Housing will see a rise as a major policy issue in 2024 as rising interest rates impact the development of housing that has struggled to keep pace with increasing economic investment. The availability of housing impacts a company’s decision to grow as a 1.5% drop-in US labor participation rate after COVID is making the recruitment of workers an even tougher task, and residential building permits remain below 2005 levels illustrating a housing shortage nationally. No housing for a limited pool of workers does not spell good news for communities seeking to retain or attract employers.

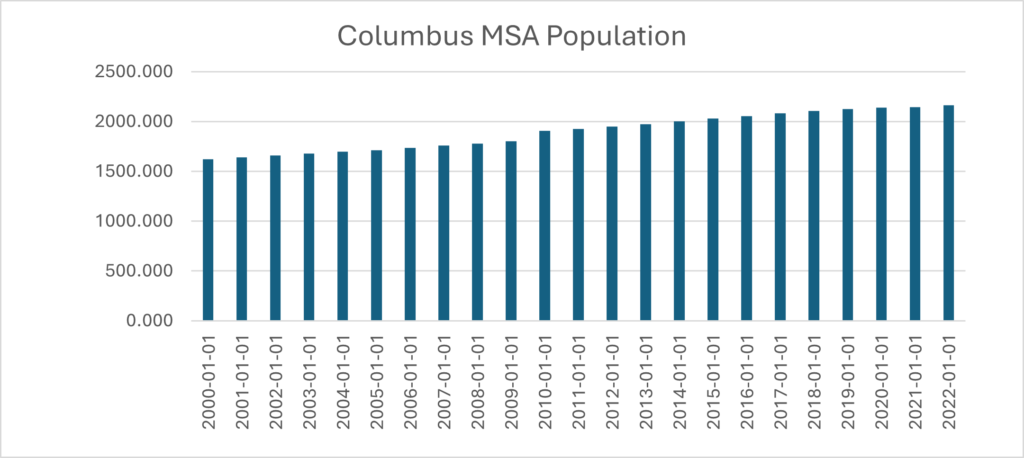

Benchmarking the challenges and opportunities in Ohio offers an illustration of why housing will be a hot policy topic in 2024. Central Ohio is driving Ohio’s economic growth but not keeping up with Southern competitors and their population growth has slowed in recent years due to a lack of housing supply. Central Ohio’s population grew by 17.4% over the last decade but is behind Austin at 40%, Indianapolis at 21%, Charlotte at 56% and Nashville at 28% and has slowed to growth of 1% annually over the last three years based upon a lack of housing. However, Ohio’s population only grew 1.89% compared to nearly 20% for Texas, 10% for Tennessee and 11% for North Carolina. Ohio’s GDP growth over the last decade is over 10% behind Tennessee, North Carolina, and Texas. From a demographic and economic standpoint, Ohio is growing but battling Southern states for economic supremacy.

Of greater concern is that Ohio is not meeting the current housing demand. Central Ohio needs 18,000 new residential permits but is only creating 13,000 permits annually driving up housing costs with listing price increases higher than Austin, Nashville, and Charlotte. Rural Ohio counties are experiencing a -2.4% population decline creating challenges in recruiting housing developers even though they lead the state in manufacturing jobs.

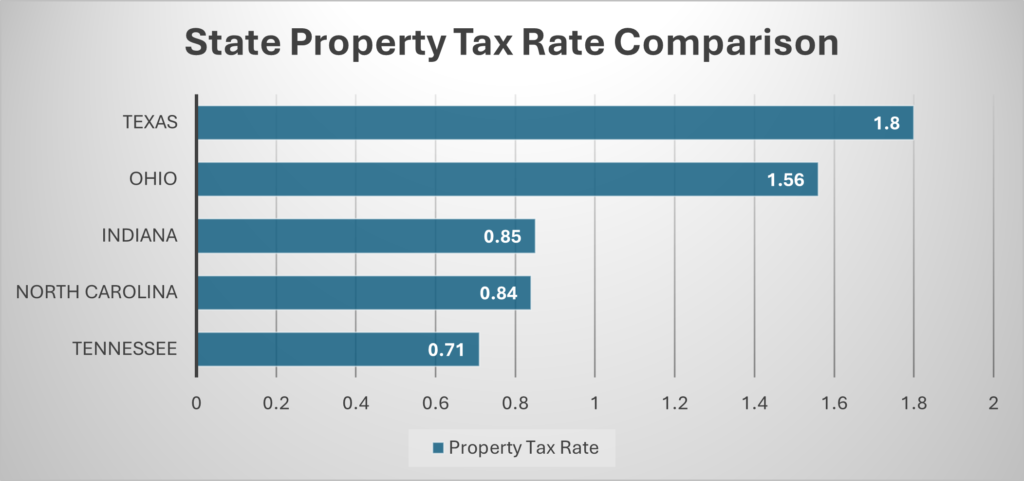

Ohio’s tax and land use regulation hurts residential development. Ohio’s property tax rates are almost double the rates of Indiana, North Carolina, and Tennessee. Columbus’s effective property tax rate is higher than in Indianapolis, Nashville, and Charlotte. Ohio is among a minority of states to have townships and permit them to regulate zoning and permit zoning referendums.

