The high profile move of Elon Musk, successful serial entrepreneur, from California to Texas due to the tax burden of the Golden State illustrates the danger high-tax states face. California which was a post-World War II success story riding the success of mega cities like Los Angeles and San Francisco and as the home of the world’s technology industry is showing its age. Lower cost markets in Arizona, Nevada and Utah have for years been gaining a massive influx of California companies and residents. COVID 19 and a shift by technology companies to a work from home model are dramatically increasing the exit from the California marketplace. Just as the Industrial Midwest has spent the last thirty years losing its manufacturing base to lower cost markets in the South, the Desert Southwest is eating California’s lunch with 1/3 of Phoenix’s new attraction projects coming from California and Telsa, HP and others expanding in Texas.

The tax burden local and state governments create through public policy decisions can be much more important to companies considering a region for a corporate site location project. Corporate site location consultants will review and compare the overall amount of local and state government spending for a region, determine the overall tax burden local and state government policy makers place on companies compared to individuals, and, ultimately, define the tax burden for a company considering a corporate site location project comparing the regions under consideration.

All local and state governments enact tax policy to pay for schools, colleges and universities, roads, water, sewer and social services that create the quality of life workers and business owners seek during a corporate site location review. Not all states are created equal when it comes to government spending which impact the overall tax burden companies and individuals face in a region. A study by the firm 24/7 Wall St. found that Florida, Indiana, Tennessee, Idaho, Arkansas have the lowest local and state government spending on a per capita basis. Alaska, Wyoming, New York, Washington and California are on the other end of the scale of having the highest per capita spending for local and state governments. States and regions that spend less on a per capita basis are generally more attractive to companies considering a corporate site location project.

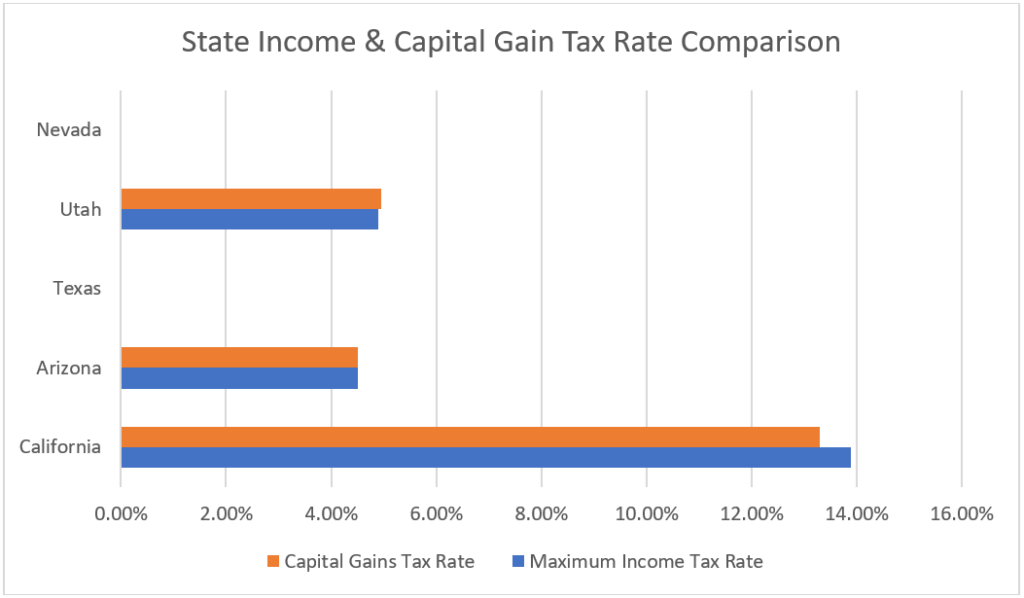

What a region or state taxes impacts a corporate site location project, and this analysis is generally very industry specific. Regions and states may tax income, property, sales transactions, or specific activities or industries through insurance premium taxes, tobacco or alcohol or hospitality activities through excise taxes, and utility service excise taxes. Different industries are impacted by local and state tax policy in different ways. Successful entrepreneurs will be focused on income tax and capital gains tax at the state level. As the chart below illustrates, California’s highest marginal income tax and capital gains tax rate of over 13% creates a major disincentive for successful tech company leaders to remain when compared to all Desert Southwest states especially Texas and Nevada that don’t have either tax at all.

