Redeveloping an existing building has always been more complicated and expensive than transforming a corn field into an office or industrial complex. However, a new generation of workers are driving communities and companies to take another look at transforming existing structures into new housing, office and commercial opportunities. In fact, historic rehabilitation for communities large and small are in many ways a workforce development program as younger, Millennial workers are focused on the quality of place, walkable neighborhoods where they can live, work and play.

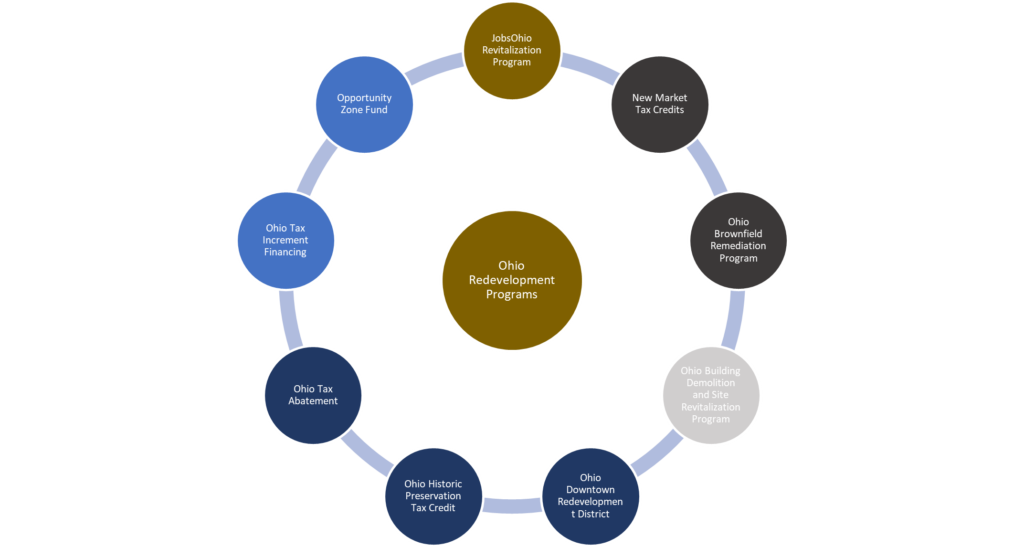

Redeveloping existing sites also benefit from a wide range of local and state government programs that can help build the Public-Private-Partnership needed for the real estate math of a project to add up. As the graphic below illustrates, states like Ohio offer a wide range of local and state government programs that can provide millions of dollars for the redevelopment of sites.

Redevelopment projects that can commit to high-wage job creation outside of the retail sector can seek funding in Ohio from JobsOhio—the state’s economic development not-for-profit corporation. The JobsOhio Revitalization Program provides $500,000 to $5 M in loans and $1M in grants for redevelopment of sites create or retain at least 20 jobs for public or private sector applicants for site demo, environmental remediation, building construction, infrastructure and environmental testing.

Brownfield sites are often prime redevelopment opportunities. A “Brownfield” is an abandoned, idled, or under-used industrial, commercial, or institutional property where expansion or redevelopment is complicated by known or potential releases of hazardous substances or petroleum with contamination to be remediated at the subsurface level, unless remediation is needed to gain access to the subsurface contamination (i.e. building demolition) in order to contain the contaminant (i.e. asbestos abatement). Redeveloping a Brownfield involves gaining legal protection against negative impacts of the environmental hazards as well as funding to redevelop a contaminated site. In Ohio, if no known or potential releases of hazardous substances or petroleum are identified by a Phase I property assessment, but a building or structure with documented asbestos is present, the property is eligible to prevent a future release during planned demolition or renovation activities. Ohio Environmental Protection Agency (Ohio EPA) Voluntary Action Program (VAP) eligible properties should use funds to gain a “Covenant-Not-To-Sue” from the Ohio EPA. The Ohio Brownfield Remediation Program provides $350 M in Brownfield remediation funding awarded by the Ohio Department of Development.

Idle or vacant sites can benefit from Ohio’s Building Demolition and Site Revitalization Program that is providing $150 M in funding with each of Ohio’s 88 counties gaining $500,000 to funding building demolition and site revitalization. One of Ohio’s 62 county landbanks are likely the stopping place for communities and developers seeking funding from this new state of Ohio program as each county will designate a lead entity to coordinate Ohio Building Demolition and Site Revitalization Program funding. A wide range of properties are eligible for the Ohio Building Demolition and Site Revitalization Program that includes non-Brownfield commercial and residential buildings and former retail, office, manufacturing, industrial, industrial warehousing, institutional, or other non-residential or mixed-use. Non-vacant and blighted structures are not eligible, unless they are contiguous/connected to vacant and blighted structures that are necessary to demolish. Applications for the Ohio Building Demolition and Site Revitalization Program are being taken on a first-come-first-serve basis and speed in preparing and filing an application counts.

