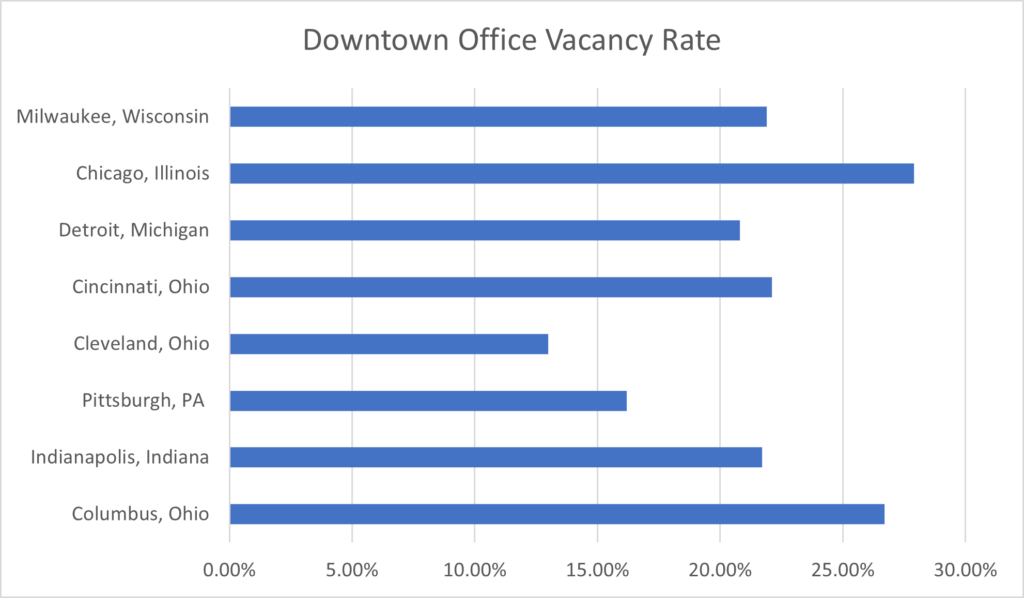

The urban Downtown office market is facing a crisis which is only going to get worse. The Downtown office vacancy rates from Cushman and Wakefield’s 2023 analysis as outlined in the chart below in the major urban markets throughout the Great Lakes illustrate substantial struggles with the current Downtown office markets. This data is of more concern when looking at the number of tenants attempting to sublease their current space—which is very high across the United States. It is clear the U.S. Downtown office market is not in good shape and is going to get worse as many companies will not renew Downtown office leases and seek much smaller spaces.

