Agriculture, food, and related industries contributed $1.109 trillion to the U.S. GDP in 2019, a 5.2-percent share, and, the output of America’s farms contributed $136.1 billion of this sum—about 0.6 percent of GDP.[i] The overall contribution of agriculture to GDP is actually larger than 0.6 percent because sectors related to agriculture rely on agricultural inputs in order to contribute added value to the economy.[ii] Sectors related to agriculture include: food and beverage manufacturing; food and beverage stores; food services and eating and drinking places; textiles, apparel, and leather products; and forestry and fishing.[iii]

The global indoor farming market size was valued at USD 26.8 billion in 2018 and is expected to expand at a CAGR of 9.19% from 2019 to 2025.[iv] Increasing consumer awareness regarding the advantages of consuming fresh and high-quality food and the expansion of medical marijuana and the legalization of marijuana across the United States with regulatory requirements about where this crop is grown.[v] A University of Missouri report found, based on the average production and the distribution of growers—indoor and outdoor— in Colorado, states like Missouri who recently adopted a medical marijuana law will need between 10 and 14 cultivators in 2020, 18 to 24 cultivators in 2021, and 24 to 29 cultivators in 2022, and, based on the growth of qualified patients over time, Missouri will support 85 infused-product manufacturers, perhaps in the first year of medical marijuana sales.

Many governments are encouraging indoor agriculture as a way to deal with changing climatic conditions impacting soil degradation and groundwater depletion, affecting the food and agriculture production systems.[vi] Also, development is overtaking traditional farmland and encouraging vertical farming.[vii] The World Bank Group estimates the overall arable land per capita has declined from 0.197 hectares in 2013 to 0.192 hectares in 2016.[viii] Indoor farms grow the total crop yield per unit area by using the stacked layers of potted seeds and these facilities are in small and large scale, use farming implements methods such as aquaponics and hydroponics and utilizes artificial lighting for adequate light levels and nutrients. [ix] However, initial capital and energy costs need to be factored in when considering the overall economic benefit of an indoor agriculture corporate site location project.[x] Greenhouses are the prime indoor agriculture facility taking up 70% of the market in 2018.[xi]

The vertical farm segment is expected to exhibit the fastest CAGR of over 18% from 2019 to 2025, owing to the growing adoption of environmentally friendly production of fruits and vegetables and higher demand for locally grown and organic food.[xii] Indoor agriculture facilities require hardware and software to control the climate, lighting, sensors, and irrigation.[xiii]

The fruits, vegetables, and herbs segment dominated the market for indoor farming and is estimated to continue leading over the forecast period but the flowers and ornamentals segment is expected to contribute significantly to market growth over the forecast period with a more than 25% market share.

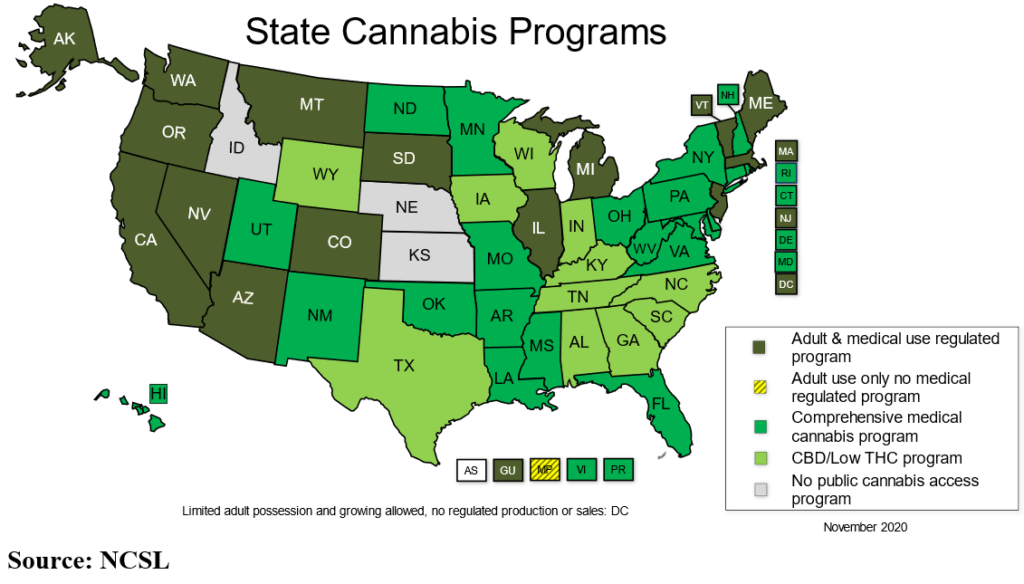

The growth in indoor agriculture is tied directly to the expansion of state’s that permit the use of marijuana for medical or recreational use. According to the National Council of State Legislators, California voters passed Proposition 215 in 1996, making the Golden State the first in the union to allow for the medical use of marijuana. Since then, 35 more states, the District of Columbia, Guam, Puerto Rico, and U.S. Virgin Islands have enacted similar laws. As of November 4, 2020, voters in Mississippi and South Dakota approved a measure to regulate cannabis for medical use, bringing the total to 36 states and 4 territories, and voters in Arizona, Montana, New Jersey, and South Dakota approved measures to regulate cannabis for adult-use. This brings the total to 15 states and 3 territories.A total of 36 states, District of Columbia, Guam, Puerto Rico, and U.S. Virgin Islands have approved comprehensive, publicly available medical marijuana/cannabis programs. The map below illustrates the status of state marijuana laws.

State public policy decisions clearly impact regional opportunities for indoor agriculture projects tied to the marijuana industry.