Indiana Economic Development Incentives

- Indiana’s Economic Development for a Growing Economy Tax Credit provides an incentive to businesses to support job creation, capital investment and to improve the standard of living for Indiana residents that is a refundable corporate income tax credit is calculated as a percentage (not to exceed 100%) of the expected increased tax withholdings generated from new job creation for up to 10 years.

- Indiana’s Hoosier Business Investment Tax Credit provides an incentive to businesses to support job creation, and capital investment with a non-refundable corporate income tax credits are calculated as a percentage of the eligible capital investment to support the project.

- Indiana’s Redevelopment Tax Credit provides an incentive for investment in the redevelopment of vacant land and buildings as well as brownfields that provides companies and developers with an assignable income tax credit for investing in the redevelopment of communities, improving the quality of the place, and building capacity at the local level.

- Indiana’s Skills Enhancement Fund – aids companies to support the training of employees required to support business growth in Indiana.

- Indiana’s Headquarters Relocation Tax Credit provides a tax credit to corporations that relocate their headquarters to Indiana. The credit is assessed against the corporation’s state tax liability.

- Indiana’s Small Headquarters Relocation Tax Credit provides a refundable tax credit to a small, high-growth business that relocates its headquarters or the number of employees that equals 80% of the company’s total payroll to Indiana. The credit is assessed against the corporation’s state tax liability.

- Indiana’s Research & Development Sales Tax Exemption provides a 100 percent sales tax exemption for qualified research and development equipment and property purchased.

- Indiana’s Patent Income Tax Exemption provides that a taxpayer may not claim an exemption for income derived from a particular patent for more than ten taxable years, and the exemption percentage begins at 50 percent of income derived from a qualified patent for each of the first five taxable years and decreases over the next five taxable years to 10 percent in the 10th taxable year.

- Indiana’s Data Center Gross Retail and Use Tax Exemption provides a sale and use tax exemption on purchases of qualifying data center equipment and energy to operators of a qualified data center for a period not to exceed 25 years for data center investments of less than $750 million.

- Indiana’s Regional Economic Acceleration and Development Initiative provides $500M to its 17 regions to fund transformative projects including redevelopment and infrastructure.

- Indiana’s Community Revitalization Enhancement District Tax Credit provides an incentive for investment in community revitalization enhancement districts for taxpayers that make qualified investments for the redevelopment or rehabilitation of property located within a revitalization district that create a positive return on investment.

- Indiana’s TIF program captures future property taxes can be captured to fund public infrastructure through a fiscal body creates redevelopment commissions which makes a declaration of public, a finding and prepares the plan, approves the declaratory resolution and the plan at a public hearing with the adoption of a confirmatory resolution establishing a redevelopment project area by the legislative unit.

- Indiana’s Industrial Grant Fund aids municipalities and other eligible entities as defined under I.C. 5-28-25-1 with off-site infrastructure improvements needed to serve the proposed project site. Upon review and approval of the Local Recipient’s application, project-specific Milestones are established for completing the improvements. IDGF will reimburse a portion of the actual total cost of the infrastructure improvements.

- Indiana’s Venture Capital Investment Tax Credit: Provides individual and corporate investors a credit against their Indiana tax liability for investments in early-stage companies.

Kentucky Economic Development Incentives

- Kentucky’s Business Investment Program provides income tax credits and wage assessments to new and existing agribusinesses, headquarters operations, manufacturing companies, coal severing and processing companies, hospital operations, alternative fuel, gasification, energy-efficient alternative fuels, renewable energy production companies, carbon dioxide transmission pipelines and non-retail service or technology related companies that locate or expand operations in Kentucky. Projects located in certain counties may qualify for enhanced incentives.

- Kentucky’s Enterprise Initiative Act is for new or expanded companies engaged in manufacturing, non-retail service or technology activities, agribusiness, headquarters operations, coal severing and processing, hospital operations, alternative fuel, gasification, energy-efficient alternative fuels, renewable energy production companies, carbon dioxide transmission pipelines, or tourism attraction projects in Kentucky provides a refund of Kentucky sales and use tax paid by approved companies for building and construction materials permanently incorporated as an improvement to real property, and for eligible equipment used for research and development, data processing equipment or flight simulation equipment.

- Bluegrass State’s Skills Corporation Skills Training Investment Credit Provides credit against Kentucky income tax to existing businesses that sponsor occupational, or skills upgrades through workforce development training programs for the benefit of their employees.

- Kentucky’s Direct Loan Program provides loans at below-market interest rates (subject to the availability of state revolving loan funds) for fixed asset financing for agribusiness, tourism, industrial ventures, or the service industry, but retail projects are not eligible.

