In an era when policymakers and media attention focus on white hot social issues such as gun control, critical race theory, transgender rights, and other topics that push the buttons of conservatives and liberals alike, the creation of high-wage jobs still matters. The predictions of an economic recession spurred by dramatic inflation increases and continued supply chain challenges make public policy debates centered on creating more high-wage jobs even more important than it was before.

The first issue to understand is what is an economic impact statement. An economic impact statement is a report that describes and assesses the economic impact of a project on any parties who may be affected by it. Economic impact statements are often documents designed to impact public policymaker decisions at the local, state, and federal government. Economic impact statements need to be honestly crafted tools aimed at organizing and evaluating information for the purpose of evaluating whether a project creates more tax benefits than it takes—in essence, creates a Return on Investment (ROI). A well-written economic impact statement is based on solid information, thoughtful reasoning, and sound projections.

Economic impact statements describe the project, program, or venture that is to be evaluated. Key inputs such as jobs and payroll and capital investment are created. Also, quantitative, and qualitative measures are part of the economic impact statement. Supporting at-risk youth or capital investment in a distressed neighborhood are examples of qualitative factors impacting an economic impact statement. Quantitative measures will include local, state, and federal government tax revenues and other developments that will happen based on decisions of the local, state, and federal governments. Economic impact statements also include direct and indirect impacts as often measured with computer software programs.

A key step in promoting local, state, and federal government policy adoption is defining the economic impact of a project or policy agenda. A critical question is “what policy decisions can be influenced by an economic impact statement?” The award of economic development incentives whether tax credits, tax abatements, loans, or grants are clearly justified to incentivize the creation of high-wage jobs and capital investment. Defining the ROI for local communities from a potential private sector development is a big step in the “but-for” test—without the economic development incentive the private development will not happen. Economic impact statements are also useful for industrial trade associations seeking to illustrate their economic power to justify local, state, or federal government executive, regulatory and legislative decisions. Legislative and executive agency government leaders may look to an industry’s economic impact statement to decide major policy issues.

As an example, the Ohio Citizens for the Arts developed an economic impact statement to support their public policy agenda that announced the following conclusions:

- Creative Industries are a critical economic driver in the State of Ohio. In 2019, creative industries supported over 329,000 jobs, $18 B in payroll, and $55 B in economic output.

- The COVID-19 pandemic had a severe negative impact on creative industries in Ohio. Between 2019 and 2020, creative industry employment declined by over 41,000 (-12.63%), while total creative industry economic output fell by over $8.6 B (-15.74%).

- The COVID-19 pandemic disproportionately affected creative industries in Ohio. Specifically, decreases (as a percentage) in employment and economic output were four times as large compared to the overall Ohio economy.

- The decline in creative industry payroll was over seven times as large compared to the overall Ohio economy, suggesting programs such as the Payroll Protection Program (PPP) did not provide adequate support to employees in creative industries.

As industrial development investments continue at a robust pace in Ohio, and across the United States, many communities are facing growing demands on public resources such as road and bridge infrastructure that can accommodate increased worker and truck traffic volumes. The role communities play in the Public-Private Partnership model is critical to landing industrial development projects; however, communities must be able to quantify projected financial benefits and the financial capacity they may have to participate in these PPP projects. As the leading provider of economic impact data and analytical applications, IMPLAN has spent decades serving the economic data needs of researchers, policymakers, decision-makers, advocates, business leaders, governments, and more. IMPLAN research is designed to assist communities, and business leaders, understand the economic and workforce implications a project will have.

Montrose conducted a hypothetical industrial development analysis for a $400 M multi-M square foot, multi-building project in central Ohio. The Project included the proposed development of new, speculative industrial warehouse/distribution type buildings on 642 acres of vacant land that was projected to provide economic benefit to the entire Columbus MSA region.

- 8,300,000 square feet of building space covering 11-13 buildings

- Creation of 4,000+ jobs

Total capital investment, projected $400,000,000

Total new payroll, projected $225,000,000

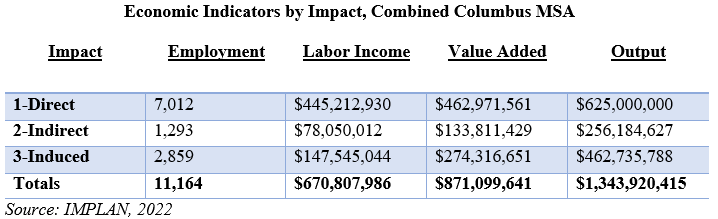

Based on the Project Investment Summary which includes the construction of facilities and operation of facilities at full occupancy, the Columbus MSA will experience significant economic impact because of the full build-out of the project. When conducting an Input-Output Analysis, the interdependence between the Project’s capital investment and job creation activities and final goods and services impacted in the economy are analyzed with projected benefits and costs calculated. More than 11,164 total jobs (direct, indirect, and induced) will be impacted, creating $670.80 M in new income, and generating a value add of $871.09 M. Direct jobs are those created by the companies operating in the newly constructed facilities and that are related to construction of those facilities. Indirect jobs are jobs that are ancillary to the project, such as producers of supplies, raw materials, and services. Induced jobs are those jobs created when direct and indirect employees spend their increased incomes on consumer goods and services. Value Added represents a measure of the Project’s contribution to GDP, including Labor Income, Other Property Income, and Taxes on Production and Imports. Overall economic output of the 11,164 jobs is estimated at $1.34 B annually.

