Rising interest rates, bank collapses, and potential additional federal regulation have created substantial challenges for communities and developers hoping to create new housing opportunities. Housing studies, streamlined zoning regulation, and parking subsidies can all help develop housing in urban, suburban, and rural markets but larger public subsidies in the near term are likely to be the key to developing housing in the United States.

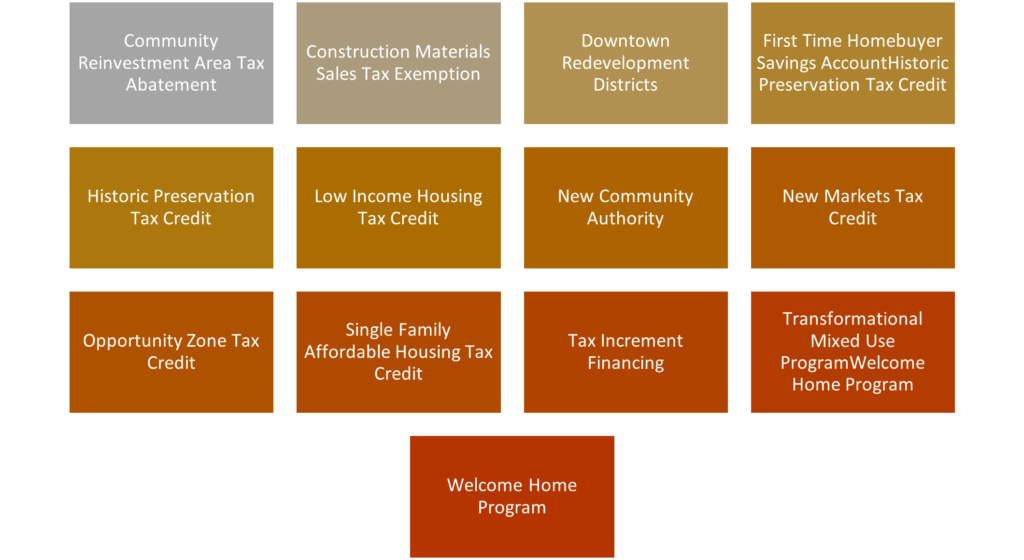

State governments, as implemented often through their local governments, can create a range of economic development incentives designed to spur residential development. Ohio offers 13 tax incentives, public finance tools, and state government grants, loans and tax credits to develop residential projects. These tools range from tax abatements to tax credits to sales tax exemptions to grants and loans to infrastructure funding.

Ohio Housing Economic Development Programs

Community Reinvestment Act Tax Abatements. Ohio law authorizes local governments to provide property tax abatements on new investments up to 100% through the Community Reinvestment Area (CRA) program that does not require local school board approval for districts created before 1994.

Downtown Redevelopment Districts. Ohio’s Downtown Redevelopment District Program permits the capture of up to 70% of the future property tax growth around 10 acres of a historic structure for public infrastructure, historic groups, building renovations, and innovation districts.

New Community Authority (NCA). A new community authority or “NCA” is a special unit of government that permit landowners to create a special assessment known as a Community Development Charge to finance and construct community facilities that include any kind of public improvement within the district and include facilities that are used in furtherance of community activities such as cultural, educational, governmental, recreational, residential, industrial, commercial, distribution, and research activities.

Low Income Housing Tax Credit (LIHTC). Governor DeWine and the General Assembly created a new Low Income Housing Tax Credit. Providing up-to $100 million in FY24-25 for the new Ohio Housing Finance Agency (OHFA) Tax Credit program. The new program is meant to support the construction of new housing projects in the state. Throughout Ohio the need for quality new housing is at an all-time high, development has not been able to keep pace with population and job growth in certain regions, while in others the need to replace outdated housing stock with newer units has hampered the ability to attract and retain people and jobs. This program along with other tools is a step in the right direction to helping to solve what is quickly turning into a crisis that impacts the state’s affordable living environment.

Ohio Single-Family Affordable Housing Tax Credit. Like the Low-Income Housing credit, the new single-family affordable housing credit will allow up to $100 million in available credits each fiscal year for the development and construction of new Single Family Homes.

