The Ohio Development Services Agency recently launched the $25 M Rural Industrial Park Loan Program (RILP) to promote economic development in eligible rural areas by providing low-interest direct loans to assist public and private sector organizations in financing the development and improvement of industrial parks and related off-site public infrastructure improvements in 35 of Ohio’s 88 counties. However, it will take more than $25M to address the economic challenges of developing sites in these Ohio communities. The economic success of Ohio’s Rural Industrial Loan Program will be driven by communities that create a Public-Private-Partnership to develop sites.

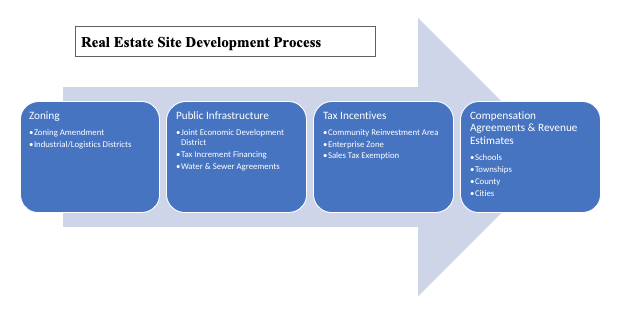

Communities or developers hoping to capitalize on the RILP needs to participate in a multi-step process involving several levels of local government that to create a Public-Private-Partnership (PPP) that designates permitted land use, develops required infrastructure, provides for needed tax incentives to attract end users and provides for tax revenues for local governments and schools impacted by the development.

Whether in a township, city or village, no economic development project happens unless the land is properly zoned. In an Ohio township, the municipal or rural zoning/planning commission is the first stop to seek a change in the zoning for a site. In many regions, specific industrial and logistics business development districts are set up with specific zoning standards to attract industrial and logistics developments. Zoning applications must be developed following the creation of engineering and consulting reports that outline the transportation and infrastructure investments need to permit the site to operate. Pre-zoning briefings with local government officials outline the scale and scope of the project as well as the transportation and infrastructure needed and the Return on Investment estimates for the local community. Approval will be sought with the local zoning and planning commission before a city council or township trustee board votes to approve of the zoning change.

If the site is in an Ohio township adjacent to a municipal corporation, the property will likely benefit from the formation of a Joint Economic Development District. This allows for the provision of infrastructure to be brought to the properties including sewer and water and roadwork. To tap into these services the property must apply to be included in the JEDD area. There is an income tax levied on employees who work in the JEDD which can be as high as 2.5% in Ohio. The JEDD is governed by a board of directors that approves the inclusion petition. Before the JEDD Board will approve the petition to be in the JEDD, the township trustees and village or city council must approve the request to be included in the JEDD and proper zoning needs to be in place. Ordinances and agreements will need to be negotiated that provide funding for site infrastructure and set income tax revenue splits and service arrangements between the local governments.

Arizona v. Ohio Business Tax Burden

| State | Property Tax | Sales Tax | Excise Tax | Corporate Income | Unemployment Insurance | Individual Income Tax | Licenses | Total Business Taxes |

| Ohio | 7.3 | 5.7 | 3.1 | 2.0 | 1.1 | 1.3 | 1.9 | 22.5 |

| Arizona | 5.5 | 3.1 | 1.2 | 0.4 | 0.5 | 0.3 | 0.6 | 11.6 |

Source: Council of State Taxation

As the table above illustrates, Ohio taxes business at twice the volume of high-growth states like Arizona—most of that tax burden is greater at the local government and school level. Thus, successful industrial and R&D developments that must compete nationally and globally require a 100%, 15-year property tax abatement to succeed. Booming regions like Columbus are driving industrial, logistics and R&D growth like data centers through the use of 100%, 15-year property tax abatements in Etna Township in Licking County, Rickenbacker Intermodal in southern Franklin and northern Pickaway County, and West Jefferson in Madison County. These incentives have helped create 83,000 logistics jobs and 73,000 manufacturing jobs in Central Ohio.

In Ohio, a Community Reinvestment Area (CRA) provides the best tax incentive vehicle for RILP counties. The Ohio CRA program is an economic development tool administered by municipal and county government that provides real property tax exemptions for property owners who renovate existing or construct new buildings. CRAs are areas of land in which property owners can receive tax incentives for investing in real property improvements, and it provides a direct incentive tax exemption program benefiting property owners who renovate existing or construct new buildings. This program permits municipalities or counties to designate areas where investment has been discouraged as a CRA to encourage revitalization of the existing housing stock and the development of new structures. Local municipalities or counties can determine the type of development to be supported by the CRA Program by specifying the eligibility of residential, commercial and/or industrial projects. Being in this area allows for the taxes on real property to be abated. Tangible personal property is not taxed in Ohio and in a township the County Commissioners and in a city the city council and mayor/manager have the authority to approve a CRA agreement. CRA’s do not abate the taxes on the buildings; thus, the property tax value gain can be captured to use for Tax Increment Financing. Part of gaining a tax abatement is negotiating a compensation agreement with local governments- primarily local school districts. In Ohio, there must be revenue sharing with the school district in order to achieve 100%, 15-year abatement and several local models exist where the developer provides revenue sharing through a Tax Increment Finance District on the land that redirects the increased taxes on land to the school district with the CRA only abating taxes on the buildings for CRAs created after 1994.

Tax Increment Financing (TIF) is another economic development mechanism available to local governments in Ohio to finance public infrastructure improvements and, in certain circumstances, residential rehabilitation. Ohio’s growing communities actively use TIFs to support economic development- Columbus’ Franklin County has over 200 TIF agreements on file with the state of Ohio. TIFs are implemented at the local level and may be created by a township, municipality or county. Payments derived from the increased assessed value of any improvement to real property beyond that amount are directed towards a separate fund to finance the construction of public infrastructure defined within the TIF legislation. Local jurisdictions seeking to establish a TIF project must enact legislation that (a) designates the parcel(s) to be exempted from taxation, (b) declares improvements to private property within the specified area as serving a public purpose, (c) delineates the public infrastructure improvements to be made that will directly benefit the parcel and (d) specifies the equivalent funds to be created for those redirected monies. Only those public infrastructure improvements directly serving the increased demand arising from the real property improvements to the parcel(s) or an Incentive District are eligible for TIF financing.

Ohio law also allows Port Authorities to own property and lease it to private entities. The largest benefit for a private entity to use a port authority is for the exemption of sales tax on construction materials. Local port authorities do these transactions frequently and has an agreement with the county or city to provide port authority financing in the county will be required. This is another funding opportunities for local governments but also provides a substantial reduction in sales tax tied to a project’s construction materials.

These incentive and public finance programs also build a PPP by creating funding streams for local school districts, cities, villages, townships and counties if development occurs at the site. TIF revenues can be used to compensate schools if a CRA tax abatement is used if development happens and the property values increase. JEDD revenue provides an income tax revenue stream for cities and townships. Fees associated with the port authority sales tax exemption can provide the county with a source of funding revenues as well if development happens.

As sites must be zoned and infrastructure planned for RIPL applications to be awarded, preparing a successful PPP for the site in question is essential for public or private sector developers to capitalize on this new $25 M Ohio economic development program.