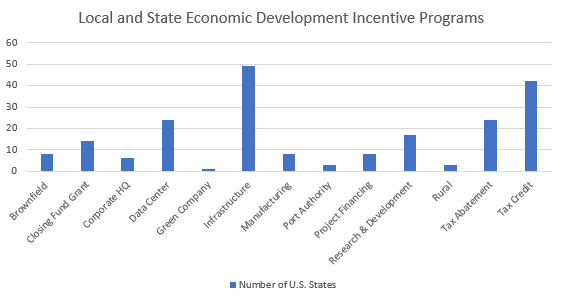

All fifty U.S. states offer some form of economic development incentives to offset regional cost of business measures. As the chart below outlines, infrastructure incentives are provided by all the states in the union. State economic development tax credits follow closely behind infrastructure program as the second most popular tax incentive program in the nation with efforts to attract data centers and using general tax abatements tying for third. Princeton Economics estimates that state and local governments invest about $30 B dollars in economic development incentives annually.

These tax incentives are awarded on a competitive basis based upon a “but-for” test that mandates the company would not choose a location without the award of the economic development incentives. This legal and policy basis for the tax incentive mandates the government or private economic development organization awarding the incentive require the companies receiving the incentive to file annual reports proving they meet their promised job creation and/or capital investment goals. In Ohio, local and state economic development incentive reports are due in March. COVID 19 is having a dramatic impact on many company’s plans for job growth and capital investment. Thousands of these companies have gained local and state economic development tax incentives which have a tax incentive agreement that award tax credits, tax abatements, loans and/or grants.

Black Swan events like COVID 19 are a major disruption to job creation and capital investment plans even for successful companies. COVID 19 will disrupt the job creation and capital investment plans that companies have committed to in a binding local and/or state economic development incentive agreement. However, well-crafted economic development incentive agreements may have a way to address a COVID 19 based disruption to a company’s job creation and capital investment without harming the company even further.

Many economic development agreements contain a “Market Conditions and Other

Factors” provision that gives the government or economic development organization partner the ability to keep the incentive agreement in place if the company does not meet its economic development commitments due to factors outside of their control. “Market Condition” clauses have their roots in the common law legal concept known as Force Majeure. Force Majeure gives the ability of parties to a contract to be excused from their obligations when certain circumstances arise beyond the party’s control making performance inadvisable, commercially impracticable, illegal, or impossible. Force Majeure is triggered through a contract provision that list the extreme events such as epidemics or pandemics, along with war, terrorist attacks, “acts of God,” famine, strikes, and fire in the list of events excusing overall performance or delay in performance.

Economic development incentive agreements may give the local and state economic development officials the ability to relieve the company impacted by dramatic events outside of their control from the job creation and capital investment commitments. This flexibility is critical as many economic development incentive agreements permit local and state governments to “claw back” tax incentives previously awarded or terminate the tax incentive agreement even though the company may well pick-up economic production following the dramatic event. Local and state government officials deciding whether to avoid tax incentive penalties for a company under a Market Condition or Force Majeure clause may ask a couple key questions:

- Does the company believe it will survive the event and recover following the event?

- Is there another company in place to implement the company’s economic commitments? and

- What is the impact of any federal, state, or local regulatory requirements imposed on company or their project?

Communication is the key to successfully utilizing a Market Condition or Force Majeure clause in an economic development agreement or to renegotiate an existing economic development tax incentive agreement. Corporate site location consultants or competent legal counsel can help negotiate good results for clients that with local and state economic development leaders who are focused on helping company succeed.

Even without a Market Condition of Force Majeure Clause, companies negatively impacted by COVID 19 preparing to file annual economic development incentive reports should work to renegotiate their economic development incentive agreements to address the following changes:

- Reduce job and capital investment commitments without reducing the incentive level;

- Adjust the timeframe that companies must meet job and capital investment commitments without adjusting the incentive level. This should be based on the time the company needs to adjust to a post-COVID-19 world;

- Reduce the job and capital investment commitments and reduce the incentive level;

- Cancel the economic development incentives if the company will not be able to meet job and capital investment commitments; and

- Put the reporting and commitments on hold for one to two years without reducing or adjusting incentive levels.