The Ohio Development Services Agency recently launched the $25 M Rural Industrial Park Loan Program to promote economic development in eligible rural areas by providing low-interest direct loans to assist public and private sector organizations in financing the development and improvement of industrial parks and related off-site public infrastructure improvements in 35 of Ohio’s 88 counties that include: Adams; Ashtabula; Athens; Belmont; Brown; Carroll; Columbiana; Coshocton; Crawford; Fayette; Hardin; Gallia; Guernsey; Harrison; Highland; Hocking; Huron; Jackson; Jefferson; Lawrence; Morgan; Muskingum; Marion; Meigs; Monroe; Noble; Ottawa; Perry; Pike; Richland; Ross; Scioto; Seneca; Vinton; and Washington;. These rural Ohio counties are primed for economic growth but lack adequate sites prepared for economic development.

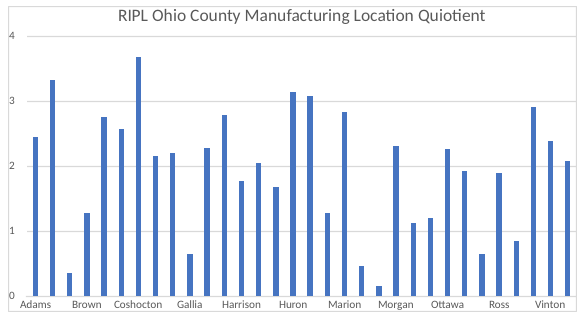

From a corporate site location analysis perspective, rural Ohio is primed for economic growth in the industrial sector. Measuring industry concentration in an area illustrates industry strengths. This is measured by a review of the industry cluster and location quotient for the success of these clusters. An industry cluster is comprised of a geographic concentration of firms within an industry. Location quotient is an indicator of the economic concentration of a certain industry in a state, region, county or city compared to a base economy, such as a state or nation. A location quotient greater than 1 indicates a concentration of that industry in the area. A location quotient greater than 1 typically indicates an industry that is export oriented. An industry with a location quotient of 1 with a high number of jobs present is likely a big exporter and is bringing economic value to the community feeding the retail trade and food services sectors. The location quotient is an indicator of past success but is also a harbinger of future success.

Ohio is a global manufacturing leader with over 15,000 manufacturing companies and over 700,000 manufacturing workers and the state has a manufacturing location quotient of 1.52—well above the national average of 1.0. The 35 rural counties eligible for RIPL are also industrial success stories as the table above illustrates. Other than outliers such as Athens County which is home to Ohio University and a number of smaller Appalachian counties, the majority of the RIPL counties are powerhouses for manufacturing with manufacturing industry cluster location quotients well over the national average and, in the case of several counties, double and triple the national average.

The population of the 35 Ohio counties eligible for the Rural Industrial Loan Program totals over 1.5 M. These rural counties if a state would be just behind Idaho and just ahead of Hawaii as the 41st largest state in the union. Census data indicates the region has over 400,000 workers.

Ohio RILP County v. United States Demographic Comparison

| Fact | Ohio RILP County Totals | United States |

| Persons 65 years and over | 19.40% | 16.00% |

| Homeownership Rate | 72.40% | 63.80% |

| Median Home Value | $103,251.52 | $193,500 |

| Median Gross Residential Rent | $643 | $982 |

| High School Graduation Rate | 86.70% | 87.30% |

| Bachelor’s Degree or Higher | 14.70% | 30.90% |

| Civilian Labor Participation Rate | 55.60% | 63.00% |

| Average Commute Time | 26.7 | 26.4 |

| Median Household Income | $44,649 | $57,652 |

| Per Capita Income | $23,272 | $31,177 |

| Poverty Rate | 16.40% | 11.80% |

The table above illustrates how Ohio’s Rural Industrial Loan Program eligible county’s compare on a demographic standpoint with the United States. On average, these rural communities, like most other rural communities in the United States, have an older population, higher homeownership rates and more affordable housing costs matched by lower income and higher poverty rates than the U.S. average. Commute times meet national averages due to the longer drive many rural workers will make for work in counties outside their residence. Civilian labor participation rates are substantially lower in Ohio’s RILP counties illustrates there are unemployed and underemployed waiting for skills training and are available for work.

The regional economic development group Appalachian Partnership for Economic Growth (APEG) believes the Southeastern Ohio RILP counties, which constitutes the majority of the list, are ready for industrial development based upon the fact that 98,000 workers from Southeastern Ohio driving outside the region to metro areas every day––an available work force as many of those workers would prefer to work closer to home, site work that is underway for an $8-billion petrochemical plant and over $2 billion in gas fired power plants currently under construction, numerous ready sites that have been developed like Dan Evans, Leesburg, Logan Hocking, and South Central with sample buildings like Nier and Jackson buildings, and major recent project wins like AMG Vanadium, Kenworth Truck Company, QuickLoadz, United Candle and Global Cooling. APEG also notes there are large sites capable of landing big projects like NS Haverhill and the National Road Business Park.

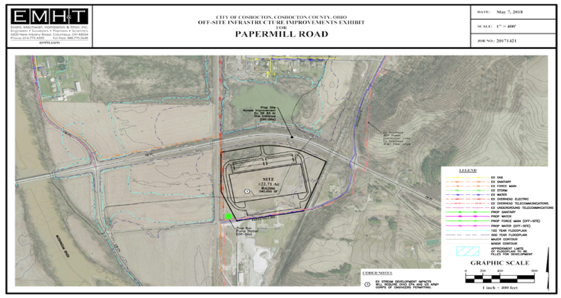

The Montrose Group worked with Coshocton County to prepare site development plans for targeted sites in this RIPL county which should give them a leg up in gaining financing for the needed infrastructure at several sites in this rural community.

Crawford County, Ohio is going through a similar process for site development with the Montrose Group, but their projects will be even more attractive as they are located in federally certified Opportunity Zones. Ohio’s RIPL counties are ready for manufacturing and R&D investments primed by a new sources of state funding.

Several Ohio RIPL counties also benefit from recent discovery of oil and natural gas as part of the Marcellus and Utica shale deposits. Many of these same Ohio counties with direct access to reliable and affordable energy are primed for energy-intensive company growth with site development funding from the RIPL. Eastern Ohio is a prime location for manufacturers, energy producers and petrochemical companies that consume natural gas or natural gas liquids (NGLs) for fuel or feedstock. Over $30 billion in capital investment tied to shale has been announced in Ohio. Since 2012, 85% of natural gas production growth has come from the prolific Utica and Marcellus shales in western Pennsylvania, eastern Ohio and northern West Virginia.