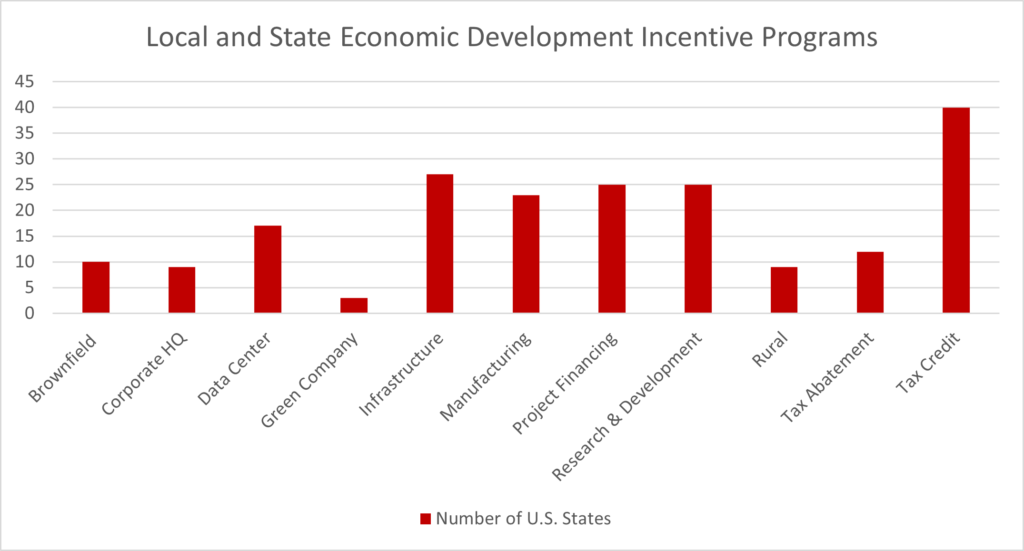

To address the regional cost of doing business factors, all fifty states offer some form of economic development incentives. As the chart below outlines, infrastructure incentives are provided by all the states in the union followed by tax credits as the second most popular tax incentive program in the nation with efforts to attract data centers and using general tax abatements tying for third. Princeton Economics estimates that state and local governments invest about $30 B dollars in economic development incentives annually.

Montrose Group has a 50 state economic development incentive guide that can be found at https://montrosegroupllc.com/50-state-incentive-guide/. Rather than do a cursory review of 50 states worth of economic development incentives, let’s do a deeper economic development incentive guide for the states of Indiana, Kentucky and Ohio.

Indiana, Kentucky and Ohio offer a wide range of economic development incentives, but Ohio has a much larger range of economic development incentives and JobsOhio private sector model funded by state liquor profits creates a sizable economic development budget advantage.