Rising interest rates have slowed to a crawl the development of private sector speculative industrial space. This presents an opportunity for communities to use an “old” tool to create public sector industrial parks to capture the manufacturing product that remains strong throughout the United States.

Industrial developers across the Country, and in particular Midwest markets (Chicago, Indianapolis, Kansas City, Columbus) have consumed large tracts of industrial land over the past 5-7 years. Across the 87 markets that make up CoStar’s National Index, there are 483 million SF of projects under construction, and vacancy rates have been rising for the last 5 quarters driving down rent growth across the country. The oversupply of speculative industrial buildings and increasing industrial vacancy rates is an opportunity for communities to form public-private partnerships to fill the gaps in attracting end users for FDI, food and beverage manufacturers, and Giga factories.

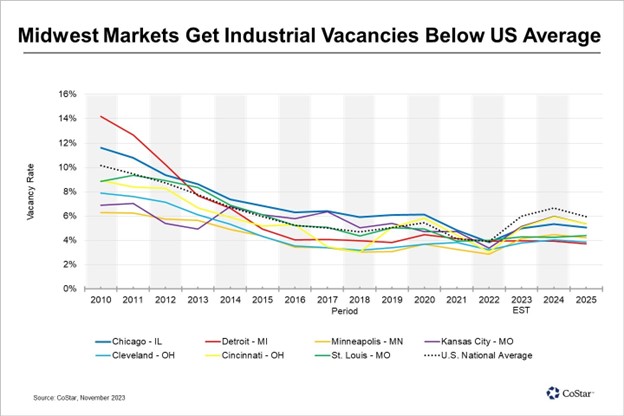

As illustrated by the Costar chart above, the Midwest market’s industrial vacancy rates are below the U.S. average illustrating there is an opportunity for growth based upon new investment. Including Chicago, seven of the 20 largest industrial inventories by square footage reporting vacancy rates below the national average are in the Midwest: Cleveland is at 3.6%, Minneapolis is at 3.8% and Detroit is at 3.8% vacancy.

Manufacturing construction starts are likely to continue to grow with the onshoring of production improving supply chains and significant new federal funding assisting those efforts according to the Dodge Construction Network Report. In 2024, Dodge anticipates that construction starts will again outperform most other sectors with a 16% increase in dollar value and a 10% gain in square footage. Since 2020, manufacturing construction starts have grown from 63 million square feet to more than 156 million square feet in 2023. Continued growth is expected in 2024.

Demand for U.S. industrial space remains strong. Lee & Associates reports demand for industrial space remained positive in the United States and Canada in the third quarter, but growth this year has lost steam compared to the strong net absorption totals of the last two years. U.S. net growth in the third quarter totaled 29.9 million SF compared to 94 million SF for the same period last year. Year-to-date net absorption is 110.2 million SF, down 62% from the same period last year. There was 411.7 million SF of growth in 2022. The 524.7 million SF of net absorption in 2021 stands as the record, but the current pace of tenant expansion is the slowest since 2012 and comes as a quarterly record of new inventory is set for delivery. Not all manufacturers will grow in 2024. Deloitte reports, that in 2024, manufacturers are expected to face economic uncertainty, the ongoing shortage of skilled labor, lingering and targeted supply chain disruptions, and new challenges spurred by the need for product innovation to meet company-set net-zero emissions goals. Deloitte’s analysis of Purchasing Managers’ Index (PMI) data reveals that the manufacturing sector was in contraction for most of 2023. The 2024 reality is regions need sites and workers to retain and attract growing manufacturing companies.