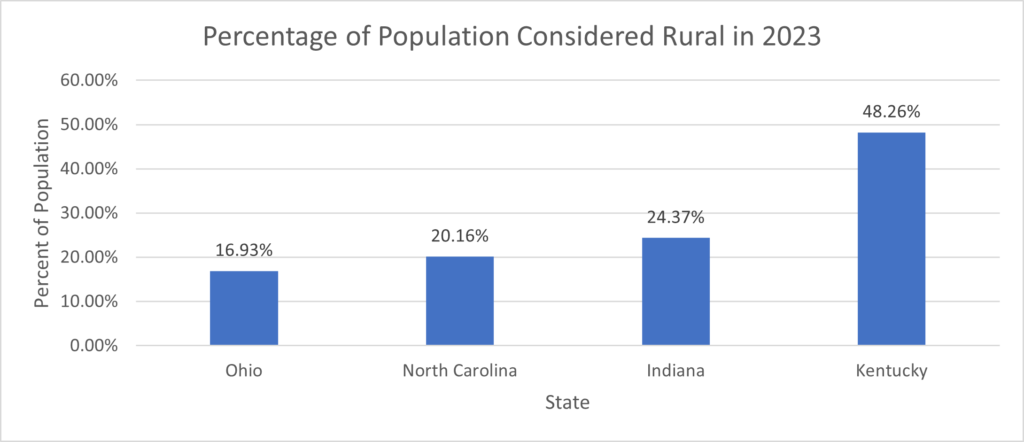

Demographics have a major impact on corporate site location decisions. Regions with a large and growing population base, have a younger, more educated workforce and less poverty are more attractive for economic investment. A comparison of Indiana, Kentucky, North Carolina, and Ohio offers insights into the competitiveness of these rural markets for corporate site location projects. Rural counties constitute 1.6 M residents of Indiana, 2 M in Kentucky, 2.1 M in North Carolina, and 3.9 M in Ohio. All four states reviewed offer a large population base in rural markets offering opportunities for corporate site location projects. North Carolina, Indiana, and Kentucky are much more rural in nature than competitors in Ohio. Kentucky is the state with the largest share of its population residing in rural communities with half its state population in rural counties.

Source: U.S. Census Bureau

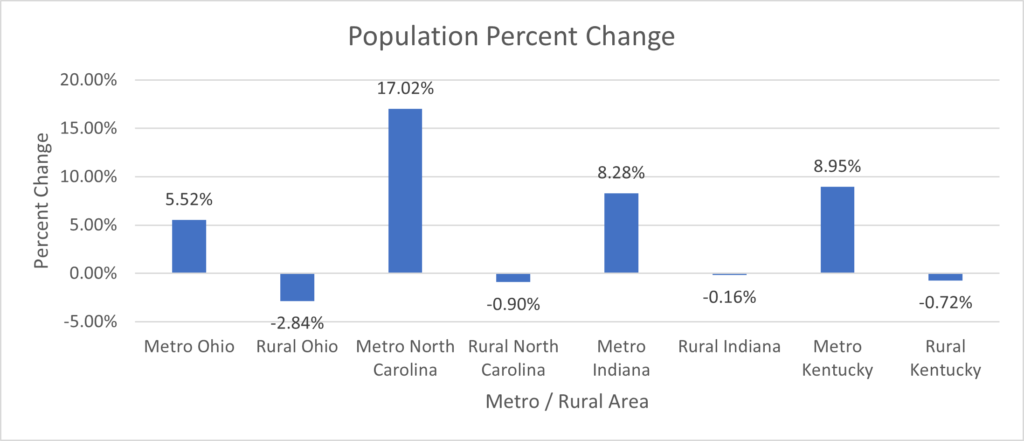

The largest challenge facing rural communities is the loss of population. As the table below illustrates, rural communities are in large part losing the population which is traveling close by to their urban counterparts. This analysis of rural markets in these benchmark states is based upon a definition of rural that defines rural counties as those counties not located in an MSA. Rural Kentucky and North Carolina lost the least amount of people in our benchmark group. However, that is not a major accomplishment. Rural Ohio saw the largest amount of population loss among the four states, and Indiana finished in the middle. These rural communities are losing population to their neighboring fast-growing mid-sized urban centers of Columbus, Ohio, Indianapolis, Indiana, Charlotte, and Raleigh Durham, North Carolina. Columbus has grown by 10% during the same timeframe. Urban centers like Cleveland continue to struggle and are not benefiting from the migration of rural workers. High-growth metro North Carolina markets driven by substantial growth in the Raleigh-Durham and Charlotte markets illustrate the state’s overall growth. The rural markets from a population standpoint are struggling as well in Indiana and Kentucky and their metro markets are not growing from a population standpoint as quickly as the South and Southwest. Of greater concern for Kentucky as their larger urban metro centers are not growing at the rate of successful mid-sized urban markets in North Carolina, Indiana, or even Ohio. The continued depopulation of rural regions will have a dramatic impact on the economic future of

rural communities across the United States. Not only are rural areas less densely populated, their

populations are getting older, on average, due to both outmigration of younger people, and, in some cases, older adults retiring to rural areas.[i] As of mid-2018, those 65 and older make up almost a quarter of the population in nonmetro areas, and prime working-age adults, 25 to 54 years old, comprise only 43 % of the population.[ii] That compares to a 50 % share of prime working-age adults and 19 % of adults 65 and older in metro areas.[iii]

Demographic challenges driven by depopulation illustrate the largest corporate site location challenge and one that needs to be addressed by policymakers to ensure these regions continue to be economic assets.

[i] https://www.investinwork.org/-/media/Files/reports/strengthening-workforce-development-rural-areas.pdf

[ii] Ibid.

[iii] Ibid.