Data centers are capital intensive and use a substantial amount of energy and water. Property and sales tax rates are prime drivers for data center corporate site location projects. Logistics and fulfillment centers house business inventory and are property rich from a tax standpoint. Property taxes are going to be a prime concern for this industry. Advanced services and tech companies are people intensive with generally higher than average wage rates. These projects are going to be more sensitive to local and state income tax rates. Local and state policy makers can shape their tax code to focus on the industries they want to locate in their region just as they can with economic development incentives. However, many regions and states fall into the trap of taxing everything that creates a substantial economic disadvantage.

The Council for State Taxation, releases an important report about the business tax burden placed on companies by regions and states that is worthy of review, In 2019, according to the most recent COST Business Tax Burden report, business property taxes increased for the ninth year in a row since 2010. Almost half of the $14.8 billion in increased property tax revenue came from gains in four large states: Texas ($2.3 billion), California ($2.0 billion), New York ($1.4 billion) and Florida ($1.0 billion). Nationally, business property tax revenue increased by an average of 4.9%, but for 33 states, this revenue grew at a slower rate. Texas had the largest dollar increase in business property tax revenue, collecting $2.3 billion more than in 2018. Washington had the highest growth rate for business property tax revenue, increasing by 15.4%. Sales tax is another substantial cost center for both the operation and construction of data centers, and many states offer aggressive economic development incentives to address their high sales tax costs which often provide revenue for local and state governments. From 2019 to 2020, the state with the largest gain in sales tax collections on business inputs was California, which saw an increase of over $3.6 billion. Of the 45 states with a state sales tax, 42 experienced an increase in sales tax collections on business inputs. Washington DC also experienced an increase in sales tax collections on business inputs. Traditional high cost states like California, New York and Illinois have substantial sales and property taxes in place as well as every other tax government can think of. Texas and Florida’s very high sales and property tax illustrates the downside of not having a state or local income tax.

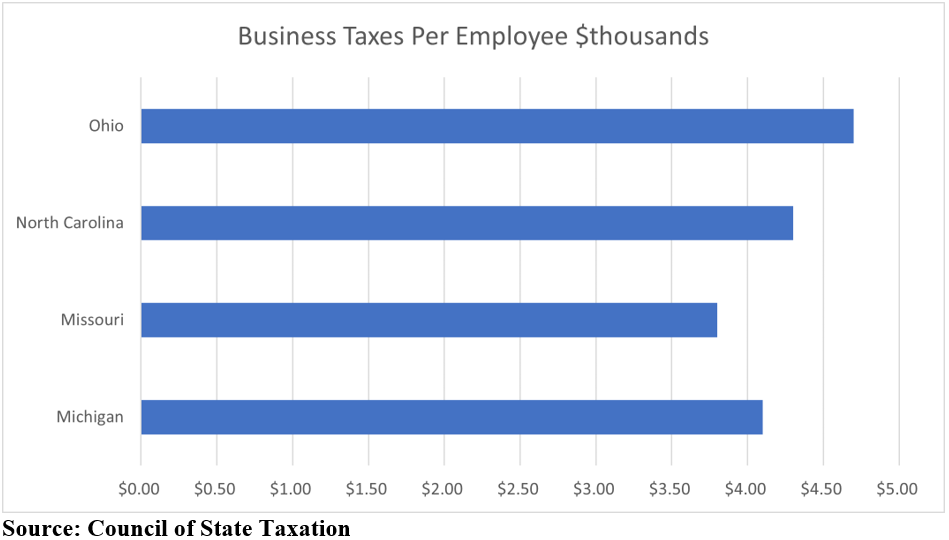

Finally, the amount of taxes imposed on business compared to individual taxpayers impacts dramatically the cost of doing business in a region and, likely, drive up the need for larger economic development incentives for that region to compete for corporate site location projects. As an example, states without an individual income tax have higher than average sales and/or property taxes that companies will pay to make up for the lack of individual income taxes. The chart below outlines a comparison between Michigan, Missouri, North Carolina, and Ohio of the business burden carried from state and local taxes on a per employee basis as measured by the Council of State Taxation from FY 2019 data.

However, the specific taxes a company will pay at a site is the most important analysis to define the cost of doing business at a site that is imposed by the local and state governments.

What activity is taxed and how much in taxes a region and state charges businesses all impact the decision by a company as to where to locate through a corporate site location process. Regions cannot build mountains, an ocean beachfront or change their weather but they can restrain the cost of government, enact a business friendly tax code focused on the industry they want to recruit and keep business tax rates low to attract new industry.