- Kentucky’s Reinvestment Act provides tax credits to existing Kentucky companies engaged in manufacturing, agribusiness, non-retail service or technology activities, headquarters operations, hospital operations, coal severing and processing, alternative fuel, gasification, energy-efficient alternative fuels, renewable energy, or carbon dioxide transmission pipelines on a permanent basis for a reasonable period of time that will be investing in eligible equipment and related costs of at least $2,500,000 for owned facilities and $1,000,000 for lease.

- Kentucky’s Tax Increment Financing is an economic development tool to use future gains in taxes to finance the current public infrastructure improvements for development that will create those gains.

- Kentucky’s SBIR-STTR Matching Funds Program matches federal awards to Kentucky-based small businesses, with up to $150,000 for Phase 1 and up to $500,000 for Phase 2 awards to foster high-tech innovation.

- Kentucky’s Small Business Credit Initiative reduces lending risks for financial institutions, enabling loans for small businesses that may not meet traditional lending standards.

- Kentucky’s Angel Investment Tax Credit provides up to a 40% tax credit for investments in Kentucky-based small businesses, promoting early-stage company growth.

- Kentucky’s Small Business Loan Program offers loans ranging from $15,000 to $100,000 for small businesses in manufacturing, agribusiness, and service/technology sectors, with a job creation requirement.

- Kentucky’s Investment Fund Act offers tax credits to investors in venture capital funds that support small businesses within Kentucky.

- Commonwealth Seed Capital provides debt or equity investments in early-stage businesses to commercialize innovative ideas and technologies.

Ohio Economic Development Incentives.

Ohio offers a wide range of economic development incentives at the local and state government level as listed below.

Ohio Economic Development Incentive Programs

- Jobs Ohio’s Economic Development Grant promotes development, business expansion, and job creation by providing funding for eligible projects in the State of Ohio

- Jobs Ohio’s Workforce Grant provides workforce development grants for companies creating and retaining jobs and in need of training of employees within a specified period.

- JobsOhio’s Growth Fund Loan provides capital for expansion projects to companies that have limited access to capital and funding from conventional, private sources of financing. JobsOhio will consider loans to companies that are in the growth, established or expansion.

- Ohio’s Community Reinvestment Area program is an economic development tool administered by municipal and county governments that provides real property tax exemptions for property owners who renovate existing or construct new buildings.

- Ohio’s Data Center Tax Abatement provides a sales-tax exemption rate and term that allow for partial or full sales-tax exemption on the purchase of eligible data center equipment. Projects must meet minimum investment and payroll thresholds to be eligible.

- Ohio’s Enterprise Zone Program is an economic development tool administered by municipal and county governments that provides real and personal property tax exemptions to businesses making investments in Ohio.

- Ohio’s Job Creation Tax Credit is a refundable and performance-based tax credit calculated as a percent of created payroll and applied toward the company’s commercial activity tax liability awarded to companies creating at least 10 jobs (within three years) with a minimum annual payroll of $660,000 and that pay at least 150 percent of the federal minimum wage and final approval from the Ohio Tax Credit Authority is required.

- Ohio’s Mega Site program is designed to attract large-scale industrial, headquarters, office, and research and development projects for high-wage jobs for projects at least $1 B in fixed asset investment and $75 M in payroll are eligible to receive double the term for local tax abatements and the Ohio JCTC.

- Ohio’s Municipal Job Creation Tax Credit provides an income tax credit tied to the provision of agreed-upon high-wage jobs and capital investment in various Ohio cities.

- Ohio’s Roadwork Development funds are available for public roadway improvements, including engineering and design costs. Funds are available for projects primarily involving manufacturing, research and development, high technology, corporate headquarters, and distribution activity.

- Ohio’s Tax Increment Financing is an economic development mechanism available to local governments in Ohio to finance public infrastructure improvements and, in certain circumstances, residential rehabilitation.

- Ohio’s Construction Materials Sales Tax Exemption program permits Ohio port authorities to offer a sales tax exemption on construction materials used for economic development projects.

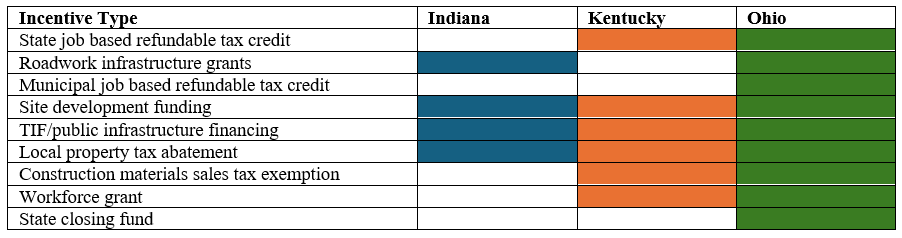

Indiana, Kentucky and Ohio all offer substantial economic development incentives covering many costs centers for a corporate site location analysis; however, Ohio as a larger state with a well-funded private state economic development corporation likely has more resources available daily for economic development and corporate site location projects.