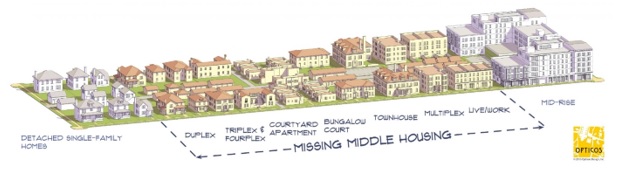

The urban core needs to attract quality market rate housing that falls in the middle point of residential housing. This “Missing Middle” is a critical step to develop quality housing that urban residents can afford. The “missing middle” housing types are those in between (mostly large-lot) single-family detached and large apartment complexes. Berkeley-based architect Dan Parolek coined the term missing middle to communicate the housing choices—increasingly in demand today—that are ignored or discouraged by conventional planning and development. These types range from small-lot single family and townhouses, to stacked townhouses and flats, duplexes, triplexes, quadriplexes, courtyard housing of various kinds, and small apartment buildings. Missing middle offers low-rise density, diversity, and forms the backbone of the quintessential American neighborhood often at a more affordable rate. In fact, according to Parolek, 59% of millennials are looking for missing middle housing in the for-sale and rental markets, versus 39% who are looking for single-family homes. Between 1990 and 2003, however, less than 10% of housing units produced would have classified as missing middle housing.

Developers Repvblik and PK Companies are developing Missing Middle housing by redeveloping abandoned hotels and office buildings into low cost multi-unit apartments. Repvblik and PK Companies in Branson, Missouri redeveloped a10-year vacant Days Inn with 423 rooms into a 340-unit apartment complex, and the facility is fully leased with a waiting list.

Developing Missing Middle market rate housing in a struggling neighborhood may require changes to municipal zoning codes and tax incentives but also aggressive efforts to address crime in the community and to improve the performance of schools in the community. These same communities often suffer from high crime and a series of socioeconomic challenges that destroy the changes for a good quality of life. Safe, affordable housing is the key to economic stability that impacts the ability to implement an economic equity agenda.

Several tax incentive tools exist to support the growth of affordable housing often tied to local, state and federal government economic development incentives.

- Illinois Tax Increment Financing. Illinois’ Tax Increment Financing captures future property tax growth in a defined district for the redevelopment of substandard, obsolete, or vacant buildings, financing general public infrastructure improvements, including streets, sewer, water in declining areas, cleaning up polluted areas, administration of a TIF redevelopment project, property acquisition, rehabilitation or renovation of existing public or private buildings, construction of public works or improvements, job training, relocation, financing costs, including interest assistance, studies, surveys and plans, marketing sites within the TIF, professional services, such as architectural, engineering, legal and financial planning, and demolition and site preparation

- Michigan Property Tax Exemption. Michigan’s Commercial Rehabilitation Exemption offers an incentive for commercial business or a multi-family residential facility with five or more units where the value of improvements must be at least 10% of the true cash value of the property at the start of the rehabilitation for up to a 10-year term, and a local entity must first establish a Commercial Rehabilitation District by resolution and create a district composed of property owners within the area.

- Ohio Community Reinvestment Area. Ohio’s Community Reinvestment Area program is administered by municipal and county government that provides real property tax exemptions for property owners who renovate existing or construct new buildings, and those CRAs created before 1994 do not need school board approval for up to a 100% abatement.

- JobsOhio Vibrant Community Program. JobsOhio’s Vibrant Community program provides limited $2 grants to 98 eligible Ohio distressed cities ranging in size from 5000 to 75,000 all across the Buckeye State. This program is designed to help small and medium sized communities to implement catalytic development projects that fulfill a market need and represent significant reinvestment in struggling areas. Business, non-profits, developers, port authorities and local governments are eligible applicants. Funding will not exceed 50% of the eligible costs, an end user of the project is required, and even mixed-use projects are eligible. Shared working spaces such as business incubators, accelerators, innovation centers and co-working spaces are expressly listed as eligible projects.

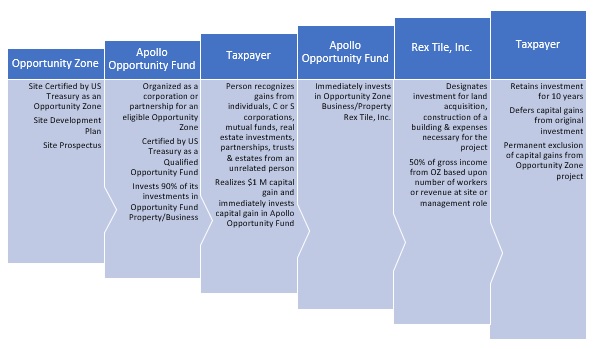

- Federal Opportunity Zone Program. Opportunity Zones are a federal government program that provides a temporary tax deferral for capital gains step-up in basis for capital gains reinvested, and a permanent exclusion from taxable income of capital gains from the sale or exchange of an investment kept for a required term in an Opportunity Zone Fund that has 90% of funding invested in Opportunity Zone property acquired after December 31, 2017 and 50% of its income derived from the Opportunity Zone property. 8700 national certified federal Opportunity Zones exist. $6.1 T in U.S. capital gains are waiting to be invested, and multi-family residential projects are a typical Opportunity Zone investment.

Opportunity Zone Investment Model

Addressing the “Missing Middle” in the urban housing market involves a partnership with local governments, schools and developers to support the long-term revival of urban centers. This challenge involves all the tools in the toolbox a community can find.

Montrose Group is engaged with several communities and companies focused on economic equity projects and please contact Dave Robinson at [email protected] if we can help your company or community address these issues.