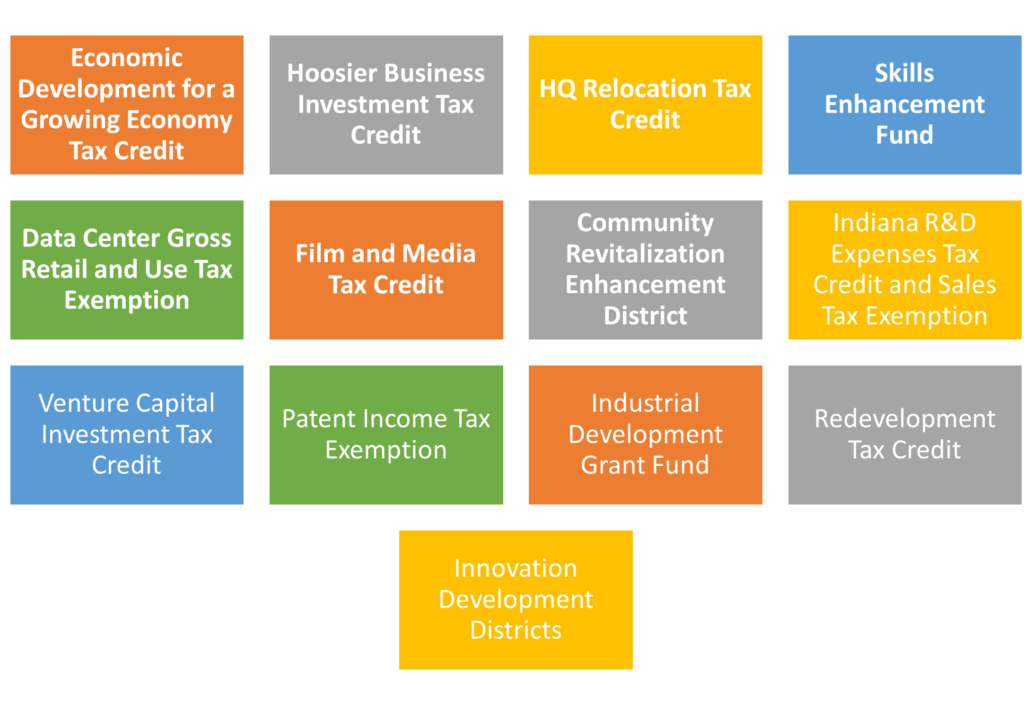

The Indiana Economic Development Corporation (IEDC) leads the state’s economic development effort, and a wide range of state economic development incentives are provided for job creation and business investment, redevelopment and quality of place, innovation and entrepreneurship, research, and development, site development and skills training, including the following incentive programs:

- Economic Development for a Growing Economy (EDGE) Tax Credit provides a refundable tax credit to businesses that create new jobs that improve the standard of living for Indiana residents. The credit certification is phased in annually for up to 20 years based on the employment ramp-up outlined by the business.

- Economic Development for a Growing Economy Non-Resident (EDGE-NR) Tax Credit provides a nonrefundable tax credit to businesses that create new jobs that are filled by residents from another state. The credit certification is phased in annually for up to 20 years based on the employment ramp-up outlined by the business.

- Hoosier Business Investment (HBI) Tax Credit provides incentives to businesses to support job creation and capital investment and to improve the standard of living for Indiana residents. The nonrefundable corporate income tax credits are calculated as a percentage of the eligible capital investment to support the project. The credit may be certified annually, based on the phase-in of eligible capital investment, over a period of two full calendar years from the commencement of the project.

- Innovation Development Districts are an IEDC-designated allocation area that captures certain incremental taxes from the district. Funds collected from the district may be used for economic development, infrastructure upgrades, or the training of employees within the designated area.

- Film and Media Tax Credit provides an income tax credit of up to 30% of the qualified expenditures for projects that are filmed or recorded in Indiana. The credit is applicable to feature-length films, television series, music productions, or media productions that are intended for reasonable commercial release.