An IMPLAN analysis of industries expected to see primary benefits from the proposed Project vary across the construction industry, professional services industry, utilities, retail and service, and warehousing and storage industry. The Industry Contribution Analysis below examines what Industries, and what level of production in these industries, is being supported by the current activity (Project). The construction of new buildings sector will generate the greatest economic output at $756,420,896 which represents the estimated total construction costs of $400,000,000 plus indirect and induced benefits to the Columbus MSA region to fully build out the proposed Project. The Warehousing and storage sector is estimated to generate a total industry output of $587,463,518 which represents the estimated total operational wages of $225,000,000 plus indirect and induced benefit to the Columbus MSA region within the facilities at full employment of 4,000 employees.

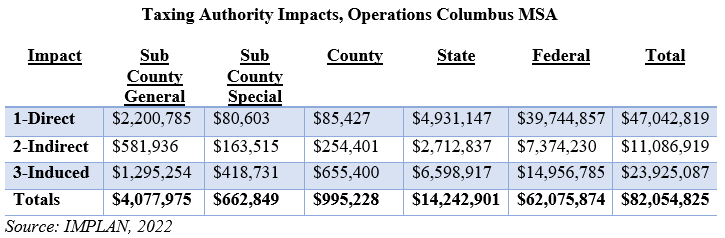

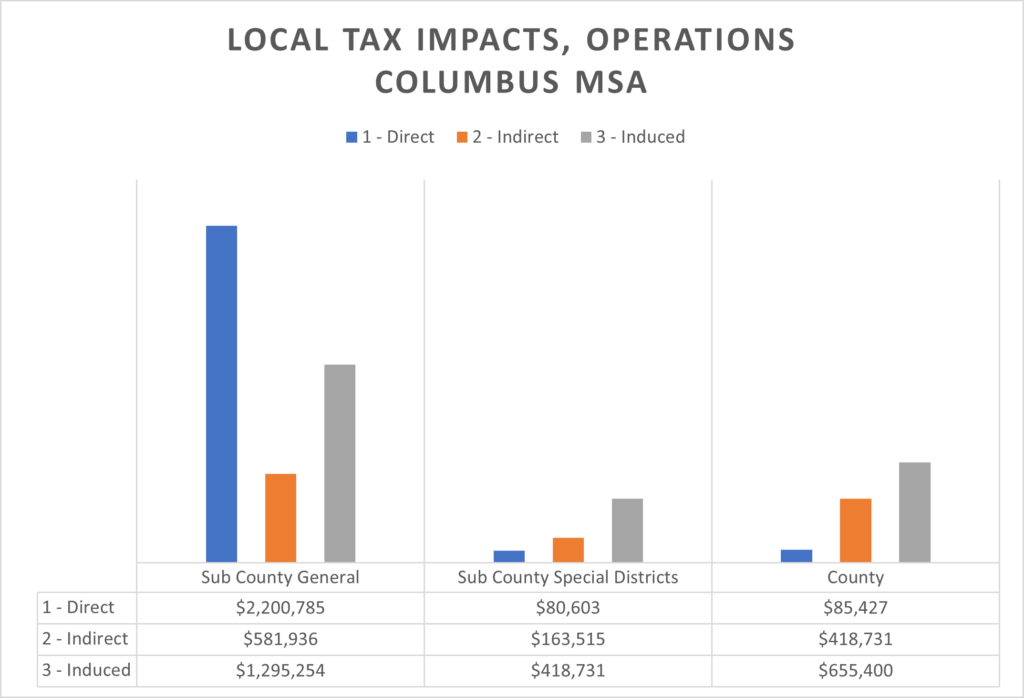

Tax implications because of the proposed project also represent a significant benefit to the local, state, and federal government across direct, indirect, and induced jobs created. Total taxes paid to taxing authorities in the Columbus MSA upon full project build-out and creation of 4,000 jobs, excluding abated real property taxes, will exceed $5.73 M with a total tax impact of $82.05 M. Sub County General taxes of $4.07 M account for taxes benefitting cities, villages, and townships within the Columbus MSA. Sub County Special taxes of $662,849 account for taxes benefitting special taxing districts such as police, fire, and schools. County taxes of $995,227 represent taxes paid directly to counties within the Columbus MSA.

Examining long-term impacts on local taxes generated by operations of the facilities at full employment of 4,000 jobs, we can estimate annual taxes generated to local taxing authorities from activity at the Project site. Direct jobs are estimated to contribute $2.36 M annually; Indirect jobs are estimated to contribute $999,852 annually, and Induced jobs are estimated to contribute $2.36 M annually. The total estimated taxes generated to the Columbus MSA is $5.73 M annually.

It is clear from this IMPLAN analysis that industrial development projects have a significant direct and indirect impact on the local community as revenue generators and job creators for not only the project itself, but for the surrounding community and businesses that will be served by the project.