Manufacturing and logistics are hot growth markets in today’s COVID 19 economy launching what could be seen as a second Industrial Revolution. A sites’ property tax rate and the availability of property tax abatement programs to provide an economic incentive for logistics and manufacturing projects both impact opportunities to gain these jobs. Shifts in consumer behavior to more e-commerce, increased industrial production and increased imports are all driving tremendous growth in the U.S. logistics, distribution, and fulfillment center industry. COVID 19 has not slowed the growth of industrial development tied directly to the changing consumer behavior to shop via e-commerce rather than in person. Logistics is a booming industry driven by the growth of the $340 B e-commerce industry expected to grow to $476 B by 2024 transforming the retail industry into the fulfillment center industry which will drive annual net industrial absorption to more than 333 million sq. ft. by 2022 continuing the expansion of the logistics industry. Based upon this expansion of a 10-year trend, CBRE estimates 2021 will see the absorption of 300M square feet of new industrial space driven by e-commerce. Manufacturers in the United States account for 11.39% of the total output in the economy, employing 8.51% of the workforce according to the National Association of Manufacturers. The Bureau of Labor Statistics found that total output from manufacturing was $2,334.60 billion, there were an average of 12.8 million manufacturing employees in the United States in 2018 with an average annual compensation of $84,832.13 in 2017.

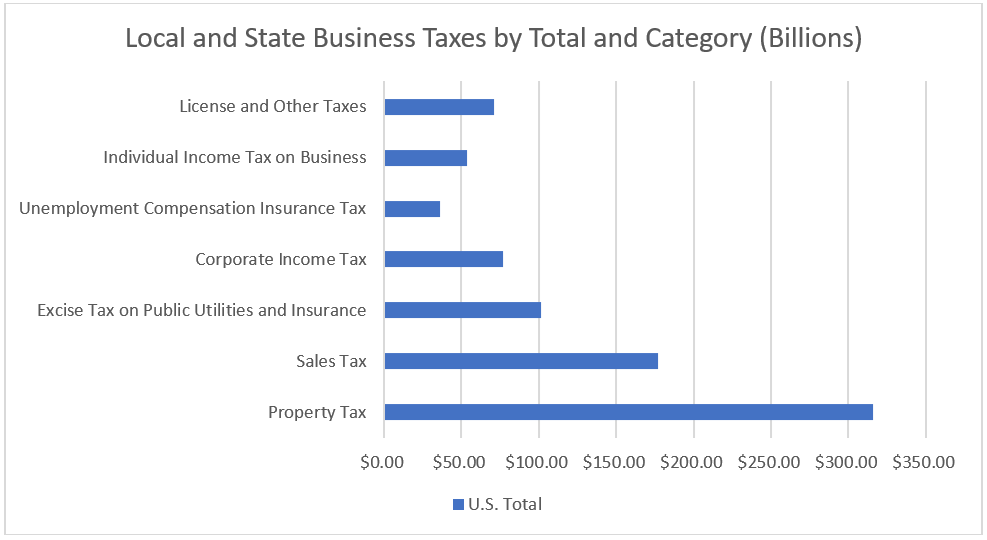

State and local tax structures impact the growth of the logistics and manufacturing industry. State and local governments cannot build oceans or mountains to attract residents but they sure can adopt tax policy to serve as a beacon for growing industry and the jobs and prosperity they bring. According to the Council of State Taxation 2020 Business Tax Report, local and state government’s tax businesses $833,200,000,000 from a range of activities as outlined in the chart below and the property tax is the prime business tax used across the United States.