Ohio First-time Homebuyer Savings Accounts. The operating budget also created a new program to support the growing cost for a first-time homebuyer through the creation of a new tax deduction for saving into a linked0-deposit account designated for the cost of a first-time home buyer. Ohioans who create an account are eligible for a deduction of up to $10,000 per year per account for couples filing jointly and $5,000 per year per account for individuals, with a lifetime maximum per account of $25,000. The budget authorizes, for account owners, an income tax deduction for interest earned on savings in, and employer contributions to, homeownership savings linked deposit accounts.

Welcome Home Ohio Program. The Welcome Home Ohio Program will provide $150 M for the development of single-family homes. The Welcome Home Ohio Program creates a grant program by which land banks may apply for funds to purchase residential property, for sale to income-eligible owner-occupants and creates a grant program by which land banks may apply for funds to rehabilitate or construct residential property, up to $30,000, for income-restricted owner occupancy. Qualifying residential property that benefits from any of the incentives offered by the program must be sold, for $180,000 or less, to an individual, or individuals, with annual income that is no more than 80% of the median income for the county where the property is located. Buyers must also agree, in the purchase agreement, to maintain ownership of the property as a primary residence, not to sell or rent the property at all for five years, and not to sell the property to anyone who does not meet the income requirements for twenty years. Land banks and developers are required to include deed restrictions with these requirements when selling property that benefits from the Ohio Welcome Home Program, and the act grants ODOD the authority and standing to sue to enforce those requirements. The buyer must annually certify to ODOD, during the five-year period following their purchase of the property, that the buyer still owns and occupies the property and has not rented it to another individual for use as a residence. The Ohio Welcome Home Program also authorizes up to $25.0 million in tax credits in each of FY 2024 and FY 2025 for the rehabilitation or construction of income-restricted and owner-occupied residential property. The tax credits are nonrefundable tax credits against the income tax and financial institutions tax. Credits equal the lesser of one-third of the cost of construction or rehabilitation or $90,000 per qualified residential property.

Transformational Mixed Use Development Program. $100 M Premium Tax Credit Program to support mixed-use development in rural and urban centers with 80% of the funding going to major cities of over 100,000 residents and the other 20% to non-major cities. These tax credits can cover up to 10% of development costs and awards are driven by a substantial Return on Investment criteria through a highly competitive Ohio Department of Development annual award process.

Ohio Historic Preservation Tax Credits. The Ohio Department of Development awards twice annually Ohio Historic Tax Credits for designated historic properties (structures 50 years or older) that can provide direct building funding for historically consistent remodeling costs. State Historic Preservation Tax Credits are awarded twice annually and provide a state tax credit of up to 25% of qualified rehabilitation expenditures incurred during a rehabilitation project, up to $5 million.

Ohio New Markets Tax Credit Program. The Ohio New Markets Tax Credit Program awards tax credit allocation authority to Community Development Entities (CDE) serving Ohio that serves as an intermediary between investors and projects. Ohio offers $10 million in tax credit allocation authority is available to CDEs each year.

Ohio Opportunity Zone Tax Credit. The Ohio Opportunity Zone Tax Credit Program provides an incentive for Taxpayers to invest in projects in economically distressed areas known as “Ohio Opportunity Zones”. If an Ohio taxpayer invests cash in the Ohio Qualified Opportunity Fund, which in turn must invest that money in an Ohio Qualified Opportunity Zone property in Ohio, the Taxpayer is eligible for a non-refundable tax credit equal to 10% of the number of its funds invested.

Sales Tax Exemption. Ohio port authorities are permitted to offer a sales tax exemption on construction materials used for economic development projects through a sales-lease back agreement that typically lasts for five years.

Tax Increment Financing. Ohio’s Tax Increment Financing (TIF) Program funds public infrastructure through the capture of future property tax growth of a defined district or site that may include residential development. An Ohio local political jurisdiction may exempt from real property taxes the value of private improvements up to 75 percent for a term of up to 10 years for a General Purpose TIF. Local governmental bodies seeking to offer greater amounts of assistance under the TIF must first obtain the concurrence of the affected local board(s) of education.

lease contact Dave Robinson, Principal of the Montrose Group, at [email protected] if you need assistance with any housing or other corporate site location matter.