Local governments can provide substantial tax incentives for the redevelopment of sites that may abate taxes and/or fund public infrastructure. Ohio’s tax abatement programs, either the Community Reinvestment Area and Enterprise Zone, provide locally enacted real and personal property tax abatement for new capital investment creating jobs. Ohio, like 49 other states offers Tax Increment Financing that permits local governments to define districts to capture future assessed value of property tax for the use on public infrastructure.

Historic properties have an even larger set of economic development programs that can directly fund the redevelopment of buildings for retail, office, housing and commercial purposes. Ohio’s Downtown Redevelopment District permits municipalities to capture the property tax gain in a 10-acre district continuous to a certified historic structure preparing for redevelopment purposes that include historic structure redevelopment, funding for historic preservation CIC, public infrastructure and development of tech corridors. Federal and state historic rehabilitation tax credits also offer a substantial economic development incentive for the redevelopment of historic structures. The Federal Historic Preservation Tax Credit offers a 20% income tax credit for the rehabilitation of historic, income-producing buildings that have a historic designation and planned rehabilitation consistent with the National Park Service’s historic preservation standards. Annually, the National Park Service Technical Preservation Services approves approximately 1200 projects, leveraging nearly $6 billion annually in private investment in the rehabilitation of historic buildings across the country. Ohio, like a majority of states, offers as a state of Ohio Historic Preservation Tax Credit as well that provides a state tax credit up to 25% of qualified rehabilitation expenditures incurred during a rehabilitation project, up to $5 million. Awarded in two rounds annually by the Ohio Department of Development, Round 28 applications of the Ohio Historic Preservation Tax Credit will have their first pre-app meeting on January 31, 2022 with applications due on March 31, 2022.

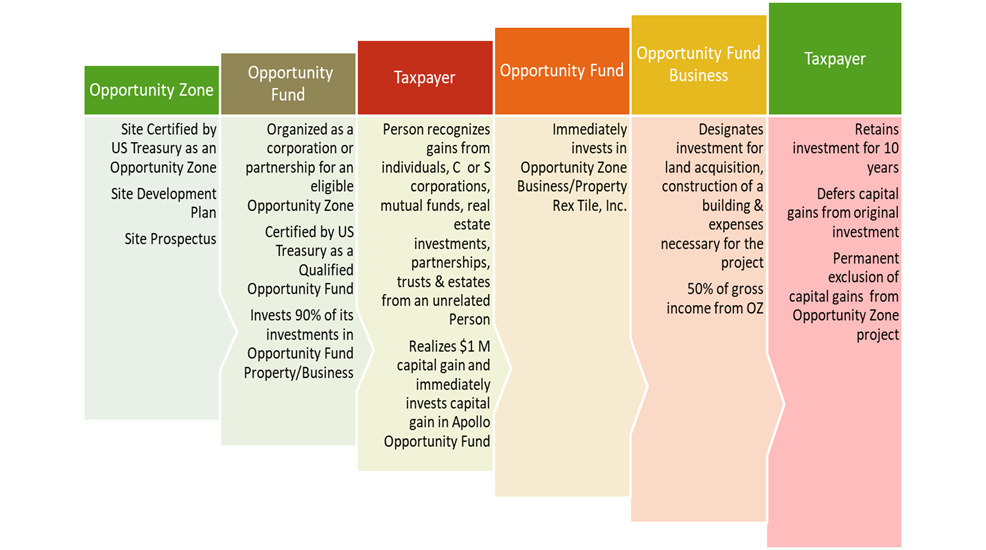

Federal government programs also encourage redevelopment projects. The New Markets Tax Credit program provides a 39% Federal Tax Credit Over 7 Years and it can be paired with a $1M Ohio New Markets Tax Credit to promote real estate investment in distressed areas for retail, office and manufacturing projects for projects generally seeking at least $5M in investment. The federal government Opportunity Zone program also rewards investment in distressed areas by permitting the deferment and potential elimination of payment of capital gains taxes if those gains are invested in qualifying opportunity zone funds and companies.

Opportunity Zone Model Investment Outline

Ohio also offers an Opportunity Zone tax credit. An Ohio taxpayer must invest in an Ohio Qualified Opportunity Fund. Second, that Fund must invest all or a portion of the Taxpayer’s investment in qualified opportunity zone property situated in an Ohio opportunity zone in the calendar year preceding the application. The credit is equal to 10 percent of the Taxpayer’s investment that has been invested in qualified opportunity zone property situated in an Ohio opportunity zone by the Fund. As an example, a Taxpayer contributes $1 million to an Ohio Qualified Opportunity Fund. The Fund then invests $750,000 of that contribution in qualified opportunity zone property situated in an Ohio opportunity zone in 2019. In January 2020, the Taxpayer can apply for a 10% tax credit on the $750,000 invested. The tax credit in this scenario calculates to $75,000 (10% of the $750,000).

Redevelopment projects should not lack from resources but they are complex and benefit from strategic consulting and legal help.Please contact Dave Robinson at [email protected] if you need assistance with any economic redevelopment project.