Source: 2020 Business Tax Burden, Council of State Taxation

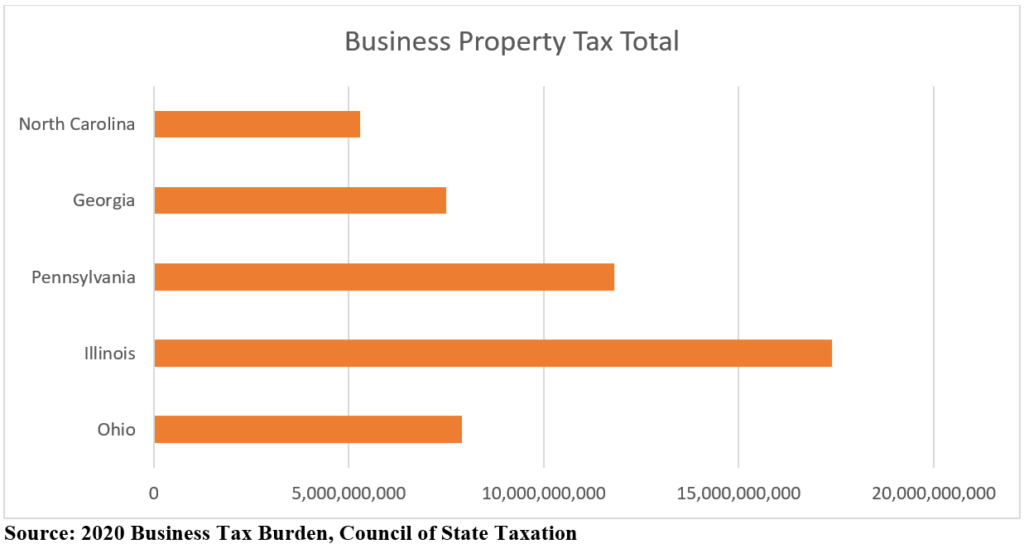

A site’s property taxes directly impact a region’s ability to retain and attract logistics and manufacturing projects. Whether a new build or new capital equipment, logistics and manufacturing facilities are a capital-intensive business that drive up property values and the tax bills. The higher a site’s property tax the more challenging it is to locate new logistics and manufacturing facilities. As the chart below illustrates, the Industrial Midwest has higher property tax rates than their Southern counterparts which is consistent with most other measures when comparing states of similar population and market size. States like Ohio who appear to be close to competitive from a property tax standpoint suffer from the fact that the state and local government tax most other business activities at a higher rate and permit municipal income taxes. Thus, Ohio taxes business nearly $23B while competitors North Carolina taxes business $16.6B and Georgia just over $18B.

To address high business property taxes, a majority of U.S. states permit local governments to adopt property tax abatement programs to provide an economic development incentive for job creation and capital investment for office, residential and industrial development.

The Ohio Enterprise Zone Program permits local governments to provide real and personal property tax exemptions to businesses within designated enterprise zones tied to company job creation and a substantial capital investment with cities and counties able to award abatements up to 75% without school board approval. Ohio Community Reinvestment Area program is administered by municipal and county government that provides real property tax exemptions for property owners who renovate existing or construct new buildings, and those CRAs created before 1994 do not need school board approval for up to a 100% abatement. Communities like Columbus, Ohio have become a logistics leader hosting 83,000 logistics jobs built around three hubs in rural counties just outside of Ohio’s largest city that is home to nearly 1 M people. The Columbus logistics industry was created based upon a Public-Private-Partnership that provides a 100% 15-year property tax abatement of industrial or logistics companies that often includes the use of Tax Increment Financing and Joint Economic Development District and state of Ohio funding for infrastructure development as well as negotiating compensation agreements with local governments and school districts to provide funding through Payments in Lieu of Taxes from the developers to assume companies as well as communities win when jobs are created. The result has put Central Ohio on the logistics map to compete with regions across the Midwest for logistics jobs.

Pennsylvania Local Economic Revitalization Tax Assistance Program (LERTA) allows local taxing authorities to provide real property tax exemptions (10-year exemption) applied to the value of the new construction and the value of the real property improvement for projects involving new construction or which result in improvement to industrial or commercial business property located within a LERTA Zone and approval is required from all local taxing authorities including school districts. North Carolina may exempt machinery, equipment, electricity, fuel and natural gas, raw materials from its sales and use tax and does not levy a property tax on inventories owned by contractors, manufacturers, and merchants. Illinois Enterprise Zone Program awards a mix of state and local tax incentives for reductions in a retailers’ occupation tax, state utility tax, and purchases on personal property used in manufacturing process and local incentives such as Cook County industrial property EZs receives special consideration under the Class 6b – Industrial Program and is generally assessed at 25 percent of market value in the absence of any incentives.

Property tax rates and the ease with which economic development incentive programs can be used for logistics and industrial projects very much will dictate how regions and states will succeed and capitalize on a second Industrial Revolution.