Ohio is a strong Home Rule state that pushes land use regulation to Home Rule cities, and Ohio offers residential economic development incentives but empowers local school boards to stop development. Local Ohio communities can provide residential property tax abatements, public infrastructure development through Tax Increment Financing and New Community Authorities, and construction materials sales tax exemptions but require schools’ approval for use of certain tax abatements and TIFs. The state of Ohio offers Opportunity Zone, New Markets, Historic, Low-Income Housing, Single Family Housing, and Transformational Mixed Use District tax credits; however, these local and state housing economic development incentive programs are not helping Ohio meet its demand for housing.

As part of a Business and Industry Association Study for Central Ohio Foundation study, the Montrose Group created a recommended state of Ohio public policy agenda.

Leadership alone will not solve Ohio or any state’s housing challenges, but it cannot hurt. Ohio should establish by a Governor’s Executive Order the Governor’s Housing Council consisting of housing developers, local government, business, and community leaders to advise the Governor on how Ohio can meet the current housing crisis, establish housing is a matter of statewide concern, and Ohio needs to adopt a comprehensive strategy for the development of housing in rural, suburban and urban communities. Also, Ohio should coordinate an annual Governor’s Housing Summit in partnership with local government, housing, and business trade associations to discuss the challenges, opportunities, and solutions for housing development in Ohio.

States cannot fix housing issues on their own. The federal government should help. Several pieces of federal legislation can support the development of additional housing and should be supported. The Revitalizing Downtowns Act (S. 2511 and H.R.4759) should be supported as it would create an office conversion tax credit for commercial office buildings built at least 25 years before their conversion, and as should federal legislation to promote the use of Community Development Block Grant (CDBG) for residential development.

Local business leadership can have an impact on the development of housing as in the case of the Greater Cleveland Partnership supporting the development of housing and development in the region. Based upon this Cleveland model, Central Ohio should create a New Markets Tax Credit Community Development Entity focused on residential development.

- Ohio should renew the Transformational Mixed Use District Program and increase the tax credit spending cap to $400 M annually to spur residential development.

- Ohio should expand the Ohio New Markets Tax Credit Program to $50 M and focus the benefits of this program on residential development to catch up with states like Indiana that have a $100 M NMTC program.

- Ohio should expand the Ohio Historic Preservation Tax Credit Program to $50 M and focus the benefits of this program on residential development.

- Ohio should create the $50M Ohio Rural Residential Development Loan program to provide forgivable loans to developers creating housing development in rural Ohio counties.

While Ohio and other states operate economic development incentive programs to support housing, more flexibility needs to be added to state housing incentives to maximize their benefit. Ohio should create a 100%, 15-year property residential tax abatement program without requiring the approval of the local school boards as done in Indiana, expand the authority of local Tax Increment Financing programs to directly fund housing development, and not require school board approval as done in Indiana.

How local governments regulate land use and zoning has a major impact on housing development. Ohio should permit residential development as a matter of right that meets density, setback, parking, and other restrictions to be located with only an architectural review by local governments for sites that are currently zoned for commercial, office, retail, and industrial to transform dead strip malls into residential development. Ohio should further regulate non-Limited Home Rule township zoning at the state government or county level and eliminate zoning referendums to build a predictable land use model as is done in Indiana, North Carolina, Texas, and twenty-two total U.S. states. Finally, on the land use front, Ohio should create a state Zoning Density Bonus Infrastructure Program to fund public infrastructure for local governments for residential developments that meet zoning density and multi-family requirements.

Ohio’s high rate of property tax and unpredictable property tax appraisal process need to be reformed. Ohio needs to continue efforts to streamline the property value appraisal process to build a more predictable process to encourage economic investment by limiting property tax appeals to only property owners, not disclosing the value of the land purchase, and exempting from property tax the value of unimproved land subdivided for residential development more than the fair market value of the property for up to eight years or until construction begins or the land is sold.

State housing challenges driven by a lack of housing supply will not solve themselves. States hoping to lead an economic renaissance need to make tough policy decisions that encourage housing investment and drive economic growth.