The Ohio General Assembly has started the process to gain input from community leaders on what state of Ohio capital budget community projects and the newly created Community Investment Fund should be proposed for planned legislation.

A lot like the state operating budget, the state capital budget is passed every 2 years, in the second year of the General Assembly. The capital budget is legislation where the State of Ohio appropriates resources to state owned infrastructure as well as other government purpose projects called community projects. Community projects make up roughly $150M-$180M of the on-average $2 billion capital budget, but these appropriations generate the biggest focus from the legislature. The Ohio capital budget bill funds “community projects” that are arts, cultural, historical, theater, sports stadiums, workforce, technology, fiber rings, parks, swimming pools, R&D, museums, sculptures, zoos, community centers, trails, presidential centers and other local projects with grants ranging from $100,000 to over $5,000,000 for projects that are “capital in nature” and have existed since the late 1980s/early 1990s.

Community Investment Fund is a completely new animal. When the General Assembly could not agree whether to keep an unusually large number of earmarks in the state operating budget last year, a $750 M Community Investment Fund was the result. Unlike the state of Ohio capital budget community projects, Community Investment Fund projects do not have to be “bondable” or have a connection to state government but they should be larger in scale and scope. The larger amount of money available for the Community Investment Fund also illustrates the substantial opportunities for public and private sector projects all over Ohio.

What the state capital budget community project and Community Investment Fund do have in common is that they are both state legislation. Local communities and business leaders are likely to have input into what is funded but the decision what to fund is up to the 132 members of the Ohio General Assembly and Governor Mike DeWine. This means that these two funding sources that could fund nearly $1 B in community projects is a lobbying project.

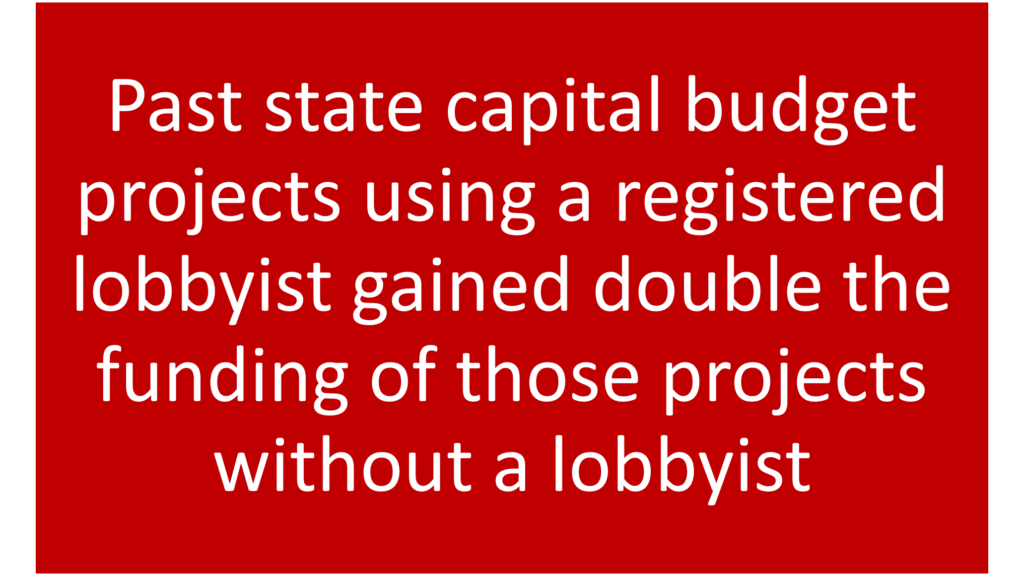

Engaging a registered lobbyist lends professional guidance and increases the likelihood of success for many matters before the local, state and federal government. State of Ohio capital budget community project and Community Investment Fund requests clearly benefit from the help of registered lobbyist who are familiar with what projects qualify for the capital budget as well as bringing established relationships with state government officials that all help gain additional funding for capital budget community projects. In fact, Montrose Group’s review of the previous state of Ohio capital budget identifies that 71 Community Projects benefited from registered state of Ohio lobbyist support gaining $57 M in funding.

The Ohio House and Ohio Senate have released their guidance for the upcoming Ohio Capital Budget and Community Investment fund process and timelines, and two separate deadlines have been established for the state capital budget and Community Investment Fund applications. The Ohio House has set Monday December 18, 2023, as the deadline to submit projects to the House using the attached project worksheet as the basis for the submission. The Ohio Senate has set a different timeline and schedule for project submission to later in the spring with project request due to the Senate by Monday, April 8, 2024. Leadership of the Montrose Group has successfully advocated on and been engaged in state of Ohio capital budget and projects similar to the Community Investment Fund since the 1990s. Please contact Tim Biggam at [email protected] if you have any questions or need assistance with state of Ohio capital budget community project and/or Community Investment Fund projects.