- Headquarters Relocation Tax Credit (HQRTC) provides a non-refundable tax credit to a business that relocates its headquarters to Indiana. The credit is assessed against the corporation’s state tax liability.

- Small Headquarters Relocation Tax Credit (SHQRTC) provides a refundable tax credit to a small, high-growth business that relocates its headquarters or several employees equal to 80% of the company’s total payroll to Indiana. The credit is assessed against the corporation’s state tax liability.

- Community Revitalization Enhancement District (CRED) Tax Credit provides an incentive for investment in community revitalization enhancement districts.

- Redevelopment Tax Credit (RTC) provides an incentive for investment in the redevelopment of vacant or underutilized land in Indiana. Qualified projects are eligible to receive a tax credit of up to 30%; however, if the project is in an Opportunity Zone or qualifies for a New Markets Tax Credit, an additional 5% may be awarded.

- Industrial Development Grant Fund (IDGF) aids municipalities and other eligible entities with off-site infrastructure improvements needed to serve the proposed project site. Upon review and approval of a local recipient’s application, project-specific milestones are established for completing the improvements. IDGF will reimburse a portion of the actual total cost of the infrastructure improvements. The grant will be paid as each milestone is achieved, with the final payment upon completion of the last milestone of the infrastructure project.

- Data Center Gross Retail and Use Tax Exemption provides a sales and use tax exemption on purchases of qualifying data center equipment and energy to operators of a qualified data center for a period not to exceed 25 years for data center investments of less than $750 million. If the investment exceeds $750 million, the IEDC may award an exemption for up to 50 years.

- Patent Income Tax Exemption Certain income derived from qualified patents and earned by a taxpayer is exempt from taxation. The Tax Exemption for Patent-derived Income defines qualified patents to include only utility patents and plant patents. The total amount of exemptions claimed by a taxpayer in a taxable year may not exceed $5 million. The exemption provides that a taxpayer may not claim an exemption for income derived from a particular patent for more than 10 taxable years. The exemption percentage begins at 50 percent of income derived from a qualified patent for each of the first five taxable years and decreases over the next five taxable years to 10 percent in the 10th taxable year. It also specifies that a taxpayer is eligible to claim the exemption only if the taxpayer is domiciled in Indiana and is either an individual or corporation with not more than 500 employees including employees in the individual’s or corporation’s affiliates or is a nonprofit organization or corporation.

- Venture Capital Investment (VCI) Tax Credit program provides a non-refundable tax credit to individuals or corporate investors who provide qualified debt or equity capital to Indiana companies, improving access to capital for fast-growing Indiana companies. A VCI tax credit certified for an investment made after July 1, 2020, may be assigned to another taxpayer.

- Research and Expense Credits make a taxpayer potentially eligible for a credit on qualified research expenses. The potential value of the credit is equal to the taxpayer’s qualified research expense for the taxable year, minus the base period amount of up to $1 million, multiplied by 15%. A credit of up to 10% is applied to any excess of qualified research expense over a base period amount greater than $1 million.

- Research and Development Sales Tax Exemption provides a 100% sales tax exemption for qualified research and development equipment and property purchased. Taxpayers may file a claim for a refund for sales tax paid on such a retail transaction should they not purchase it exempt from sales tax at the time of the actual transaction.

- Skills Enhancement Fund (SEF) aids companies to support the training of employees required to support business growth in Indiana. The grant may be provided to reimburse a portion (typically 50%) of eligible training costs over a period of two full calendar years from the commencement of the project, and SEF grants may only support training that leads to a post-secondary or nationally recognized industry credential or is specialized company training. If the training is provided to an existing employee, the company must also provide an increase in wages. Specialized company training should meet the applicable industry standard or be administered by a third party.

The state of Indiana offers a wide range of economic development incentives for companies considering a corporate site location project.