Source: Cushman & Wakefield

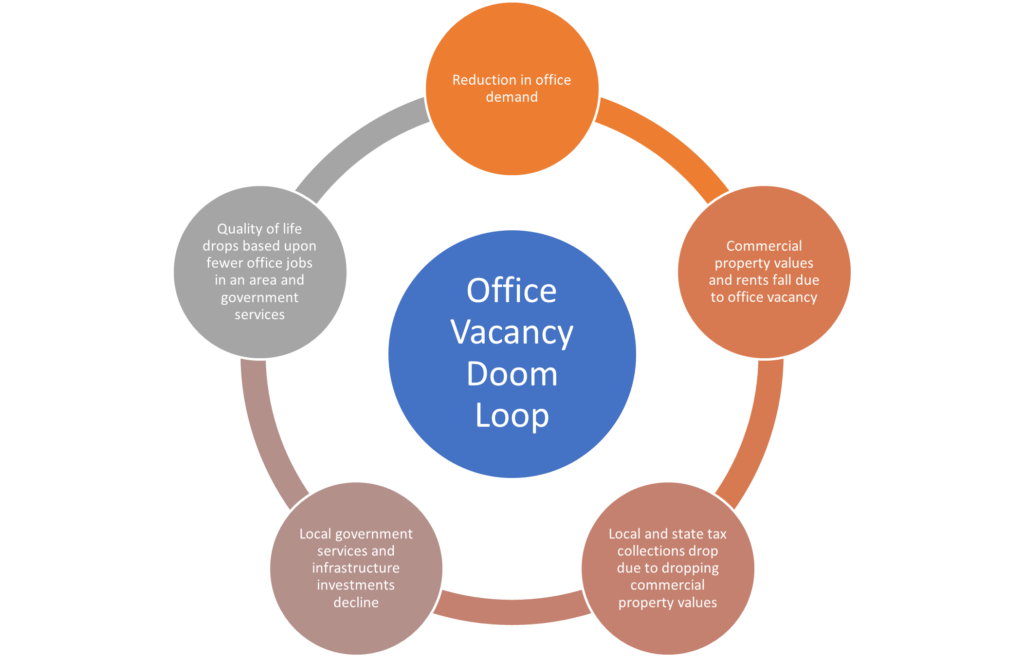

This high office vacancy rate may well trigger a “Doom Loop” in urban and suburban Central Business District and suburban office parks respectively. A “Doom Loop” is a downward economic spiral triggered by remote work, which makes office towers less valuable and results in reduced city tax revenues which begins a domino effect in which workers who no longer need to live in a city leave for cheaper housing, causing retail businesses to shutter and city services such as police and utilities are reduced by the cash-strapped municipality, causing even more residents to leave the downtown core.

Rents in urban centers are falling as well. A Columbia University study for the National Bureau of Economic Research found that central city rents have been in a decline. The relationship between rent growth and distance from the city center is steeply upward sloping with rents declining sharply near the center and growing rapidly far away from the center. The same pattern holds for prices. Office valuation is another series of concerns. A recent paper suggested that in New York City alone, office value destruction could total $453 billion and that values could remain around 45% below pre-pandemic levels in the long run driven by the office vacancy rate expansion.

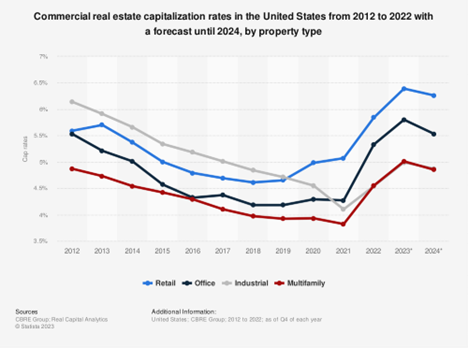

The timing of debt due on U.S. office buildings also spells challenges coming. $1.5 trillion in commercial real estate debt owed before the end of 2025. Also, commercial real estate capitalization rates are going through the roof. Capitalization rates are an indication of return and risk, and higher cap rates have a higher return, but they also have a higher risk due to higher interest rates.

2024 will not see improvement in the “Doom Loop” challenge. In fact, the “Doom Loop” will likely worsen in 2024. COVID-19, and Artificial Intelligence (AI) all spell the launch of urban doom loops in Downtown urban markets across the United States. COVID-19 continues to provide a substantial hangover for the U.S. economy—that is devasting the U.S. office market. Forbes reported that 12.7% of full-time employees work from home, while 28.2% work at a hybrid model. Currently, 12.7% of full-time employees work from home, illustrating the rapid normalization of remote work environments. Simultaneously, a significant 28.2% of employees have adapted to a hybrid work model. Researchers from Ladders have been carefully tracking remote work availability from North America’s largest 50,000 employers since the pandemic began. Remote opportunities leaped from under 4% of all high-paying jobs before the pandemic to about 9% at the end of 2020, and to more than 15% today. AI is going to impact the U.S. office market as well. AI is going to be the next great disruption of the global economy. Just as automation disrupts the global manufacturing industry, AI is going to disrupt the advanced services or white-collar industries. A Pew Research study found that workers with a bachelor’s degree or more (27%) are more than twice as likely as those with a high school diploma only (12%) to see the most exposure. Jobs are considered more exposed to artificial intelligence if AI can either perform their most important activities entirely or help with them. AI could well replace the tasks of “getting information” and “analyzing data or information,” or it could help with “working with computers.” These are also among the key tasks for lawyers, software engineers, accountants, customer service representatives, and other white-collar workers—all these occupations currently fill many global offices. AI will likely create more jobs than it eliminates but in the near term, AI will have a negative impact on urban office markets.