions is their concentration in the company’s industry. Industry clusters are regional concentrations of related industries. Clusters consist of companies, suppliers, and service providers, as well as government agencies and other institutions that provide education, information, research, and technical support to a regional economy. Clusters are a network of economic relationships that create a competitive advantage for the related firms in a particular region, and this advantage then becomes an enticement for similar industries and suppliers to those industries to develop or relocate to a region. Clusters exist in all types of economies and are more prevalent in locations that achieve better performance relative to their overall stage of development. It is useful to view economies through the lens of clusters rather than specific types of companies, industries, or sectors because clusters capture the important linkages and potential spillovers of technology, skills, and information that cut across firms and industries. Viewing a group of companies and institutions as a cluster highlights opportunities for coordination and mutual improvement. A location quotient is an indicator of the economic concentration of a certain industry in a state, region, county, or city compared to a base economy, such as a state or nation that measures industry clusters in a region. A location quotient greater than 1 indicates the concentration of that industry in the area. A location quotient greater than 1 typically indicates an industry that is export oriented. An industry with a location quotient of 1 with a high number of jobs present is a big exporter and is bringing economic value to the community feeding the retail trade and food services sectors.

The Great Lakes states maintain a substantial manufacturing strength in a range of industries. The Great Lakes states of Indiana, Illinois, Michigan, Ohio, Pennsylvania, and Wisconsin have at or near double the national average of jobs in primary metal, plastics, and rubber products, machinery, fabricated metal product manufacturing, paper, electrical equipment, appliance and component, transportation equipment, printing and related support activities, and furniture and related product manufacturing as illustrated by the table below. In fact, these states are above the national average in nearly every industry category measured by the Bureau of Labor Statistics, and with the development of the Intel “fab” project in Ohio and several Electric Vehicle battery and supply chain projects in the region, the manufacturing base of employers should remain strong for the Great Lakes states.

Measuring the economic opportunity of the Great Lakes States is best done from the perspective of a company considering the region for a corporate site location project. Corporate site location projects involve the process where companies decide where to grow or retain jobs and make capital investments. This process is influenced by macroeconomic, demographic, workforce, quality of life, cost of doing business, and industry cluster research as these companies want to invest in growing regions, with lower poverty rates and higher population growth, a competitive cost of doing business and a high quality of life attractive to a skilled workforce connected to common industries with this company. The Great Lakes States of Indiana, Illinois, Michigan, Ohio, Pennsylvania, and Wisconsin compete not just globally for high-wage jobs and capital investment but often with the Southern U.S. states to serve as the manufacturing heartland of the nation.

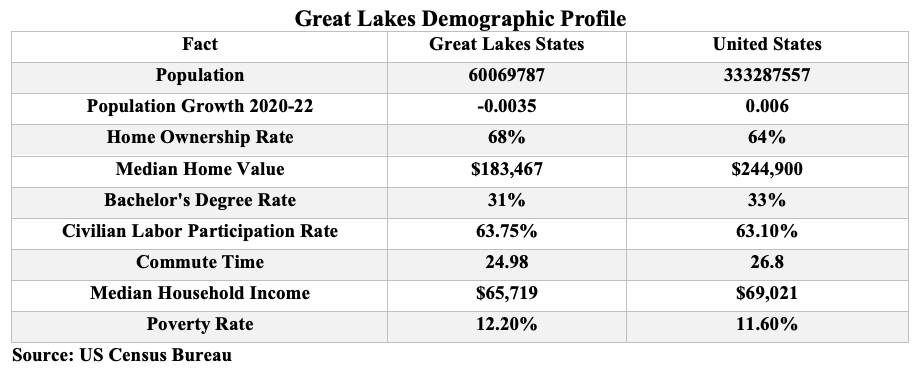

The Great Lakes Region’s demographic data offers a mixed bag for corporate site location projects. Key demographic measures that impact corporate site location decisions include total population and population growth which impact the ability of a region to provide skilled workers—the larger the population pool the more chances for creating a skilled worker. Also, homeownership and median home value illustrate whether workers will be able to afford housing. Labor issues such as the level of higher education degree attainment and how many workers are in the active workforce impact a region’s ability to attract certain types of companies and companies at all if they have no room for growth in the active labor market. Quality of life issues such as commute times to work matter as well and overall wealth measures such as median household income and poverty rate impact company location decisions.

As the table above illustrates, the Great Lakes states of Indiana, Illinois, Michigan, Ohio, Pennsylvania, and Wisconsin are home to over 60 M residents, but the region is not growing from a population standpoint which is troubling. Homeownership rates in the Great Lakes are higher than the national average. The median home value is lower than the national average, which is an advantage, but the bachelor’s degree attainment rate is lower than the national average. Commuting times are below the national average, but the median household income is below the national average. Finally, the poverty rate in the Great Lakes Region is slightly higher than the national average.

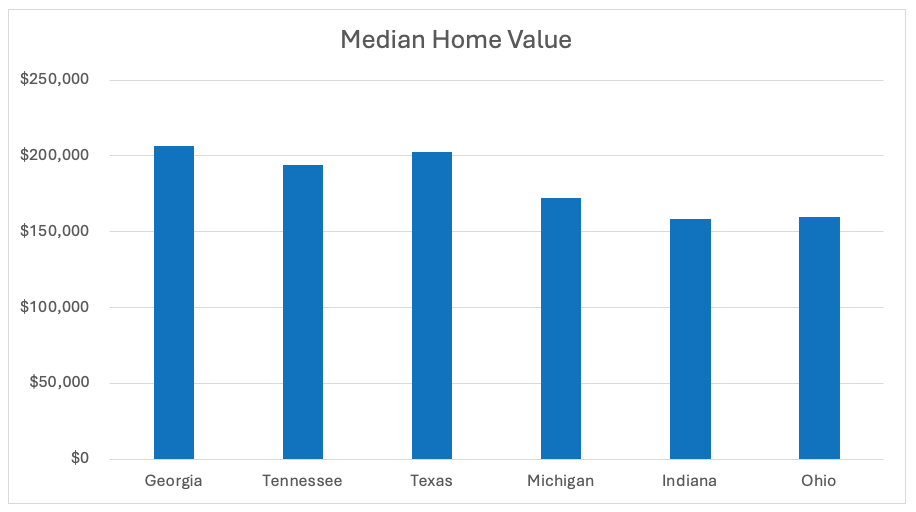

However, the Great Lakes states remain a more affordable place for workers to live as the chart shows the housing costs of regions across the United States.

Six economic conclusions about the growth prospects of the Great Lakes states compared to the South are crystal clear.

-

- The Great Lakes states are not growing as quickly as Southern states related to population and macroeconomic measures as the long-term Southern and Southwest U.S. state expansion continues in 2023, and this slower population and economic growth serve as a threat to future economic expansion in the Great Lakes Region.

- The Great Lakes States have a large pool of manufacturing companies and workers, but their manufacturing labor wage rates remain higher than their Southern State competitors.

- The Great Lakes States have become a less costly place to do business as state income taxes have been reduced but still ensure residents and not just companies bear the burden for the cost of local and state government operations than states that lack an income tax at all.

- The Great Lakes States have enhanced their quality of life but also have more affordable housing than faster-growing Southern markets which can have an outsized influence on corporate site location decisions as companies remain concerned about the lack of available and affordable workforce housing for their workers.

- The Great Lakes states remain an industrial powerhouse with every state in the region having an above-average base of manufacturing workers and Indiana leading the way as the number one state in the nation on a per capita basis for manufacturing.

- The Great Lakes States benefit from highly function regional and state economic development organizations and usually aggressive economic development incentives that can make up for higher labor wage rates for competitive corporate site location projects.

Indiana, Illinois, Michigan, Minnesota, Ohio, Pennsylvania, and Wisconsin remain economic powerhouses but operate in a highly competitive market to retain and attract high-wage jobs and capital investment impacting the chances for a positive year for the region in the 2024 hunt for corporate site location projects.

1. https://councilgreatlakesregion.org/the-great-lakes-economy-the-growth-engine-of-north-america/#:~:text=The%20Great%20Lakes%20Region%20includes,powerhouse%20on%20an%20international%20level.

2. https://www.ibrc.indiana.edu/ibr/2015/spring/article2.html

3. lbid

4. lbid

5. https://clustermapping.us/content/clusters-101

6. lbid